the ground

the ground

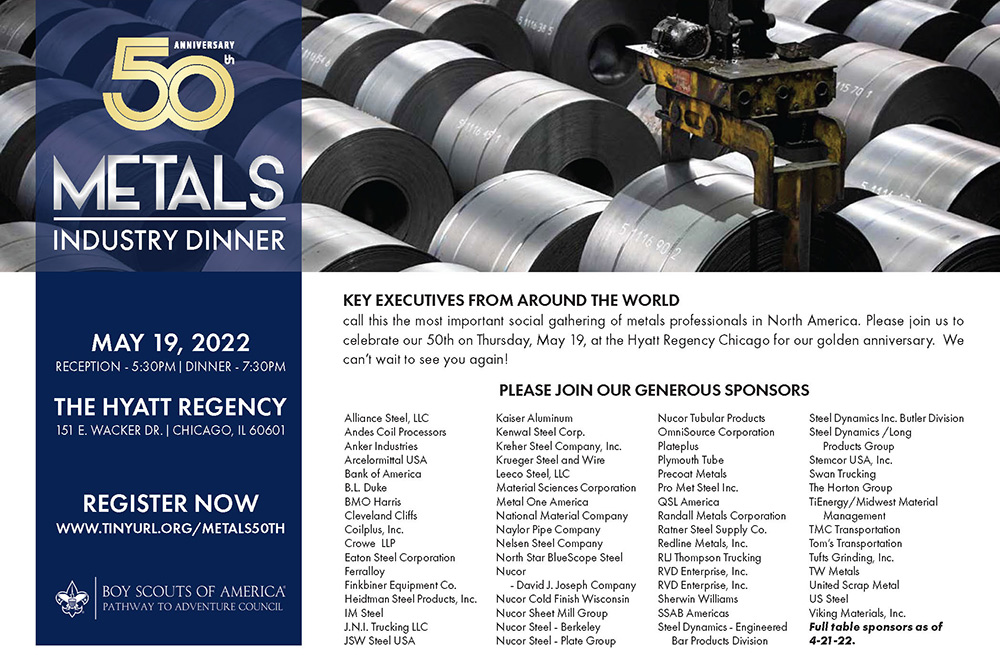

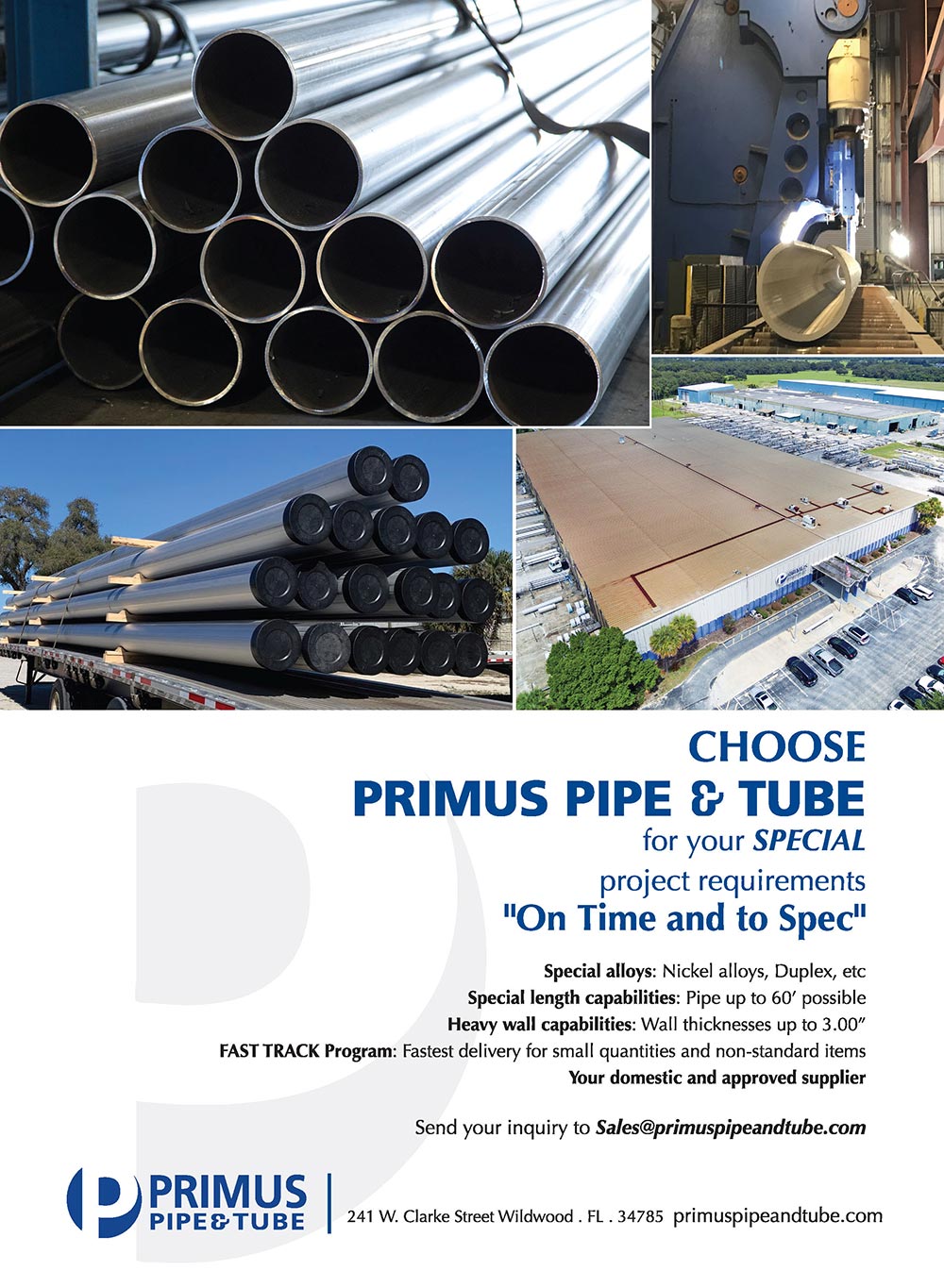

serving metal service centers, fabricators and OEM/end users since 1945

logistics

Features

ow.ly/Is5T30sfYTu @aisc

he Office of Management and Budget issued a memorandum April 18 date outlining the federal government’s initial implementation guidance on the application of Buy America preferences in federal financial assistance programs for infrastructure. The OMB gave agencies until May 14, 2022, to ensure that all applicable programs comply with section 70914 of the Infrastructure Investment and Jobs Act, including by incorporating a Buy America preference in the terms and conditions of each award with an infrastructure project.

Under the law, all iron and steel used in the project must be produced in the United States. This means all manufacturing processes, from melting stage through the application of coatings, occurred in the United States.

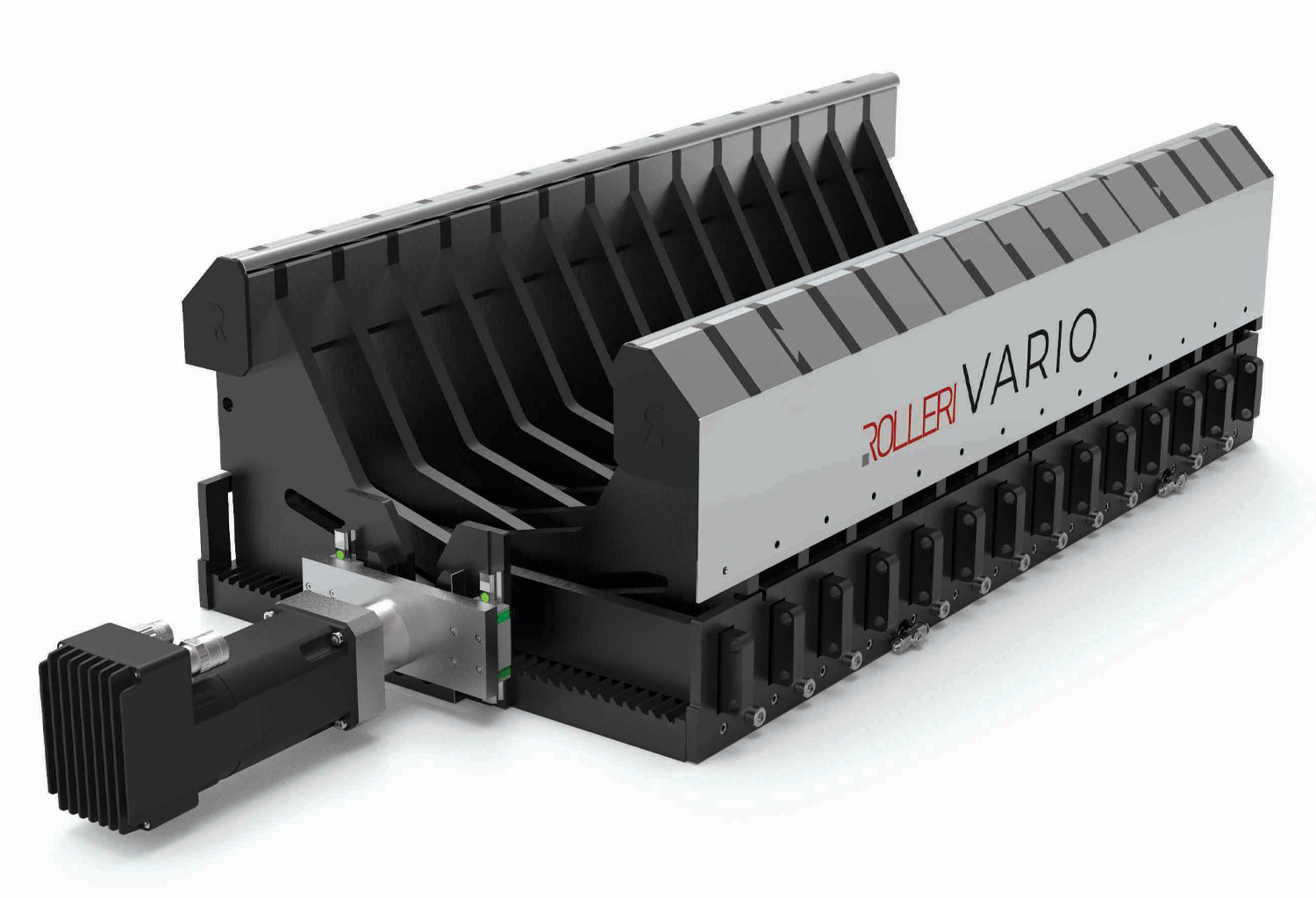

With the Rolleri Vario, average setup time can drop by as much as 85 percent.

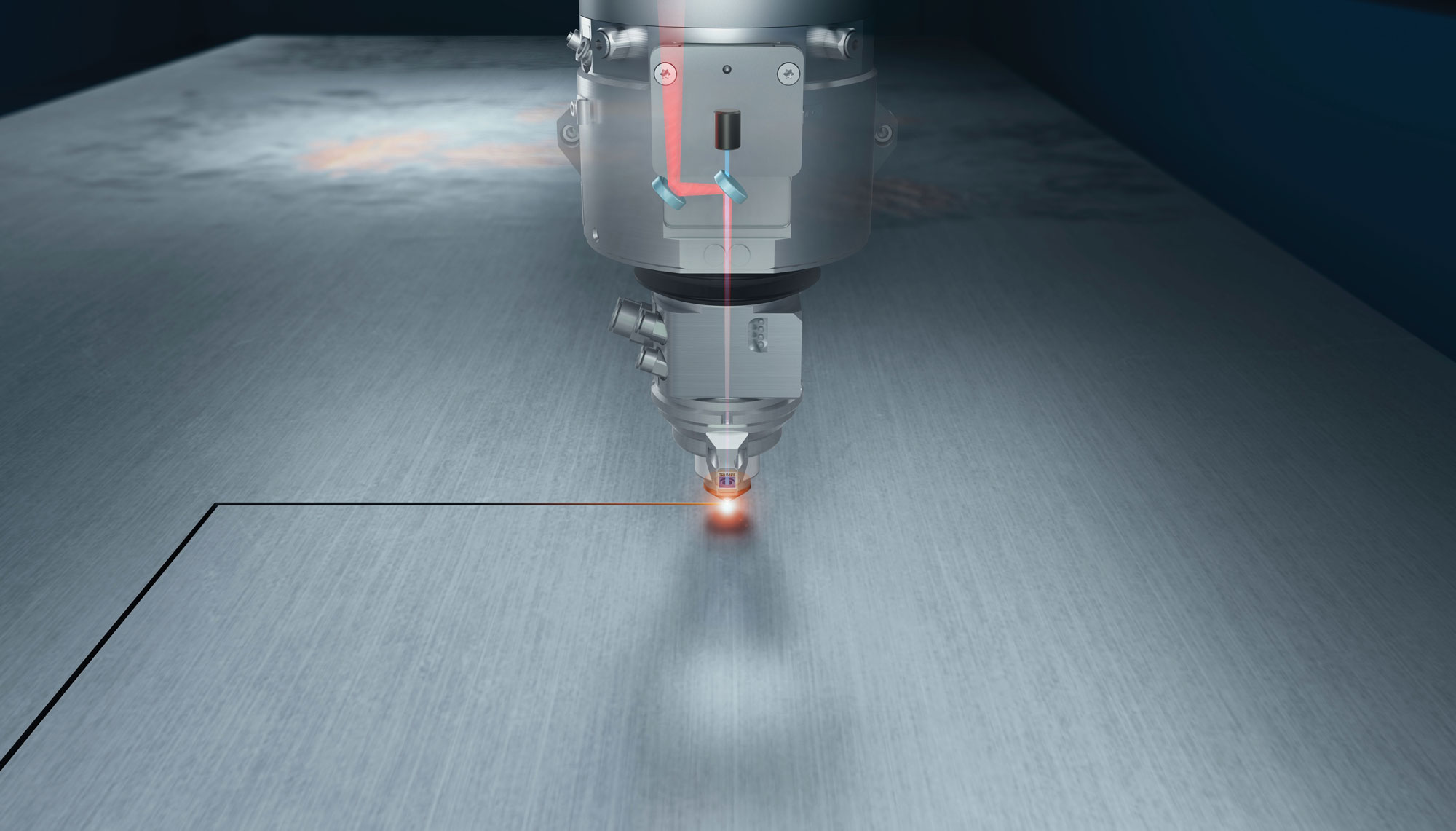

very aspect of the global economy has been tested in the past decade, and the fabrication sector has not been exempt from the challenges. With booming gas and energy costs, environmental requirements and increased efficiency needs of modern industry, abrasive-resistant (AR) steels have evolved as a major contributor for countless applications, despite having been around for a while.

In fact, all indicators point to the need for even lighter, more durable, reliable and efficient trucks, tractors, mining equipment and other products that require abrasive-resistant steels. However, fabricating these materials can be a challenge. Abrasive-resistant steels are much harder, making them difficult to penetrate, resistant to traction and less ductile, which means they can crack much more easily than mild or stainless steel during processing. In order to properly bend a part made from abrasive-resistant steel, fabricators must step up both their equipment and knowledge.

hris Smrekar, product specialist for Unist Inc., talks with Modern Metals about common customer concerns and questions surrounding minimum quantity lubrication (MQL). What is MQL? It’s exactly what the name implies: a minute amount of a high-quality lubricant delivered to a cutting tool or workpiece to reduce friction. MQL can benefit sawing applications, dedicated tapping machines, drilling fixtures, beam drills and other machining processes.

A roundtable discussion at the Copper and Brass Servicenter Association’s annual meeting, held in April, covered a wide range of topics. Most of the CBSA members who spoke said they have revised their purchasing strategies in order to meet consistently strong demand for red metal products.

Although raw materials aren’t necessarily tight at the source, the obstacles in terms of port and ocean freight capacity worldwide, and trucking capacity domestically, have compelled producers and distributors to increase inventory, pay more for everything, and even create supply contracts for spare machinery parts and consumables.

his car could be a major piece of machinery. This car could be systematic, hydromatic, ultramatic. Why, it could be greased lightning!” The hit Broadway show and 1978 film, “Grease” spoke to the love of hot rods as well as lust between high schoolers.

America since the end of World War II really developed into a car culture; it was and is home to the most iconic brands—Ford, GM, Chrysler (now Stellantis). Today, the Germans, Japanese and Koreans all also make cars in the U.S., Canada and Mexico. Even the Chinese EV automaker NIO has opened offices in California.

The electrification of the vehicle, for the sake of the planet, is a disruptor, to be sure. OEMs like Ford, GM and Mercedes-Benz, which have built fossil-fueled internal combustion engine models for roughly a century, are taking on the challenge of producing battery electric vehicles (BEV) on a much greater scale than they have before. This inexorable trend presents challenges for the automotive supply chain, but the risks of not preparing for this evolution are greater than the risks of failing to adapt.

his car could be a major piece of machinery. This car could be systematic, hydromatic, ultramatic. Why, it could be greased lightning!” The hit Broadway show and 1978 film, “Grease” spoke to the love of hot rods as well as lust between high schoolers.

America since the end of World War II really developed into a car culture; it was and is home to the most iconic brands—Ford, GM, Chrysler (now Stellantis). Today, the Germans, Japanese and Koreans all also make cars in the U.S., Canada and Mexico. Even the Chinese EV automaker NIO has opened offices in California.

The electrification of the vehicle, for the sake of the planet, is a disruptor, to be sure. OEMs like Ford, GM and Mercedes-Benz, which have built fossil-fueled internal combustion engine models for roughly a century, are taking on the challenge of producing battery electric vehicles (BEV) on a much greater scale than they have before. This inexorable trend presents challenges for the automotive supply chain, but the risks of not preparing for this evolution are greater than the risks of failing to adapt.

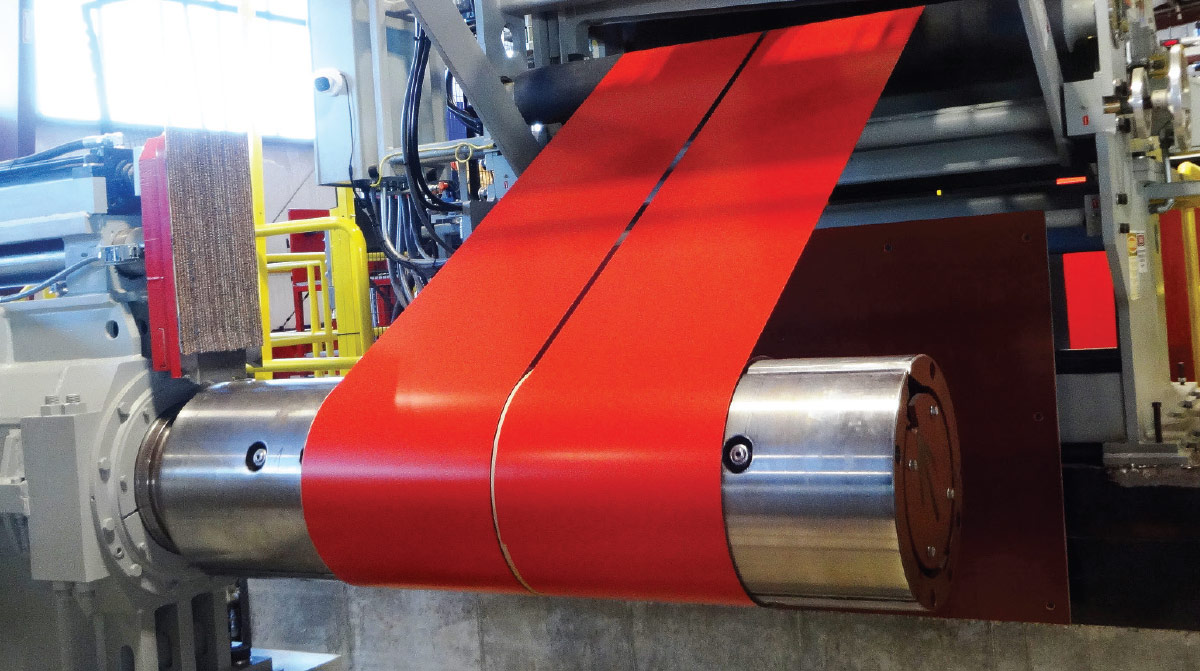

hen something works out well, that’s proof enough to do it again. That’s what United Steel Supply did when it installed its second complete slitting line from Braner USA Inc.

United Steel Supply (USS) furnishes Galvalume, galvanized and prepainted steel coils for metal roofing and siding applications to the agricultural, commercial, industrial and residential markets, both domestically and for export. Coatings include a polyester coating, a SMP Weather XL coating and a fluoropolymer paint coating, according to Will Waldrip, vice president of the service center.

.S. shipments of transportation equipment during the first two months of 2022 exceeded those of the same two-month period in 2021 by 7.4 percent, according to the U.S. Census Bureau’s Durable Goods report. New orders for transportation equipment jumped by 21.6 percent year over year.

A few trends are likely at work here. First, the pandemic threw up enormous obstacles in the supply chain while delivery demand to households skyrocketed. Second, major commercial vehicle manufacturers around the globe are feverishly working to expand their capacity to build electric trucks. Third, the lightweighting of Class 5-8 trucks and trailers has gained incredible momentum.

he pandemic laid bare some of the negative aspects of globalized supply chains. Although there is no real likelihood that purely localized economies will return, there has been substantial consideration for reshoring work that has been done overseas for years. This is a positive development, but one critical aspect that goes into the decision of how and where a product is produced is simple consideration of profit margin. Wealthier nations have labor forces that are considerably more expensive than those in the developing world. Setting aside the current disruption, for domestic production to make sense it must be efficient—and it must be intelligent.

Transportation & Logistics

i’ve been here almost 15 years. I stay because i love sunline and wouldn’t want to be anywhere else

i’ve been here almost 15 years. I stay because i love sunline and wouldn’t want to be anywhere else

manuel soriano, sunline driver

t’s a story most readers have heard before—the one where a few overworked, overtired “kids” didn’t know any better but still figured out how to make a go of a startup company. That is the story of Sunline, a San Antonio, Texas, asset-based carrier that started out as a family enterprise in 1994 with four owners and it still retains all the original kids.

Over time, this family worked to cultivate long-term relationships with vendors, employees and customers based on intelligent solutions so that all stakeholders could grow successfully together. Today, the company employs about 70 people, including drivers.

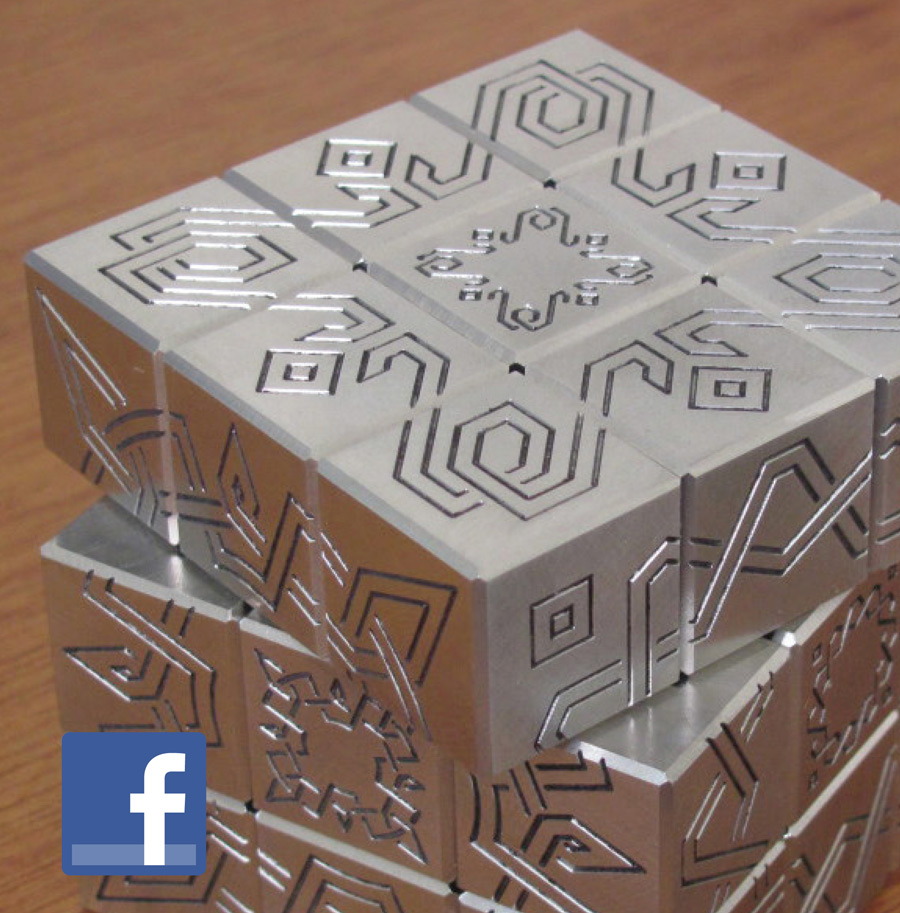

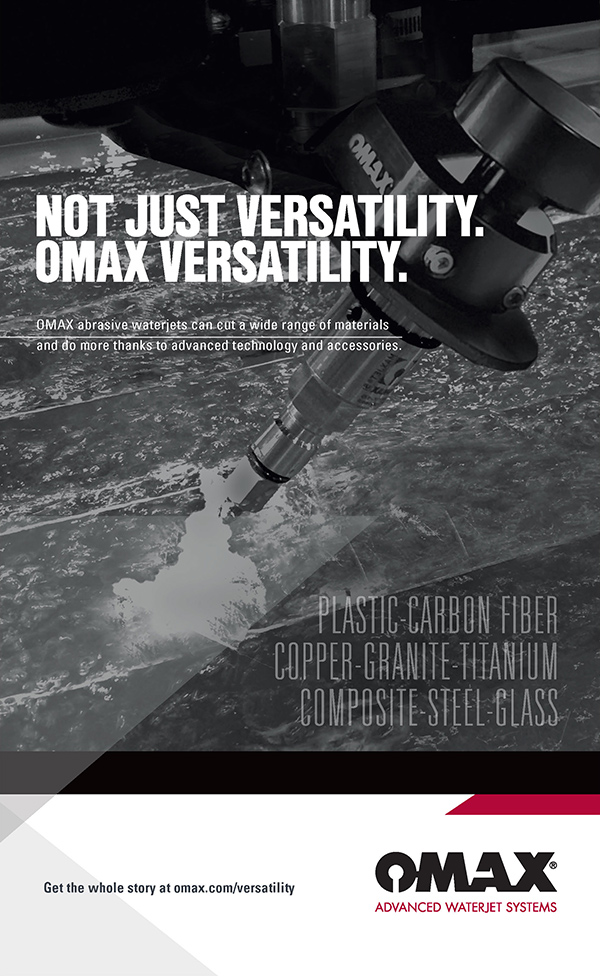

abricating high-end residential and public art requires a machine tool that’s versatile enough to cut a variety of materials and programming software that is user friendly. Scott Gallagher, a partner at Metalistics, says he found what the Everett, Washington-based manufacturer needed in the Mach 500 abrasive waterjet cutting machine and the FlowXpert software for 3D modeling and programming from Flow Waterjet. In addition to waterjet cutting, Metalistics provides rolling, forming, fabrication, installation and design services. The company’s other partner is Scott’s brother, Chris, and eight employees work 10-hour shifts four days a week at Metalistics’ 10,000-square-foot facility. The two brothers founded the company 20 years ago.

Amada Machinery America Inc., Brea, California, 847/285-4800, amadamca.com.

a nationwide network.

Our team is here, there and everywhere ready to help when you need it. Let us bring your business the ultimate flexibility and competitive edge so you can deliver the most consistent product to your customers!

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

ModernMetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

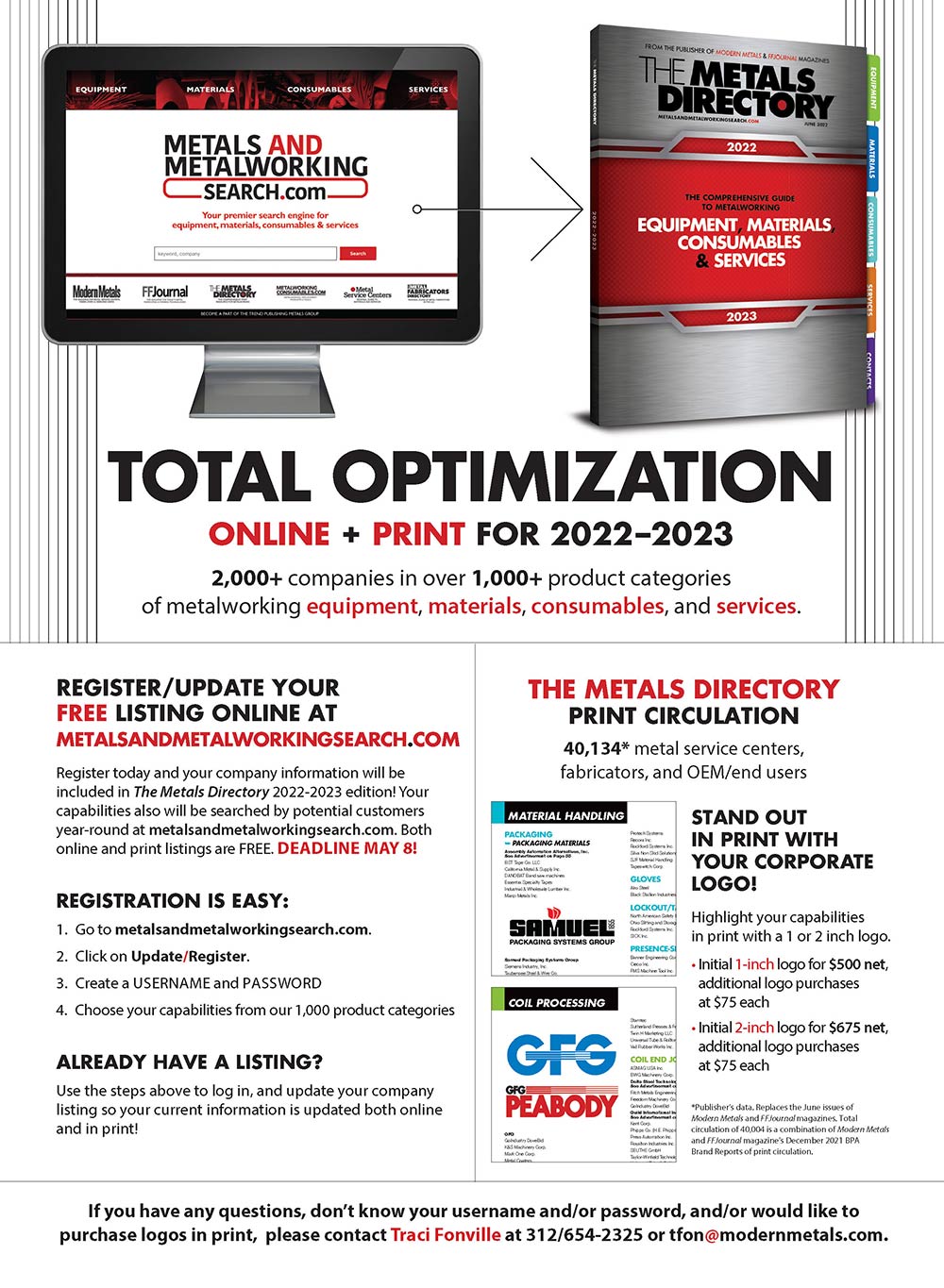

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) MAY 2022, Vol. 78, No. 05 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Omeda – Modern Metals – 4 Overlook Pt., Ste. A25E, Lincolnshire, IL 60069. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) MAY 2022, Vol. 78, No. 05 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Omeda – Modern Metals – 4 Overlook Pt., Ste. A25E, Lincolnshire, IL 60069. Printed in the USA.