We’re relentlessly committed to passionate customer service, offering versatile operations and the industries’ most expansive national footprint.

Come ride the VORTEQ wave of momentum for your coil coating needs! Let’s get started at vorteqcoil.com

serving metal service centers, fabricators and OEM/end users since 1945

serving metal service centers, fabricators and OEM/end users since 1945

Features

he Federal Reserve Bank, in its economic conditions report released June 2, noted increases in business spending generally and a rise in manufacturing orders, backlogs, shipments and materials prices. However, inventories for a host of industrial and consumer goods remain low.

The Chicago district, for example, reported that new light vehicle inventory levels fell to very low levels. One dealer reported that its stocks were at 33 percent of normal and that automakers indicated the situation wouldn’t improve until August at the earliest. Many manufacturing contacts said inventories were below comfortable levels.

“We continue to see solid demand across nearly all of our major end markets, including automotive, heavy truck and agriculture,” Worthington CFO Joe Hayek said during a June 24 earnings call with investors.

“The U.S. steel market remains tight [yet] our Steel Processing team has done a great job managing through a fluid and constrained market to take care of our customers,” he says.

Dark

ecent strong demand has combined with sharply falling inventories, which will add to [economic] growth as companies replenish inventories during the second half of the year,” says Joel Prakken, chief U.S. economist with consultancy IHS Markit. In addition, “the relaxation of state [COVID-19] containment measures has accelerated as the vaccinated share of the population continues to rise.”

IHS Markit raised its forecasts of U.S. GDP growth for this year and next: from 6.7 percent to 7.4 percent for 2021 and from 4.7 percent to 4.8 percent for 2022.

In its short-range outlook, the World Steel Association predicts steel demand will grow by 5.8 percent in 2021 to reach 1.874 billion metric tons, and that demand will climb another 2.7 percent next year.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

Dark

Dark

ecent strong demand has combined with sharply falling inventories, which will add to [economic] growth as companies replenish inventories during the second half of the year,” says Joel Prakken, chief U.S. economist with consultancy IHS Markit. In addition, “the relaxation of state [COVID-19] containment measures has accelerated as the vaccinated share of the population continues to rise.”

IHS Markit raised its forecasts of U.S. GDP growth for this year and next: from 6.7 percent to 7.4 percent for 2021 and from 4.7 percent to 4.8 percent for 2022.

In its short-range outlook, the World Steel Association predicts steel demand will grow by 5.8 percent in 2021 to reach 1.874 billion metric tons, and that demand will climb another 2.7 percent next year.

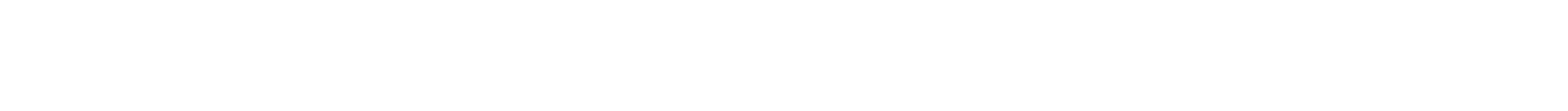

arker Steel Co. distributes a wide variety of metals in metric sizes to customers across North America and is highly focused on meeting its commitment to source customers’ critical needs.

The company, based in Toledo and Maumee, Ohio, has designed all steps in the procurement process to make it easy for its customers to purchase and receive their orders with minimal time and hassle, says President Jerry Hidalgo.

“We put a major emphasis on shipping received orders on the same day each order is placed. In most cases, we succeed in doing so,” he says. Internal statistics show that over 99 percent of delivery promises are met. Parker can achieve this level of performance because every employee is willing to make “extraordinary efforts” to ensure customer commitments are met.

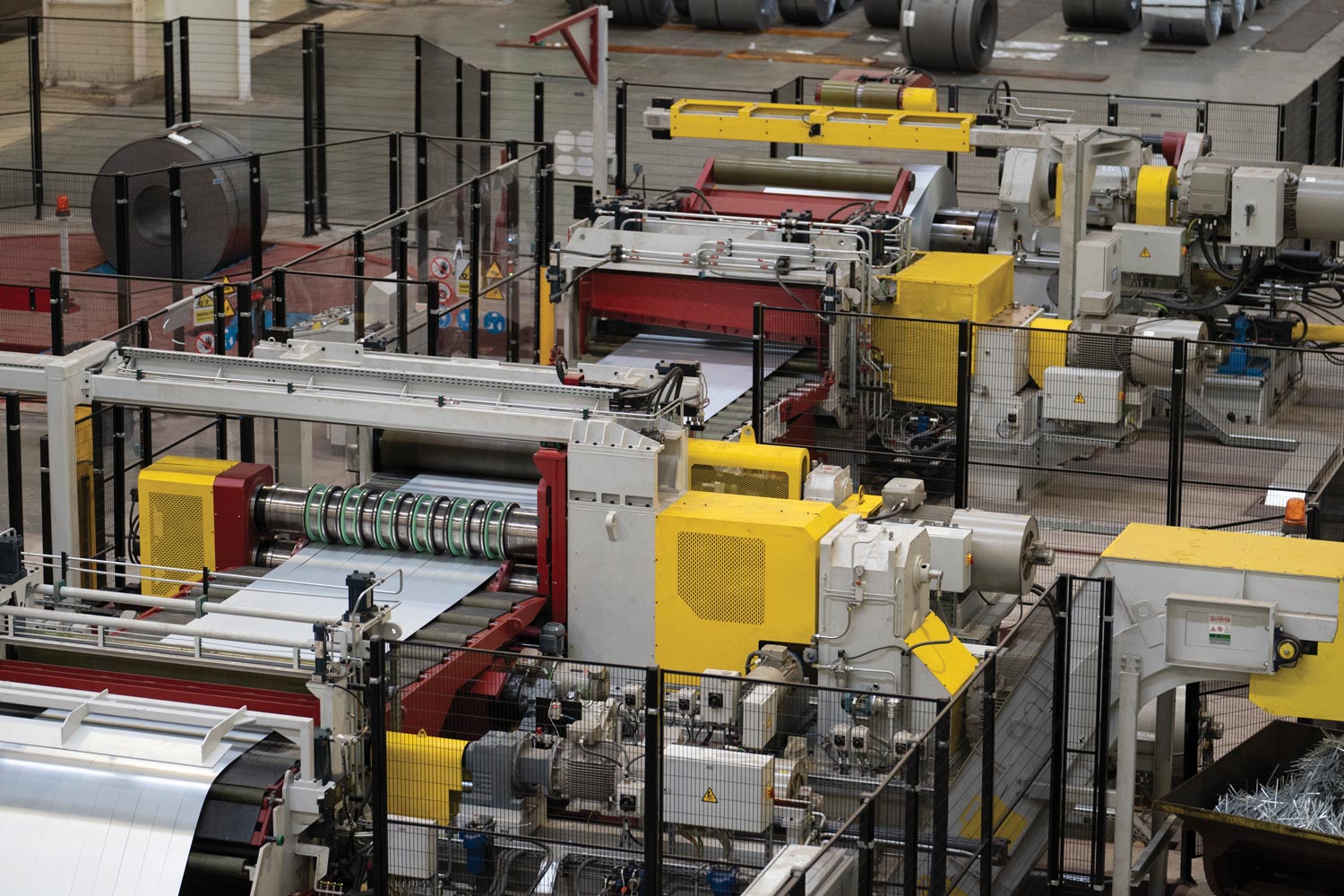

o many variables go into the process of specifying, installing and commissioning a metal processing line. For the team at Coilplus Illinois, Plainfield, the capital project to design and purchase a new slitter was time consuming, but has proved worth the effort.

The Plainfield processing center is one of 10 branches Coilplus runs across North America. After running a slitter practically full out for nearly 30 years, the team sought to widen the gauge range and grades it could slit, while moving ahead of the curve by employing robotic technology and automation.

ommercial and residential building developers and architects don’t want their projects to start looking shabby after a couple decades due to weathering or other environmental factors. When they wish to clad buildings in coated metal panels or specify metal roofing and trim, they want a material that will look almost new for a very long time.

Metalescent coil and extrusion coating systems have long been specified for their classic aesthetics and lasting performance. Three-coat 70% PVDF metallic systems are widely accepted as the industry standard among builders and architects who want to make a lasting impression.

t first glance, packaging for metal products seems uncomplicated—wood skids and pallets, dunnage, shrink wrap—mainstays at the ready to receive loads of steel, copper, etc., and carry them to their destinations. But packaging is a process where companies can shrink costs if they switch to materials that better protect products and contribute to a more efficiently loaded truck.

Automatic for the future

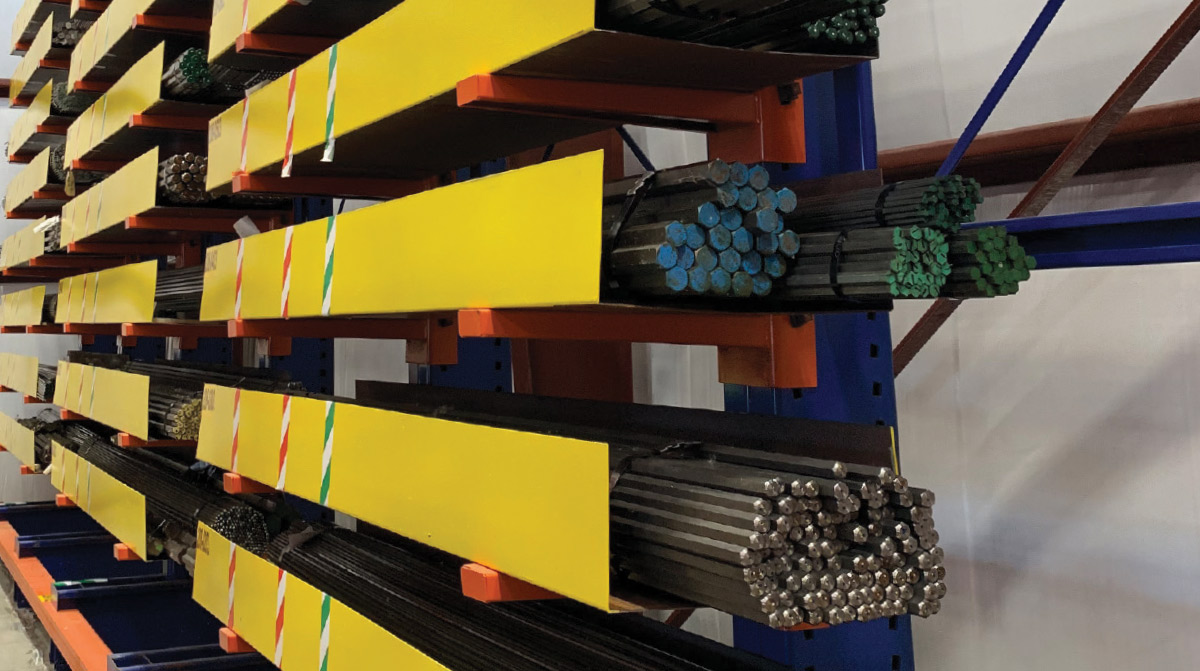

ational Tube Supply (NTS) distributes carbon and alloy round mechanical tubing. NTS supports OEMs, machine shops and other distributors in the oil and gas, agriculture and construction, fluid power, and general equipment manufacturing industries.

NTS is a division of the Bianco Group, a family-owned company with stakeholders based in Europe. With its U.S. headquarters in University Park, Illinois, and branches in Moreno Valley, California; Baytown, Texas; Beaver, West Virginia; and Mississauga, Ontario, the company is able to support customers across North America by providing cut-to-length materials quickly and reliably.

John Tillman Co., Compton, California, 800/255-5480, jtillman.com.

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) July 2021, Vol. 77, No. 6 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) July 2021, Vol. 77, No. 6 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.