We’re relentlessly committed to passionate customer service, offering versatile operations and the industries’ most expansive national footprint.

Come ride the VORTEQ wave of momentum for your coil coating needs! Let’s get started at vorteqcoil.com

logistics

logistics

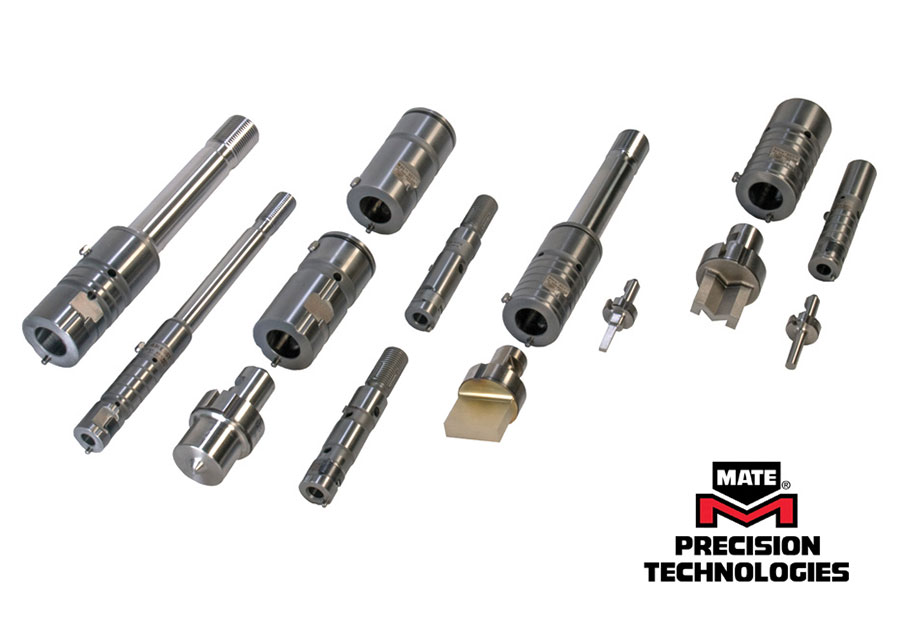

Features

ow.ly/keX930r7ClY

@Forbes

t is really eye opening to track how many jobs have been lost as a result of the pandemic, and how varied they are. Some business sectors are very obvious, and some are not. Airlines, sure—but also in-flight meal providers, aviation mechanics and companies that make jet bridges. Hotels, resorts and casinos but also linen suppliers and janitorial services. Restaurants but also breweries, wineries, caterers and commercial bakeries.

Film and stage theaters, museums and entertainment venues (think Legoland, horse racing, Dollywood and the Harlem Globetrotters)—but also Ticketmaster and Eventbrite, parking garages and taxicab companies. Professional sports stadiums went quiet, so each support industry for that sector stopped work, too. My goodness, how did we live without pro sports for that long?

Office management firms, corporate and retail security, courier/messenger services, office supplies. Companies that fill the snack food vending machine or water live plants in the office tower lobby. Calls for advertising and marketing services slipped.

etals distribution is characterized by a commoditized market and a highly fragmented industry. Given this fragmented nature, the entry of large virtual B2C or B2B marketplaces, like Amazon, that broker transactions between manufacturers, service centers or distributors on one side and retail or business customers on the other, appears inevitable.

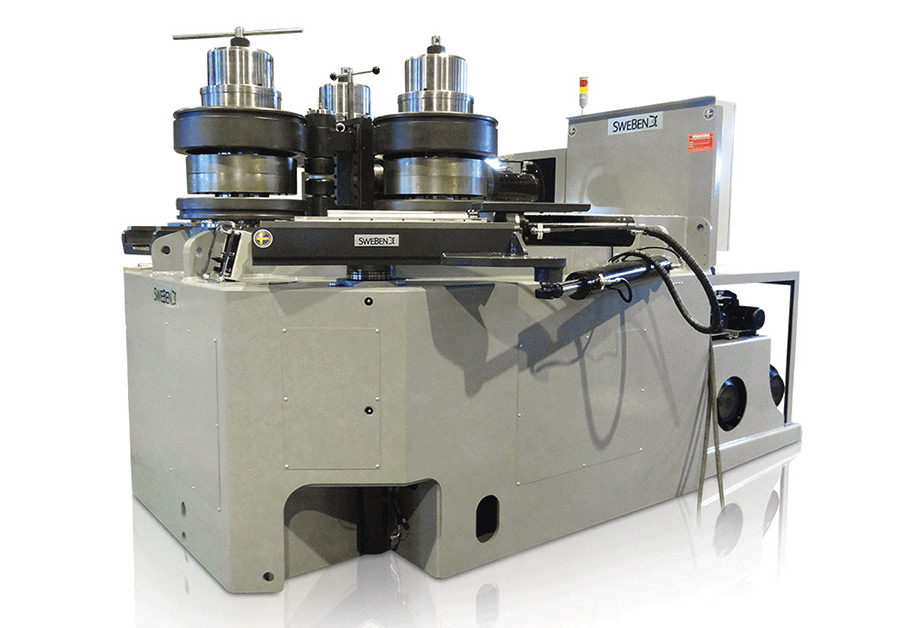

We are also spending about $4 million for improvements at our Birmingham mills. We will perform upgrades and install new equipment that will enhance the quality of our products and increase efficiencies. We are adding quick change-over technology; upgrading mill coolant systems to improve surface quality and increase tool life; adding weld monitoring systems, including flux leakage for improved weld integrity; upgrading mill cut-off systems to improve cut end quality and length tolerances; and improving plant layout for reduced material handling. We will maintain our full range of capabilities while simplifying our mill scheduling.

Ulbrich debuts app

David Sheer, vice president and CEO for The Steel Supply Co., Rolling Meadows, Illinois, has retired after 51 years in the service center industry. When Sheer left the U.S. Air Force in 1969, he started working at another steel company but soon joined the inside sales staff at Steel Supply. After two years, Sheer was promoted to outside sales, covering seven states. He was named general manager in 1981 and added the role of vice president in 1991. Sheer became CEO in the early 2000s. He was involved with the Metals Service Center Institute for over 30 years, serving on various committees and councils, and on MSCI’s board of directors.

TW Metals, Exton, Pennsylvania, has made some personnel changes. Bill Schmid has moved to the role of vice president for supply chain and product development. Bob Pullen was named Midwest regional general manager, leading the Chicago, Minneapolis, Milwaukee, Toledo and Cincinnati branches. Steve McMahon was selected as Northeast regional general manager covering service centers in Agawam, Rochester, Charleston and Cranbury.

Leeco Steel, Lisle, Illinois, promoted Kelan Thompson to Southeast sales manager. Thompson joined Leeco Steel in 2008 as a sales representative based in Oshkosh, Wisconsin, was promoted to national account manager in 2012 and senior account manager last year.

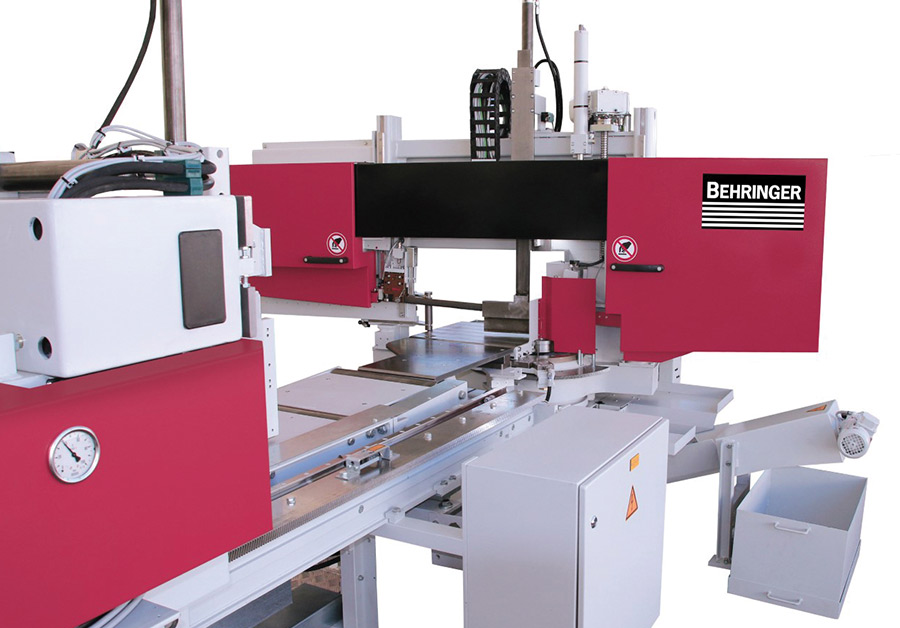

Behringer Saws Inc., Morgantown, Pennsylvania, hired Gregory Bielitz as an electromechanical technician. He will provide electrical support throughout all departments, with a focus on adding saw options and material handling integration.

his line, “…and feel by turns the bitter change of fierce extremes,” comes from John Milton’s poem “Paradise Lost.” Black swan is defined as “an unpredictable or unforeseen event, typically one with extreme consequences.” And so here we are.

There are numerous measures for how the economy is faring during a black swan event such as the global pandemic. These include sharp changes in GDP, shipments, new orders, prices, capacity utilization and trade activity. Buckle up as we hit the speed bumps.

the number of jobs lost in metal production between august 2019 and august 2020 is 47,900.

the number of jobs lost in metal production between august 2019 and august 2020 is 47,900.

his line, “…and feel by turns the bitter change of fierce extremes,” comes from John Milton’s poem “Paradise Lost.” Black swan is defined as “an unpredictable or unforeseen event, typically one with extreme consequences.” And so here we are.

There are numerous measures for how the economy is faring during a black swan event such as the global pandemic. These include sharp changes in GDP, shipments, new orders, prices, capacity utilization and trade activity. Buckle up as we hit the speed bumps.

the number of jobs lost in metal production between august 2019 and august 2020 is 47,900.

the number of jobs lost in metal production between august 2019 and august 2020 is 47,900.

CEO Scott Kirby said that United Airlines’ revenue is expected to fall by 85 percent in the third quarter. The airline initiated layoffs effective Oct. 1. “Business travel is almost nonexistent,” he said. “Leisure travel is down significantly. As for international travel, United’s revenue was down 96 percent year over year for the second quarter and continues to take a hit as coronavirus restrictions keep borders closed,” he said during a September interview on “Face The Nation.”

CEO Scott Kirby said that United Airlines’ revenue is expected to fall by 85 percent in the third quarter. The airline initiated layoffs effective Oct. 1. “Business travel is almost nonexistent,” he said. “Leisure travel is down significantly. As for international travel, United’s revenue was down 96 percent year over year for the second quarter and continues to take a hit as coronavirus restrictions keep borders closed,” he said during a September interview on “Face The Nation.”

Second-quarter results for Airbus and Boeing tell a similar story. Airbus reported a 55 percent decline in revenue during second quarter compared to the same 2019 period. The company attributed the loss to fewer deliveries. Following cancellations, the OEM’s gross orders in August 2020 totaled 370 aircraft with net orders of 3,030. Airbus delivered a total of 39 aircraft. Its backlogged deliveries stood at 7,501, comprising a range of Airbus commercial models.

Passenger vehicle sales in the U.S. were already falling in 2017, 2018 and 2019. Through the first eight months of 2020, new light-vehicle sales were off by 20.7 percent compared with the same period in 2019, says Patrick Manzi, chief economist for the National Automobile Dealers Association. Cox Automotive Senior Economist Charlie Chesbrough points to COVID-19, civil unrest and continued unemployment as causes for the latest downtick. “The auto market will have some major obstacles that will slow the V-shaped rebound we had all hoped for,” he said.

Passenger vehicle sales in the U.S. were already falling in 2017, 2018 and 2019. Through the first eight months of 2020, new light-vehicle sales were off by 20.7 percent compared with the same period in 2019, says Patrick Manzi, chief economist for the National Automobile Dealers Association. Cox Automotive Senior Economist Charlie Chesbrough points to COVID-19, civil unrest and continued unemployment as causes for the latest downtick. “The auto market will have some major obstacles that will slow the V-shaped rebound we had all hoped for,” he said.

CEP Technologies President Ken Kaufmann Jr. is hearing a similar story from his customers. The Tier 3 supplier produces miniature and small progressive stampings for automotive OEMs and makes ignition terminals for the industry’s aftermarket. “The automotive industry has a long road ahead in terms of recovering sales volumes,” he says. “I anticipate it will be at least 2025 before we hit the numbers we saw after the Great Recession.”

Delays, cancellations and uncertainty swirl around construction projects—whether it’s fallout from COVID-19 restrictions or concern about equipment and materials tied up in supply chain bottlenecks.

Delays, cancellations and uncertainty swirl around construction projects—whether it’s fallout from COVID-19 restrictions or concern about equipment and materials tied up in supply chain bottlenecks.

The majority of architecture firms continued to report a decline in billings in August, according to the Architecture Billings Index from the American Institute of Architects. A main reason cited for the decline is a reluctance to commit to new projects due to a continued resurgence in COVID-19 cases around the country. “Conditions remained very weak at firms with a commercial/industrial specialization, and have stabilized modestly at firms with an institutional specialization,” reports the AIA.

Forecasts for the amount of future space needed for offices, though, are murky. The traditional office “isn’t obsolete yet, but it is changing,” PwC points out, noting that employees still want to engage with colleagues in person. Thirty percent of executive respondents to the PwC survey foresee the need for less office space due to remote work, while 50 percent anticipate an increase due to longer-lasting requirements for physical distance or growth in their workforce.

As economic activity starts back toward pre-pandemic levels, both intermediate refining demand for crude oil and end-market consumer demand for oil products remain depressed, says Matt Epstein, managing director for Clearview Geospatial. “Demand is off 15 percent year over year. International supply cuts by OPEC+ and domestic production declines—expected to average about 1.1 million barrels of oil per day—continue to chase falling demand,” he says.

As economic activity starts back toward pre-pandemic levels, both intermediate refining demand for crude oil and end-market consumer demand for oil products remain depressed, says Matt Epstein, managing director for Clearview Geospatial. “Demand is off 15 percent year over year. International supply cuts by OPEC+ and domestic production declines—expected to average about 1.1 million barrels of oil per day—continue to chase falling demand,” he says.

Over the summer, the U.S. Energy Information Administration forecast a decline in U.S. gross domestic product of 7.4 percent in 2020 because of efforts to combat COVID-19. “As a result of the effects of travel restrictions and stay-at-home orders on the U.S. economy, EIA forecasts that domestic consumption of petroleum liquids will decrease with gasoline consumption falling by nearly 13 percent in 2020 and diesel decreasing about 10 percent.”

Most notably, however, the EIA projects that the most significant declines are behind us and that, going forward, domestic consumption of petroleum liquids is expected to rise in the next 18 months.

In efforts to offset economic fallout from COVID-19, states have taken measures such as offering stimulus checks to taxpayers as well as financial relief for businesses. Sharp declines in tax revenues have led to state and local budget shortfalls, resulting in many planned infrastructure projects to be either postponed or halted indefinitely.

In efforts to offset economic fallout from COVID-19, states have taken measures such as offering stimulus checks to taxpayers as well as financial relief for businesses. Sharp declines in tax revenues have led to state and local budget shortfalls, resulting in many planned infrastructure projects to be either postponed or halted indefinitely.

The Council of State Governments COVID-19: Fiscal Impact to States and Strategies for Recovery report estimates that states will experience a combined $211 billion budgetary deficit to overall state funds. While states driven by the hospitality and tourism sectors, such as Nevada and Hawaii, are experiencing higher economic risk, the manufacturing sector remains stronger. In the Midwest especially, a good portion of manufacturers have stayed open and operational, serving as essential businesses.

The global heavy construction equipment market was valued at $121.66 billion in 2019 and is projected to reach $240.49 billion by 2027, according to a recent construction equipment market outlook from Allied Market Research.

This spring, ahead of shelter-in-place orders, Americans found that once-reliable household staples like paper products, disinfecting wipes, dried pasta and canned beans were suddenly difficult to track down. Although disinfecting wipes remain scarce, the other items were restocked in fairly short order, thanks to hardworking front-line workers, including truck drivers. “The business impact of COVID-19 has varied significantly from one trucking company to the next,” according to Transport Topics, with fleet owners describing a range of experiences from steady volumes and upticks in demand to downturns.

This spring, ahead of shelter-in-place orders, Americans found that once-reliable household staples like paper products, disinfecting wipes, dried pasta and canned beans were suddenly difficult to track down. Although disinfecting wipes remain scarce, the other items were restocked in fairly short order, thanks to hardworking front-line workers, including truck drivers. “The business impact of COVID-19 has varied significantly from one trucking company to the next,” according to Transport Topics, with fleet owners describing a range of experiences from steady volumes and upticks in demand to downturns.

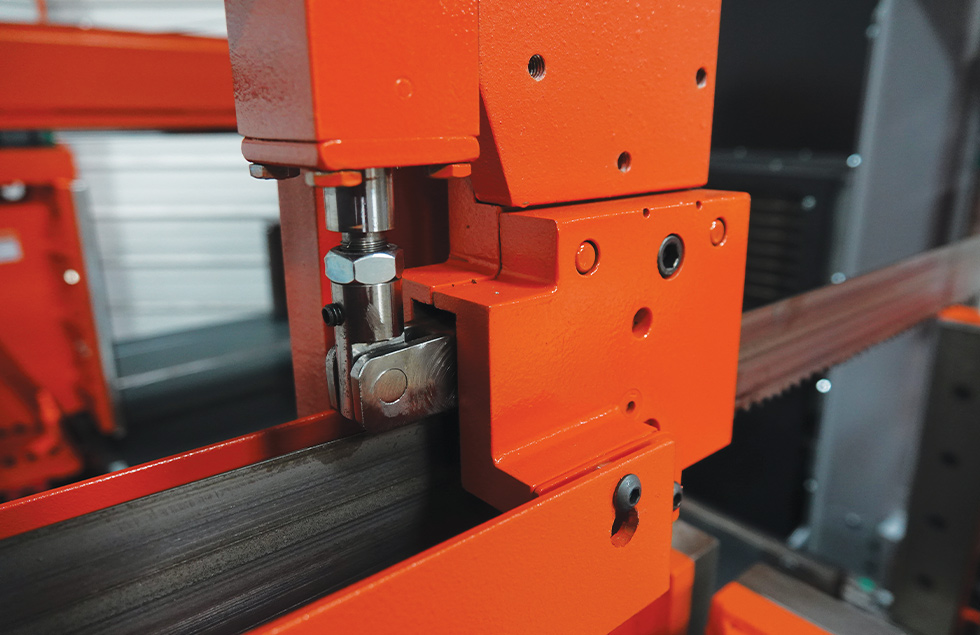

elta, Ohio, may not look very significant on a map but it is an exurb of Toledo and surrounded by steel consumers. Fulton County Processing (FCP), which sits on the campus of flat-rolled steel producer North Star Bluescope, is right where it wants to be.

“FCP is in the Michigan Corridor. We are centered from Toledo to Chicago, Cleveland and Detroit,” says President and General Manager Jeff Kunkel.

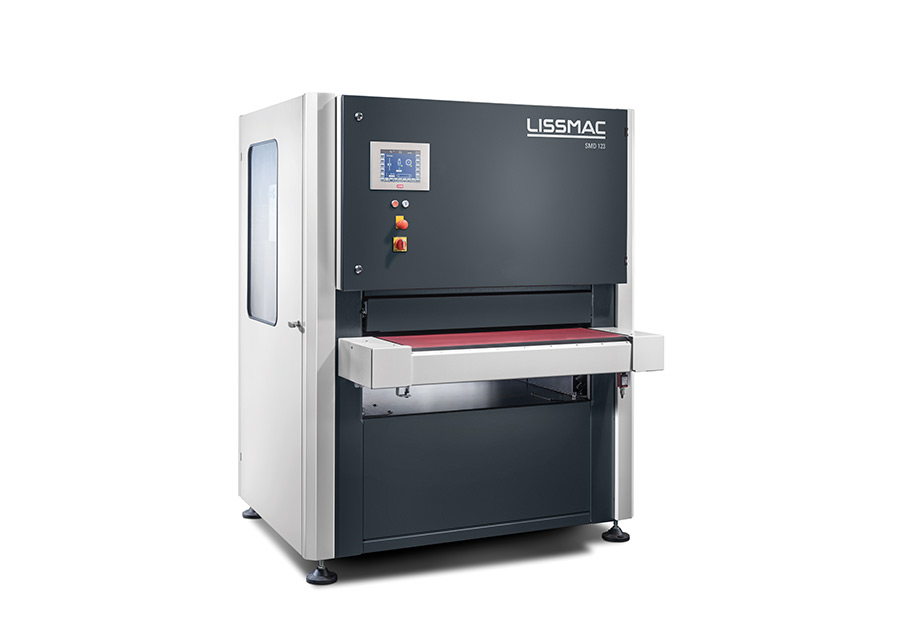

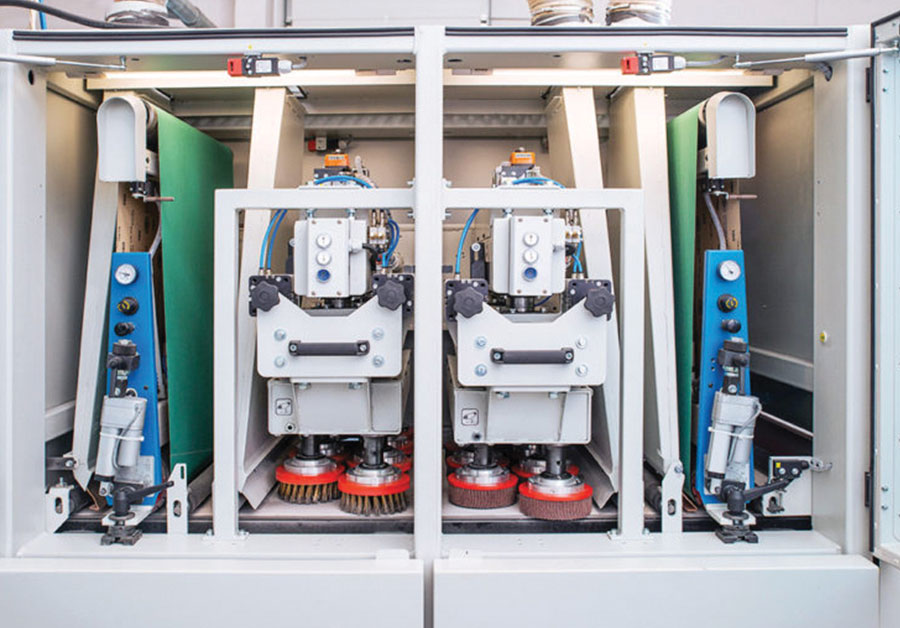

Since starting up in 2002, the company has steadily increased its capacity to pickle, slit and level carbon and stainless sheet products. The toll processor’s quest is to continuously improve its finished product and better serve mills and end users.

teel Dynamics Inc. is well along its timeline for executing a plan, announced in early 2019, to open a 3 million-tons-per-year minimill in Sinton, Texas, a town with roughly 5,600 residents who enjoy a warm climate with average annual rainfall of 34 inches.

The location’s advantages are obvious. It’s 30 minutes from the Port of Corpus Christi, which serves other nearby steel-related interests in addition to oil and chemical companies. It’s 150 miles from Nuevo Laredo and 170 miles from Matamoros. Apart from SDI’s Omnisource scrapyards, the steelmaker will source scrap from a new acquisition, Zimmer Recycling, just outside Monterrey.

“It’s a big project and we’re completing it in the middle of a pandemic,” comments Glenn Pushis, senior vice president for special projects at SDI. The company broke ground last year and expects to start up production in 2021. “Building a steel mill in 18 months is super aggressive,” he acknowledges.

Ahead

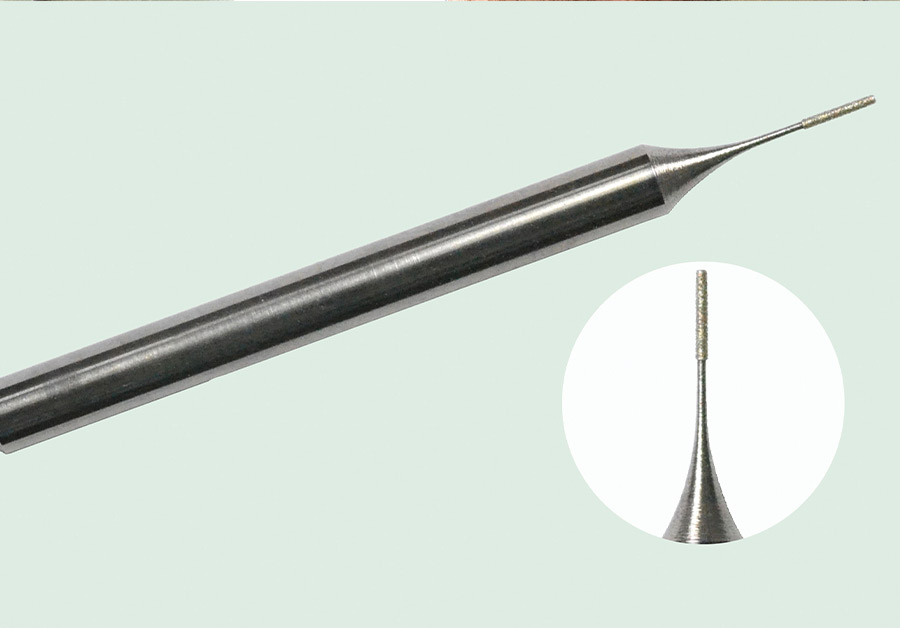

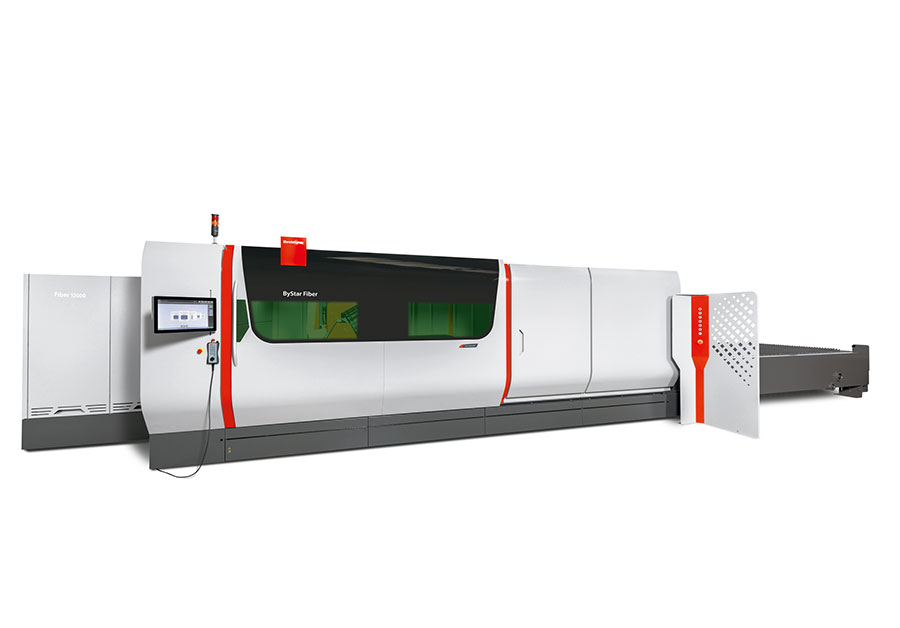

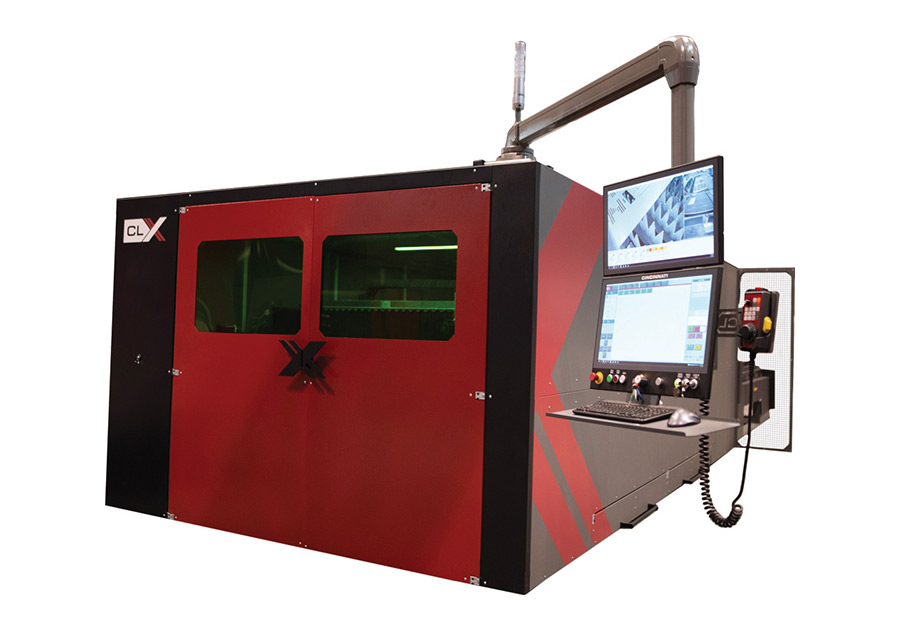

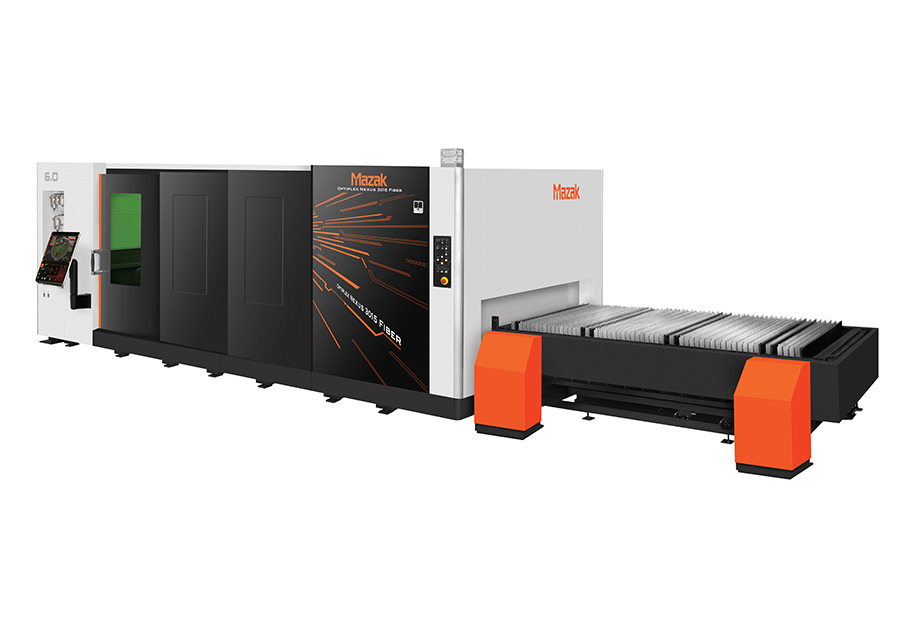

everal methods and types of machinery will help a metals processor or fabricator to cut a pipe and prepare it for welding: Laser, cold saw, band saw, abrasive saw, lathe cutting, shearing and CNC plasma cutting.

Ahead

everal methods and types of machinery will help a metals processor or fabricator to cut a pipe and prepare it for welding: Laser, cold saw, band saw, abrasive saw, lathe cutting, shearing and CNC plasma cutting.

“The next generation of plasma cutting machines performed better by using shield gases, creating less dross and less edge bevel,” Turner says. Even so, a 3- to 5-degree bevel may still have to be ground in order to butt weld the ends.

sail

hree years ago, private equity lender Robert Gutierrez heard from business partner Aaron Browning about a houseboat company shutting down in landlocked Tolleson, Arizona. He and his wife Mia flew to Phoenix, combed through the company’s financial records and toured the facility. After a marathon of negotiations with the previous owners, Browning and Gutierrez decided it was a venture worth pursuing.

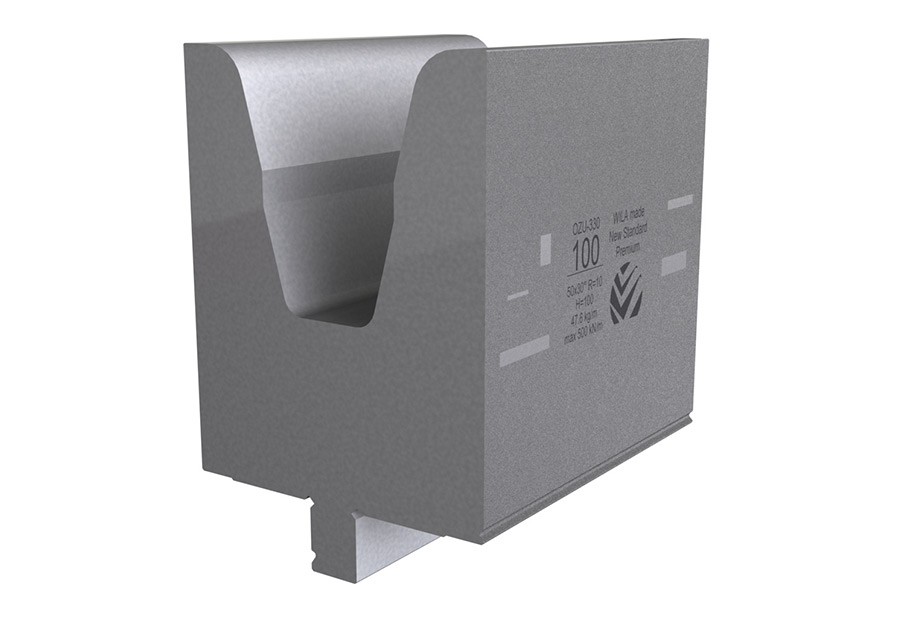

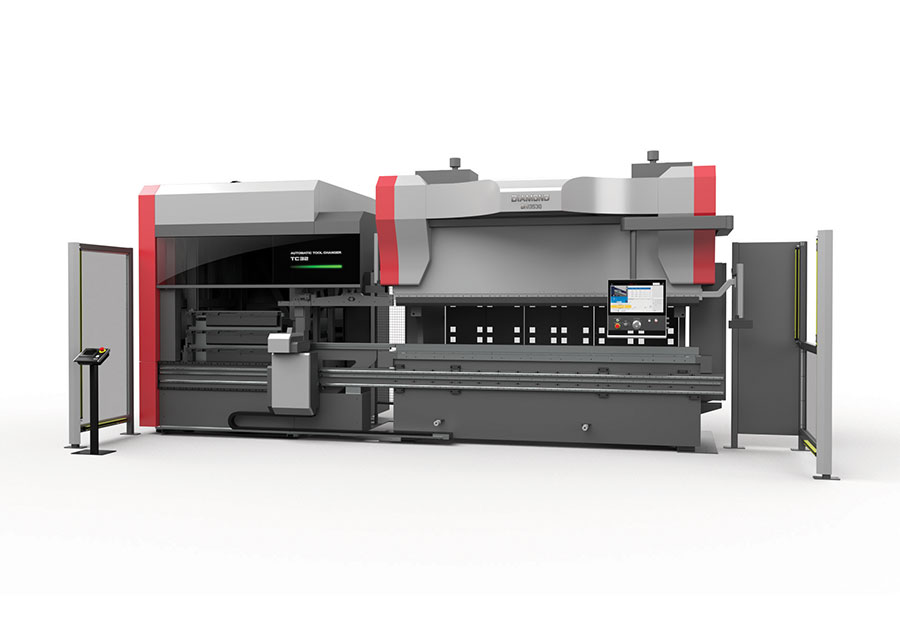

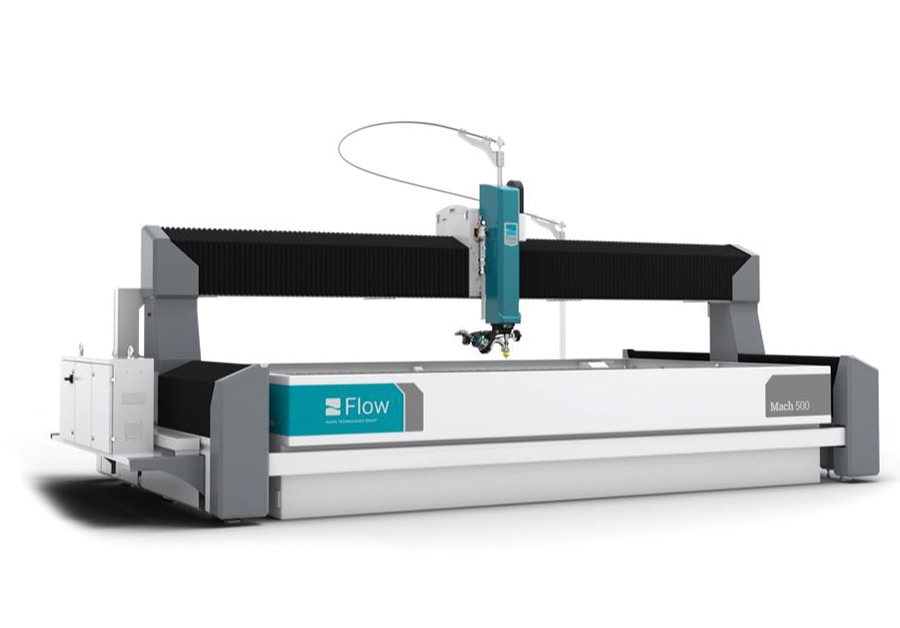

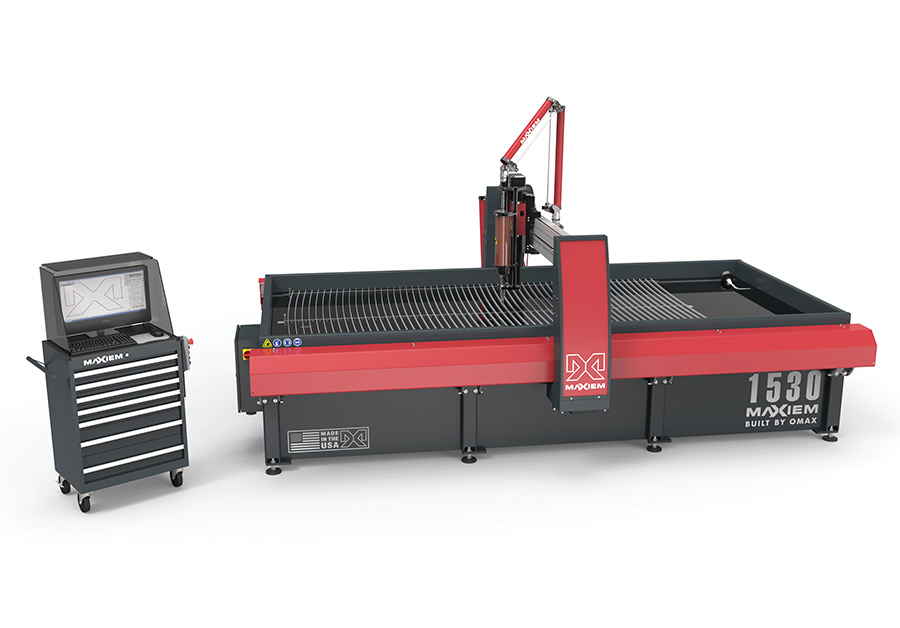

“It was an interesting purchase for us,” recalls Bravada Yachts co-owner Robert Gutierrez. “When we started, we inherited a press brake, a shear and an older waterjet, which were decent machines. But when we started making design changes, we realized we needed a more flexible and accurate cutting method.”

With his team in place, including his wife, son and a shop full of seasoned fabricators, his next prerogative was to find new equipment. He met fabrication machine merchant Dave Graf at Mac-Tech in Milwaukee. “Dave introduced us to Techni. I went to look at what the machines could cut and how detailed the work could be,” he says. “We use a lot of different materials from composites to aluminum and steel.”

he integration of the best resources in any given market can be achieved in many different ways. One of the most powerful ways is to partner with an expert that will not only deliver what you ask but also help you to make your organization better. It’s a give and take.

In June, Exton, Pennsylvania-based TW Metals, an operating company of O’Neal Industries, signed a long-term partnership agreement with Phoenix-based GlobalTranz Enterprises LLC, a third-party logistics solutions provider, to manage a substantial portion of its transportation needs.

“Proprietary technology is pivotal in our platform,” says Ross Spanier, head of operations at GlobalTranz Enterprises. “How we engage with customers can be highly transactional on the one hand—managing rates and service in a commodified manner—if that is the level of service they desire. But with TW Metals, this is a more integrated offering. That engagement includes process and technology. We are an extension of their business.”

sawing/cutting

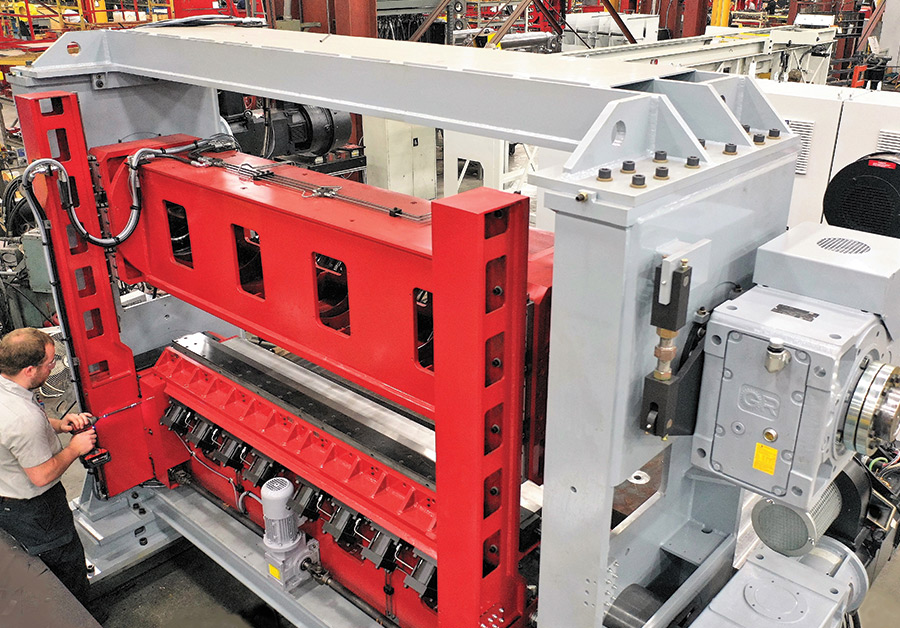

avage Saws, a division of Thermatool Corp., which itself is an Inductotherm Group company, has built saws for very specific metal-cutting operations since the 1800s. Versatility is a key ingredient in the saw-building recipes developed by Savage Saws.

Feed rates, material dimensions, hardness, coolants, speed, blade diameter and other variables are what customers must consider when selecting a saw that best suits their application, according to Mike Abbas, director of engineered systems and cutting products at Thermatool Corp.

Abbas says Savage Saws machines add value. “[They] are built for production and, with our many equipment features and options, we are set far apart from competitors.

Advertiser Index

View Index

Paralympic Museum

Paralympic Museum

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

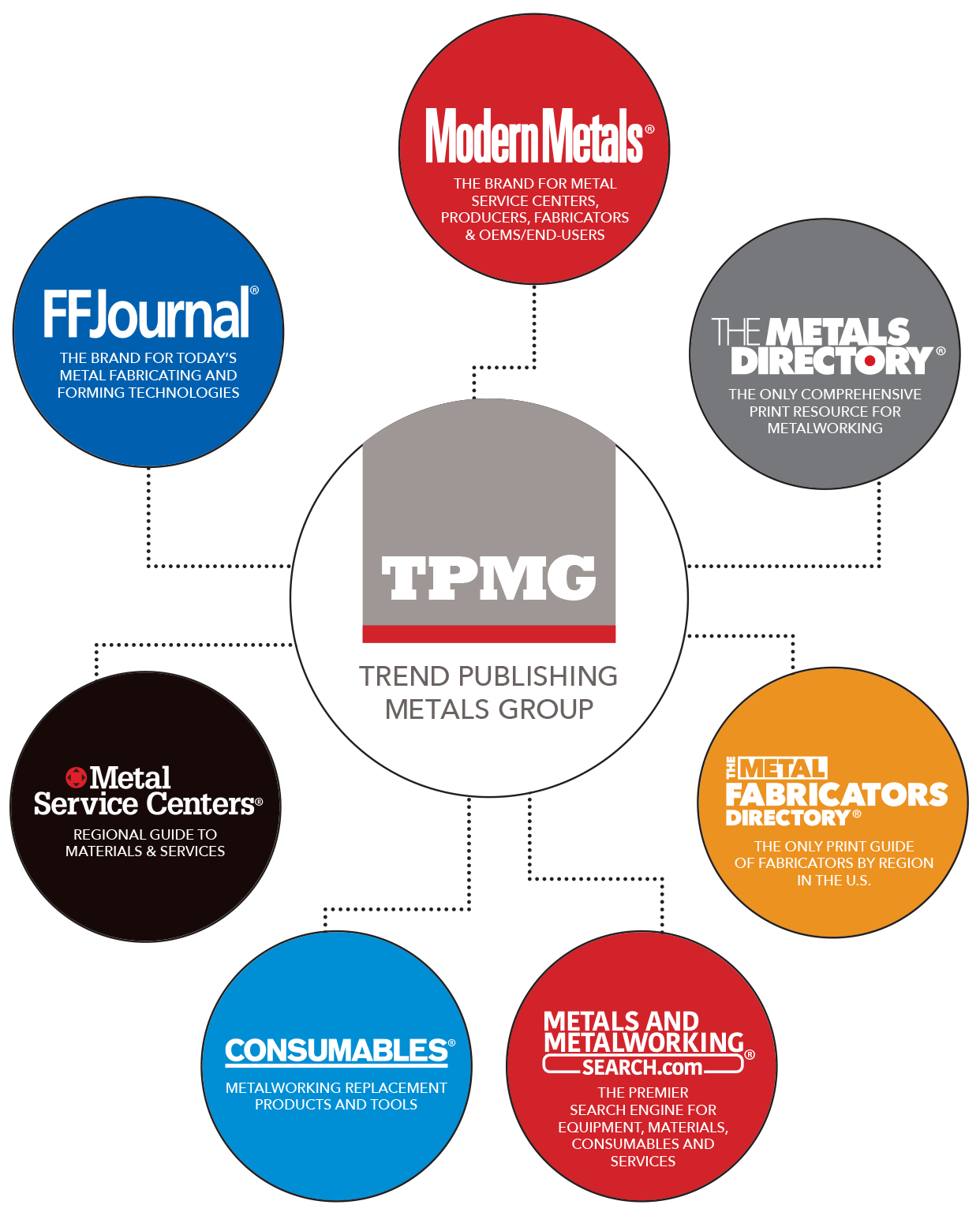

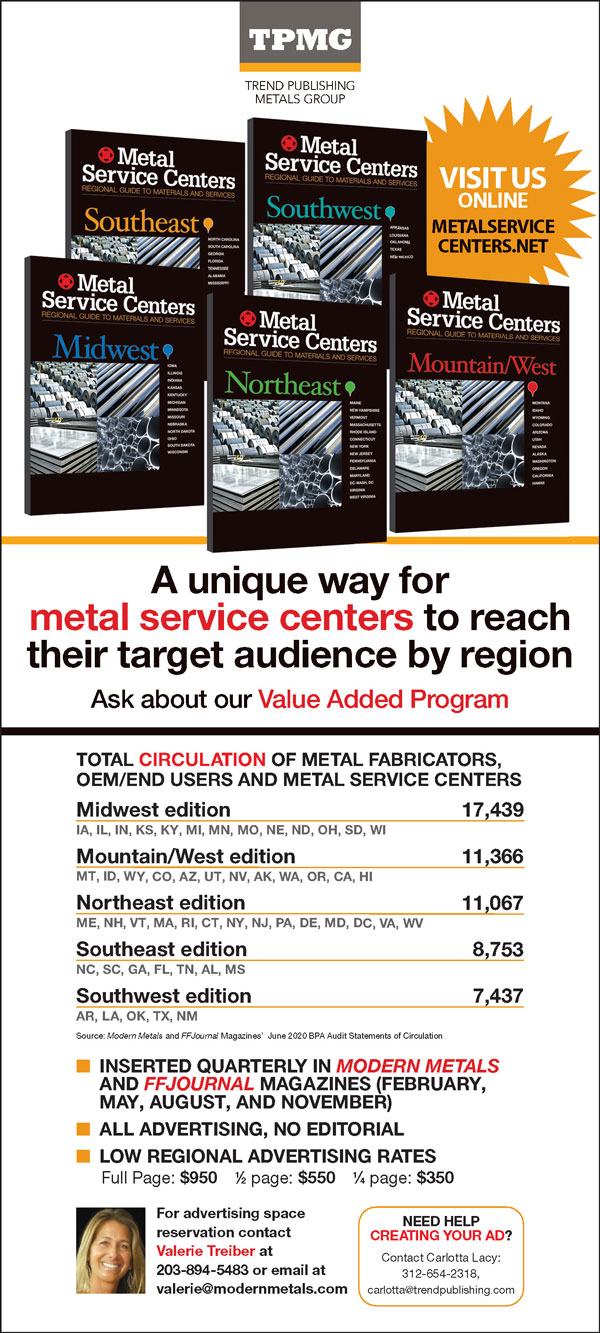

Modern Metals® (ISSN 0026-8127, USPS 357-640) October 2020, Vol. 77, No. 9 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) October 2020, Vol. 77, No. 9 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.