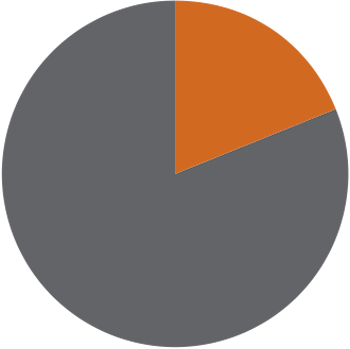

he Kansas City Federal Reserve Bank, in its latest survey of industrial borrowers, found that 47 percent of respondents indicated their capital spending plans for 2021 are higher than pre-COVID (2019) levels, with another 33 percent saying their spending levels were similar to 2019.

Manufacturers reported that stronger demand and growth were primary factors supporting capital projects for the second half of 2021. Some manufacturers cited the lack of availability of parts and employees as primary factors restraining business investment and capital spending.

Due to labor shortages, 41 percent of firms reported investing, or plans to invest, in labor-saving automation strategies at a faster pace than in the past. “We are looking for ways to automate and reduce the need for employees,” one survey respondent stated.

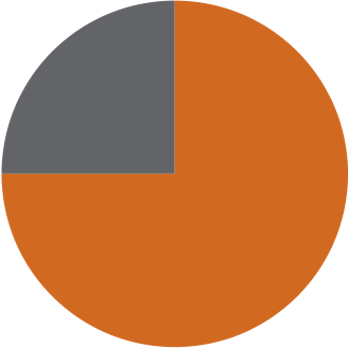

In its 35th annual survey of corporate executives, Area Development, a news site devoted to commercial real estate development, found that only 14 percent of companies pursued expansion plans during 2020, citing the pandemic, compared with 22 percent that did so during 2019.

we are looking for ways to automate.

we are looking for ways to automate.

For 2021, just slightly more than 25 percent of respondents are planning a new facility, compared with nearly half who had new facility plans in the 2020 pre-pandemic survey. Manufacturing and warehouse/distribution facilities each represent a quarter of the planned new domestic facilities.

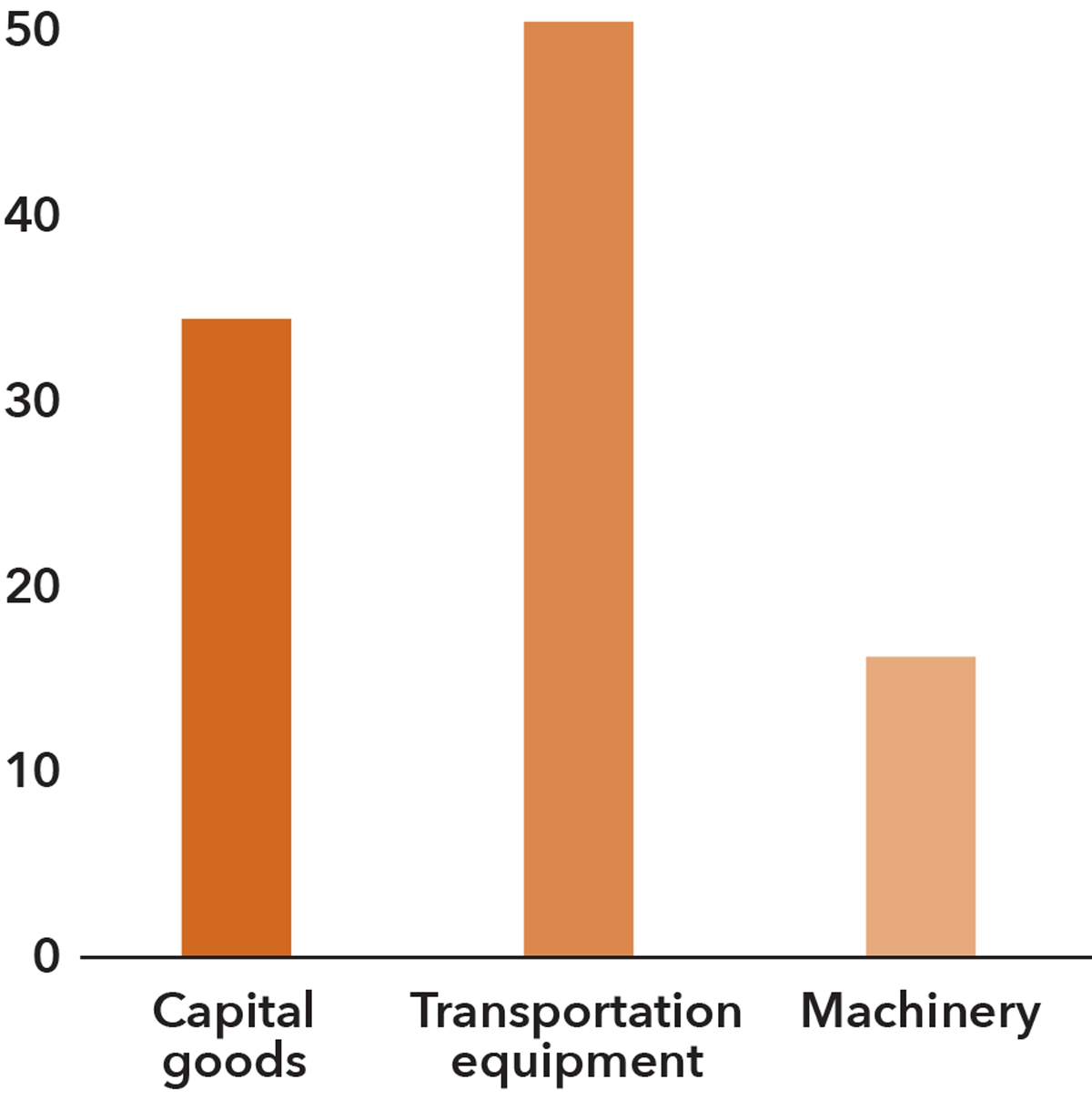

The latest U.S. Census report on factory shipments and new orders found a 34.3 percent jump in capital goods new orders through the first five months of 2021, compared with the same period last year. New orders for capital equipment rose 50.3 percent, and new orders for machinery increased by more than 16 percent (see table, right).

In the metals sector, there is a great deal of investment occurring, some of it nearing completion, some just breaking ground. There is also some disinvestment in the market, particularly with obsolete or near-obsolete facilities (see sidebar, page 27).

Some U.S. steel mills are operating at near-record-high capacity utilization rates. Steel Dynamics Inc. said its first-quarter operating rate was 93 percent. During Q1, SDI spent $310 million on projects, $254 million of that on its new 3-million-ton minimill in Sinton, Texas.

For the remainder of 2021, “we estimate capital investments will range from $650 million to $700 million, with the Texas steel mill representing about $535 million of that amount,” CFO Theresa Wagler told shareholders in spring.

“This estimate does not include spending for construction or the recently announced four flat-roll coating lines, which will cost between $400 million and $425 million combined. Those coating lines are slated to start up during the second half of 2022.”

President and CEO Mark Millett says the coating lines comprise a 550,000-tons-per-year galvanizing line with Galvalume capability and a 250,000-ton paint line. Both were to start up this summer. In addition, the company plans to install two new galvanizing lines and two new painting lines in the Midwest and South, costing about $400 million, in the next two years.

According to Millett, “Galvalume products represent the fastest-growing market in the United States, primarily serving the metal building industry.” In the past, 45 percent of the steel used in such applications came from foreign producers, he noted.

“The Sinton hot-strip mill will be commissioned in September. As we start the mill up, we’ll be hiring to build working process inventory.”

Cleveland-Cliffs Inc. is also investing in its workforce. As Chairman, President and CEO Lourenco Goncalves told shareholders, “We are hiring because we are growing. Make no mistake: we are adding jobs. Since December 2020, we have already added 710 new employees to our workforce.

“As we always do at Cleveland-Cliffs, we are putting our money where our mouth is and bringing back the America that we love with a vibrant manufacturing sector, a thriving middle class, and with opportunities for all people that believe in education and hard work,” said Goncalves, noting that median annual pay for Cliffs employees is $102,000.

Nucor Corp. temporarily delayed its commissioning of a new joint venture galvanizing line in Mexico last year, but since then, “the team there is busy conducting trials and qualifying product with automotive customers as well as shipping product for alternative end-use applications,” President and CEO Leon Topalian told investors.

The commissioning of a third-generation galvanizing line at Nucor Steel Arkansas is expected to occur in the third quarter, with prime production off that line to follow soon after, he says.

An expansion and modernization project at Nucor Steel Gallatin in Kentucky is on track to produce steel by the end of this year.

“We anticipate a gradual ramp-up of the incremental capacity at Gallatin, reaching 1 million tons of incremental output from the upgraded facilities in 2022. We expect to achieve the full benefit of the added production capability of 1.4 million tons in 2023,” Topalian said.

A $1.7 billion plate mill being built in Brandenburg, Kentucky, is scheduled for a start-up in late 2022. “Nucor Steel Brandenburg will be one of only a very few mills in the world capable of reliably supplying steel plate suited to offshore wind market applications and expectations,” said Topalian.

CFO James Frias estimates Nucor will spend about $2 billion this year on capital projects.

Brazil-based long products producer Gerdau S.A. completed modernization projects at its Petersburg, Virginia, and Cartersville, Georgia, plants, which roll structural steels and profiles. “This allowed us to expand our product mix to the market,” including products with higher added value, CEO Gustavo Werneck Da Cunha told shareholders in May. In addition, Gerdau is on track to expand and modernize its melt shop in Whitby, Ontario. The rolling mill there produces rebar.

same

shorter

No

Strip mills, metal formers and fabricators, stampers, extruders, contract manufacturers, platers and powder coaters, shipbuilders and nonferrous scrap recyclers have announced a host of capital investments so far this year (see table, page 26).

Carbon neutrality is at the heart of some projects. For example, ElementUS, a joint venture of DADA and Enervoxa, tentatively plans to spend $800 million to extract rare earth elements at the Noranda Alumina site in Gramercy, Louisiana.

DADA Holdings, parent of Noranda Alumina, is partnering with green technology firm Enervoxa to separate rare earth elements and other valuable minerals from alumina byproducts. The Gramercy site has a 35 million dry-ton reserve of mineral-rich residual bauxite. The joint venture would create 200 jobs.

we will not bring idled capacity back.

we will not bring idled capacity back.

“Rare earth elements are in short supply and are vital to national defense and critical technologies. We have the opportunity to extract and commercialize valuable rare earths and other minerals while further reducing the environmental footprint at our alumina refining business and U.S. dependence on China for these limited and technologically strategic minerals,” DADA Chairman and CEO David D’Addario stated.

Sometimes, the best way to support the bottom line is to idle capacity—and even to take it off line permanently. U.S. Steel Co., Cleveland-Cliffs Inc. and TimkenSteel are among those companies that acknowledged such steps are necessary to match real demand and move up the efficiency ladder.

U.S. Steel Corp. has decided to “set aside the Mon Valley endless casting and rolling and cogeneration project. It is one of those difficult decisions,” CEO David Burritt told shareholders. Mon Valley Works remains a competitive steelmaking asset in the Pittsburgh company’s portfolio and will continue to serve such markets as appliance and construction.

U.S. Steel will permanently idle three of Clairton Works’ coke batteries, which represent about 16.3 percent of total coking capacity at the plant. Those batteries will be shut down by first quarter 2023.

This decision was informed “by our expanded understanding of our steelmaking future and accelerated approach to reducing our carbon and capital intensity,” Burritt said.

During an earnings call with investors, Cleveland-Cliffs Inc. Chairman, President and CEO Lourenco Goncalves made a list of idled assets. Neither Indiana Harbor’s blast furnace No. 3 is operating nor is the blast furnace at Ashland Works in Kentucky. “They will never come back; they are done,” he said.

However, Cliffs is producing more hot metal by using hot-briquetted iron (HBI) in another Indiana Harbor furnace; in Dearborn, Michigan; and in Middletown, Ohio. “So we will continue to increase productivity, increase throughput and not bring any [idled] blast furnace [capacity] back.”

Asked whether the two basic oxygen furnaces will ever be restarted, Goncalves replied, “When I say never, I mean never. It’s not going to happen. Are the [furnaces] for sale? No.”

TimkenSteel indefinitely idled its Harrison plant melt shop and casting operations in Canton, Ohio, during the first quarter.

“All of our melting and casting activities will take place at the Faircrest location,” also in Canton, according to CEO Michael Williams. “We’re fully manned at the Faircrest melt shop,” after hiring more workers this past spring to support rising steel demand.

“By operating one melt shop, we will be using our manufacturing assets more efficiently, while producing the best possible mix of products to meet our customers’ needs. We expect our melt utilization to reach at least 80 percent or higher in the second quarter of 2021,” Williams said.