Passenger vehicle sales in the U.S. were already falling in 2017, 2018 and 2019. Through the first eight months of 2020, new light-vehicle sales were off by 20.7 percent compared with the same period in 2019, says Patrick Manzi, chief economist for the National Automobile Dealers Association. Cox Automotive Senior Economist Charlie Chesbrough points to COVID-19, civil unrest and continued unemployment as causes for the latest downtick. “The auto market will have some major obstacles that will slow the V-shaped rebound we had all hoped for,” he said.

Passenger vehicle sales in the U.S. were already falling in 2017, 2018 and 2019. Through the first eight months of 2020, new light-vehicle sales were off by 20.7 percent compared with the same period in 2019, says Patrick Manzi, chief economist for the National Automobile Dealers Association. Cox Automotive Senior Economist Charlie Chesbrough points to COVID-19, civil unrest and continued unemployment as causes for the latest downtick. “The auto market will have some major obstacles that will slow the V-shaped rebound we had all hoped for,” he said.

CEP Technologies President Ken Kaufmann Jr. is hearing a similar story from his customers. The Tier 3 supplier produces miniature and small progressive stampings for automotive OEMs and makes ignition terminals for the industry’s aftermarket. “The automotive industry has a long road ahead in terms of recovering sales volumes,” he says. “I anticipate it will be at least 2025 before we hit the numbers we saw after the Great Recession.”

Bloomberg New Energy Finance anticipates that electric models will “account for nearly 60 percent of all new passenger car sales worldwide by 2040.” The International Energy Agency’s Global EV Outlook 2020 report noted that while global sales of passenger cars in 2019 was sluggish, “electric cars had another banner year.”

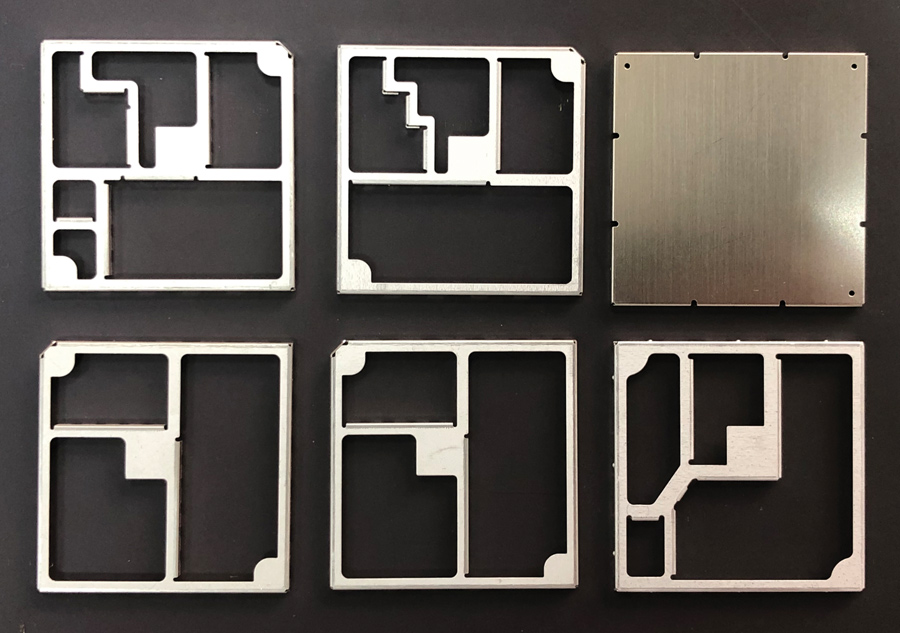

For these things to function without interruption, he says, “you have to protect the boards and what is on them with a shielding frame and cover” that encapsulate these components.

CEP produces custom EMI/RFI shielding components for circuit boards along with battery contacts, terminals and heat sinks that are assembled on an infotainment unit for in-car WiFi.

The pandemic, which brought commuter traffic down dramatically during the middle of 2020, is fueling a growth spurt in do-it-yourself projects and purchases for the automotive aftermarket space, NPD Group Inc., a market research firm reported in August 2020.

CEP is seeing growth abroad. “We’re getting a boost in business from China,” Kaufmann says. “China has rebounded from the pandemic considerably better than the U.S. We’re seeing a greater number of new automotive projects come out of Asia than North America right now. Much of this business is OEM-driven.”

On the materials side of the equation, Kaufmann has seen steel prices drop while copper continues to hold its own. “Right now copper is about 8 percent higher than it was at the beginning of the year, which is significant when you consider the effects of COVID-19 and how far off production levels are. Material sourcing lead times, however, have been impacted. Currently we’re seeing an increase of four to six weeks.”

As the market’s supply chain continues to take baby steps forward, Kaufmann has one other piece of advice. “A diversified portfolio can help companies weather these types of events,” he notes. “Being a fiscally responsible company allowed us to build our inventories during the shutdown to support customers once the economy reopened. A supplier who can readily secure material and make parts is critical to helping manufacturers survive during times like these.”