a nationwide network.

Our team is here, there and everywhere ready to help when you need it. Let us bring your business the ultimate flexibility and competitive edge so you can deliver the most consistent product to your customers!

serving metal service centers, fabricators and OEM/end users since 1945

Features

e’ve seen quite a few announcements this year by steelmakers seeking to adopt new methods of carbon reduction and lessening their reliance on fossil fuels. Let’s highlight just four programs announced during late June and July.

Nucor Corp. is pursuing greenhouse gas emissions reduction strategies that will lower the GHG emissions intensity of its steel mills to 77 percent less than today’s global average. That comprises an additional 35 percent combined reduction in the Scope 1 and Scope 2 GHG emissions intensity of its mills by 2030. That goal is measured against a 2015 baseline, the year the Paris Climate Accord was adopted.

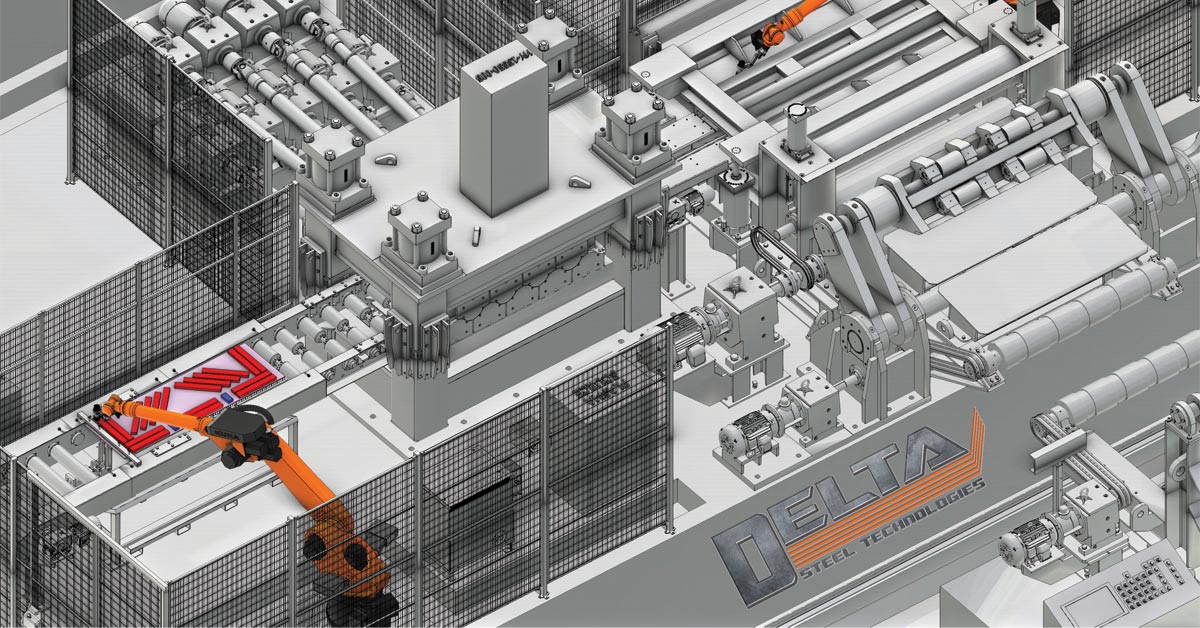

Why does demand for coil processing equipment continue to grow?

rices for flat-rolled steel products have been on a continuous uptrend for most of the past year, reaching highs previously considered unimaginable. Begging the question: When will the market peak?

Steel Market Update surveys buyers every week to track changes in steel prices, as well as lead times, sentiment and a host of other factors. As of the week of July 5, SMU reported the following average prices per net ton, FOB the mill: hot-rolled coil, $1,770 ($88.50/cwt); cold-rolled coil, $1,970 ($98.50/cwt), galvanized coil, $1,995 ($99.75/cwt), and Galvalume coil, $2,030 ($101.50/cwt). Plate prices were at $1,520 ($76.00/cwt). These were all historic highs.

Nucor Corp., for example, plans to lower the GHG emissions intensity of its steel mills to 77 percent less than today’s global average. Nucor is actively supporting the development of new renewable energy sources. Last year, Nucor was the seventh largest corporate buyer of renewable energy in the United States. The company will implement new energy efficiency projects, pursue carbon capture and storage, and explore ways to further reduce the CO2 emissions associated with its raw materials mix.

he Kansas City Federal Reserve Bank, in its latest survey of industrial borrowers, found that 47 percent of respondents indicated their capital spending plans for 2021 are higher than pre-COVID (2019) levels, with another 33 percent saying their spending levels were similar to 2019.

Manufacturers reported that stronger demand and growth were primary factors supporting capital projects for the second half of 2021. Some manufacturers cited the lack of availability of parts and employees as primary factors restraining business investment and capital spending.

he U.S. economy has regained the previous peak level of production and is gradually converging toward its pre-pandemic path. The recovery remains on solid footing,” says Joel Prakken, chief U.S. economist for Boston-based consultancy IHS Markit.

“Strong … demand combined with lean inventories, a rising proportion of vaccinated Americans and the nearly complete recission of domestic pandemic containment measures—all against the backdrop of expansionary monetary and fiscal policy—support our forecast of 6.6 percent GDP growth this year and 5.0 percent next year.” That forecast compares with a 2.3 percent decline in U.S. GDP for 2020.

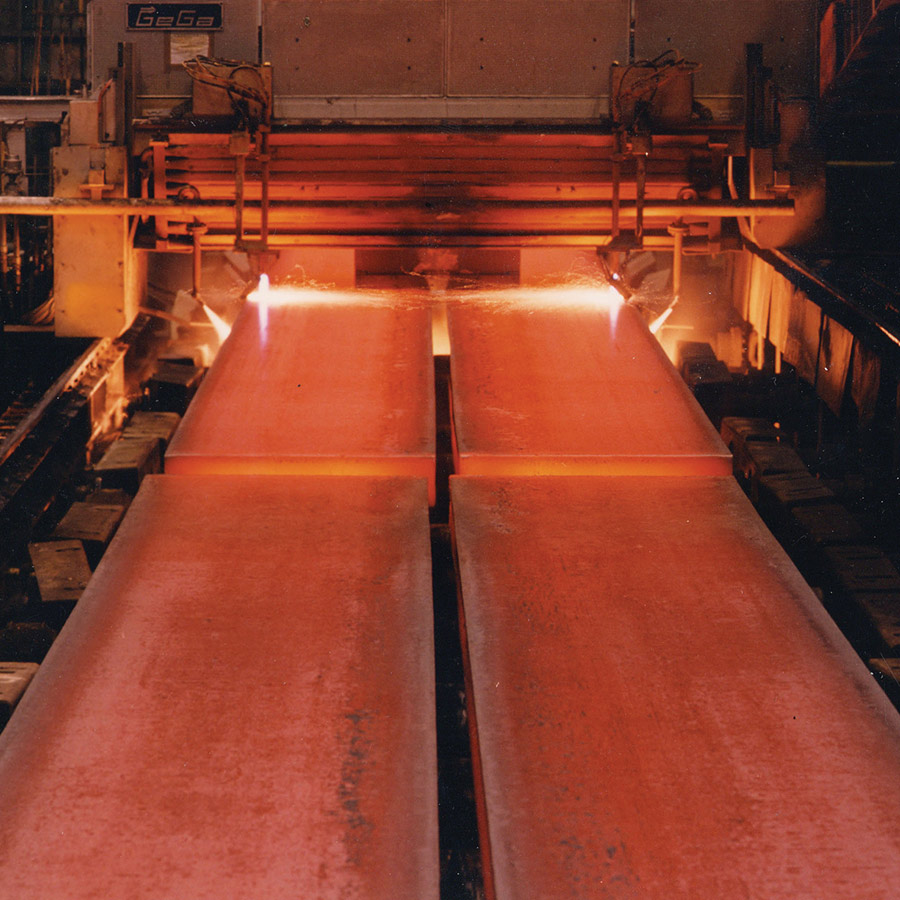

lueScope Steel Limited, an integrated producer with an international reach, has its largest operation in the industrial harbor town of Port Kembla, New South Wales, Australia. Major products include steel slab; hot-rolled, cold-rolled and coated coil; plate; automotive sheet; galvanized; Zincalume coated steel; and Colorbond pre-painted steel.

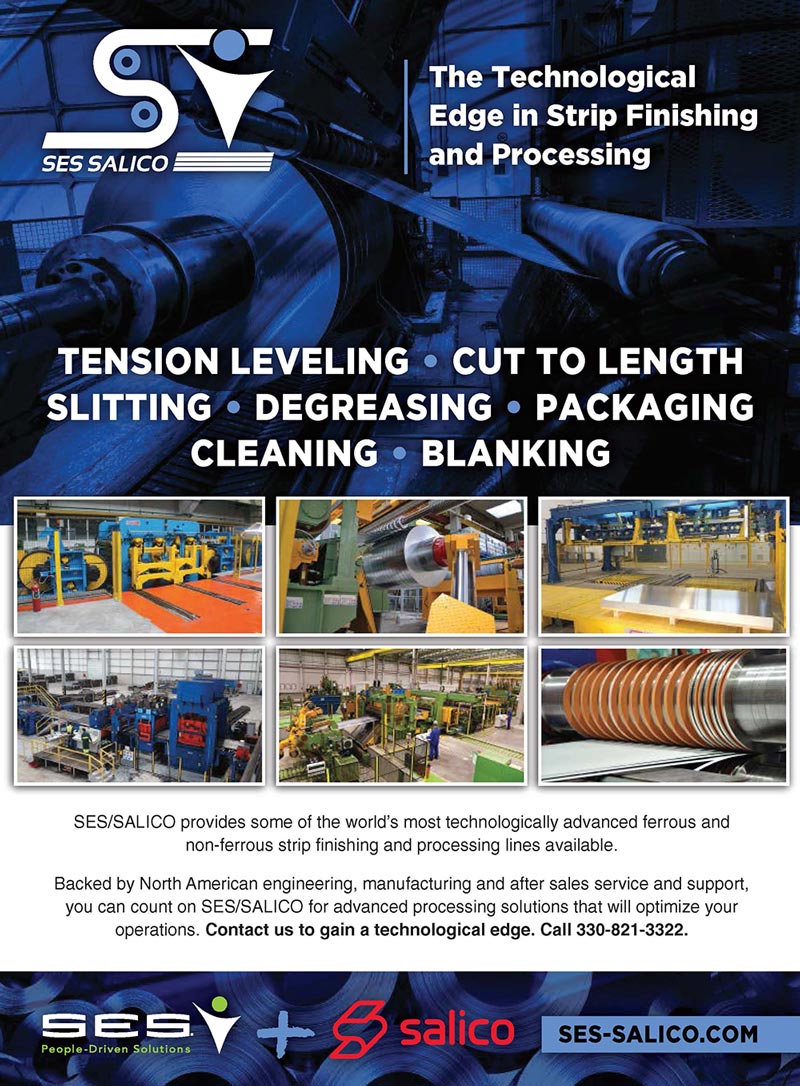

smattering of steel and aluminum manufacturers around the world have stealthily become integrated producers—not only by owning scrapyards and downstream fabrication companies but also by bringing high-volume metal processing lines in house. They are relying on full-service machinery builders like SES-Salico to achieve that.

SES-Salico is a joint venture between SES LLC, Alliance, Ohio, and Salico Group, Molteno, Italy, that formed in 2015. Founded in 1976, SES specializes in heavy-duty mill equipment, including melt shop components, transfer cars, slab and coil handling, long product handling and processing lines. Salico Group, established in 1978, builds slitting, cut-to-length, leveling, blanking and packaging lines.

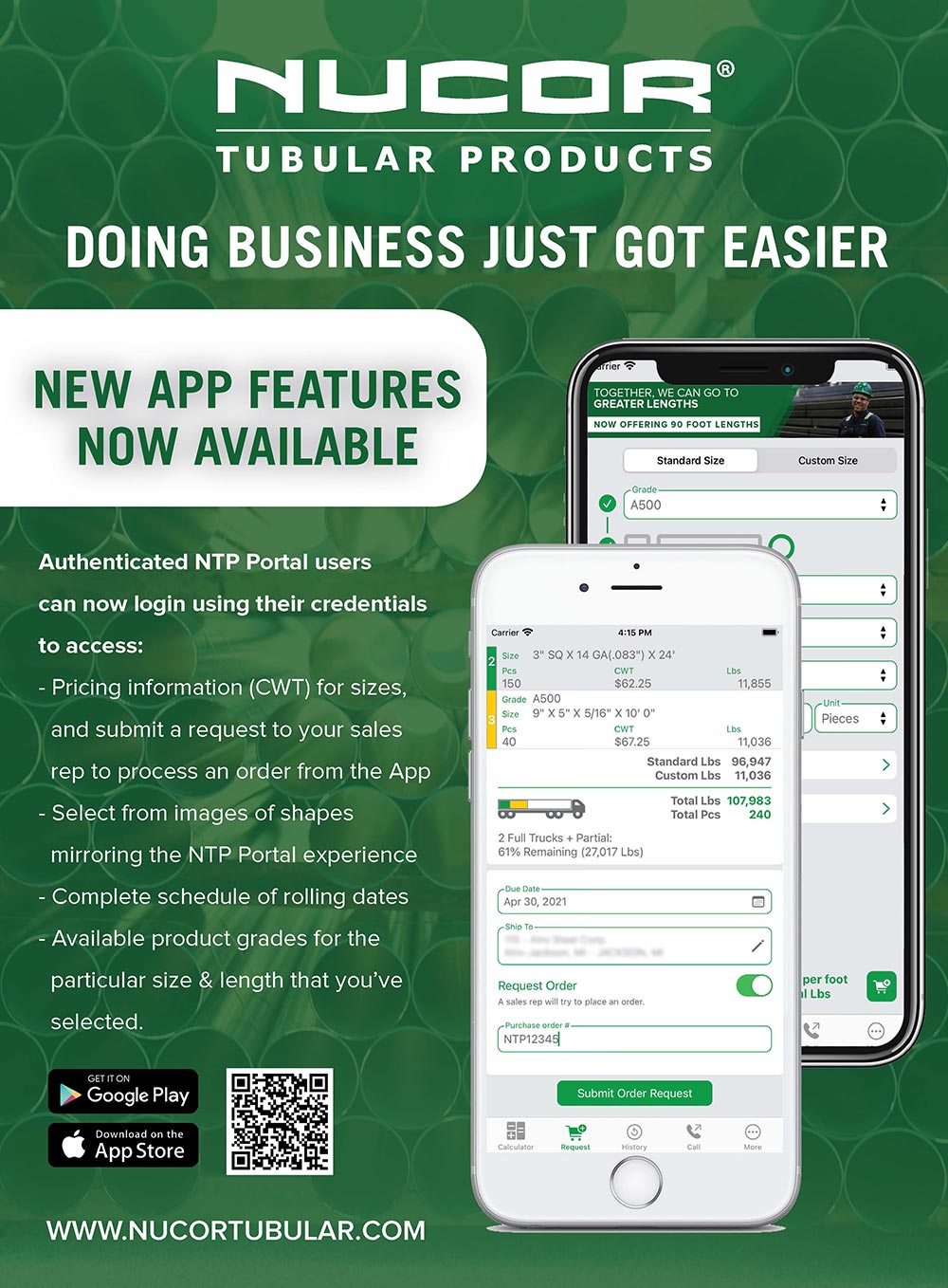

he events of the last year caused many aspects of life to move to an online format, changing both the sales fulfillment process and interactions between customers, suppliers, vendors and stores. Delivery networks increased exponentially as stores shut down. And while the supply chain struggled, those who had already invested in automation continued to operate more easily than their counterparts who relied more heavily on systems requiring manual processes.

Automation, when applied correctly, can strengthen supply chains and keep things moving. Applying automation, data capture and Industry 4.0 provides an opportunity to improve the overall buying experience, as well. Providing transparency as to where a customer’s order is in the fulfillment process, whether it is staged and ready to go and once it is on a truck and en route, is no longer considered a nice-to-have feature but is part of standard customer service.

eep production in house or outsource work? The answer depends upon myriad factors, from dollars to flexibility. In-house manufacturing often helps cultivate closer relationships with customers—and allows a company to quickly adapt and customize products to specific needs—while outsourcing can provide cost savings.

Kasto Inc., Export, Pennsylvania, 724/325-5600, kasto.com.

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) AUGUST 2021, Vol. 77, No. 7 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) AUGUST 2021, Vol. 77, No. 7 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.