rices for flat-rolled steel products have been on a continuous uptrend for most of the past year, reaching highs previously considered unimaginable. Begging the question: When will the market peak?

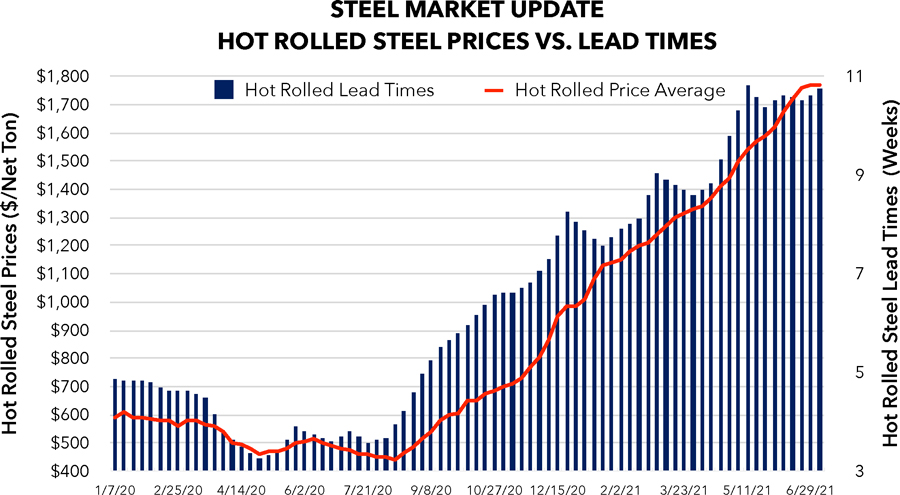

Steel Market Update surveys buyers every week to track changes in steel prices, as well as lead times, sentiment and a host of other factors. As of the week of July 5, SMU reported the following average prices per net ton, FOB the mill: hot-rolled coil, $1,770 ($88.50/cwt); cold-rolled coil, $1,970 ($98.50/cwt), galvanized coil, $1,995 ($99.75/cwt), and Galvalume coil, $2,030 ($101.50/cwt). Plate prices were at $1,520 ($76.00/cwt). These were all historic highs.

The table (below) shows the close relationship between hot-rolled steel prices and lead times for deliveries of spot orders from the mills. Since the market bottomed out last summer as the pandemic tanked demand, hot-rolled coil prices have climbed from a low of $440 per ton in August 2020 to a record high of $1,770 per ton as of July 5—an astounding fourfold increase. In the same period, lead times spiked from an average of around three weeks to the current high of more than 10 weeks.

Why the huge run-up in prices? Put simply, demand for steel continues to outpace supplies. On the demand side, the economy is still riding a sugar high from government stimulus, with more infrastructure spending likely on the way. The major steel-consuming markets—construction, automotive, manufacturing and even energy—have rebounded dramatically from the pandemic-induced recession in 2020.

Nothing is certain when it comes to steel prices, except that the higher they rise, the harder they will fall. A correction of even a modest percentage could translate into large dollars for those with inventory when steel costs nearly $1,800 per ton.