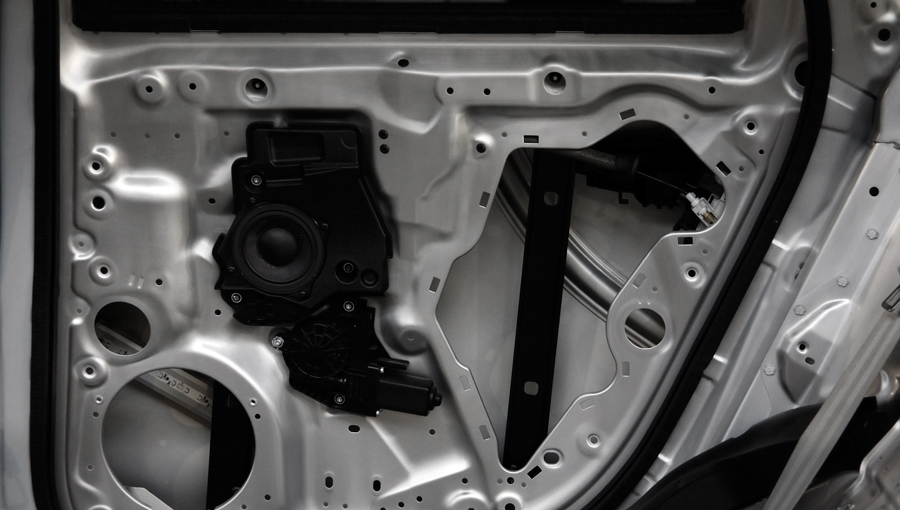

“We continue to see solid demand across nearly all of our major end markets, including automotive, heavy truck and agriculture,” Worthington CFO Joe Hayek said during a June 24 earnings call with investors.

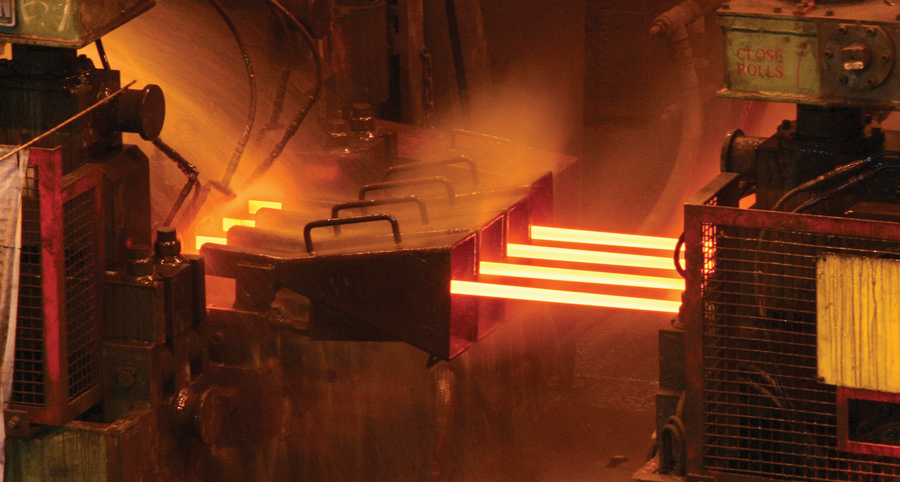

“The U.S. steel market remains tight [yet] our Steel Processing team has done a great job managing through a fluid and constrained market to take care of our customers,” he says.

“Our demand levels and backlogs are quite good across almost all of our major markets. We’ve also been proactively raising prices in our downstream manufacturing businesses to offset increased raw material costs,” President and CEO Andy Rose said on the same call.

our demand levels and backlogs are quite good.

our demand levels and backlogs are quite good.

Asked about new steel capacity starting up in the U.S. market—such as SDI in Sinton, Texas, Big River Steel in Arkansas, North Star Bluescope in Ohio and Gallatin in Kentucky—Rose says additional volume is generally good for the market. “It [can] provide some relief,” first on availability of material but also, “hopefully, on pricing.”

Regarding additional incremental capacity among other domestic producers and whether Worthington might be interested in negotiating with those suppliers, Hayek says, “We talk to everybody and try to deal with as many people as it makes sense, based on what steel [our customers] require, where it needs to go and what [processing step] needs to happen to it. So we chat with everybody and make the best decisions we possibly can, relative to availability and needs.”