he U.S. economy has regained the previous peak level of production and is gradually converging toward its pre-pandemic path. The recovery remains on solid footing,” says Joel Prakken, chief U.S. economist for Boston-based consultancy IHS Markit.

“Strong … demand combined with lean inventories, a rising proportion of vaccinated Americans and the nearly complete recission of domestic pandemic containment measures—all against the backdrop of expansionary monetary and fiscal policy—support our forecast of 6.6 percent GDP growth this year and 5.0 percent next year.” That forecast compares with a 2.3 percent decline in U.S. GDP for 2020.

Not surprisingly, this V-shaped recovery has caused strain throughout the metals supply chain.

Kevin Averill, chief operating officer for Admiral Steel in Alsip, Illinois, provides an inside view of what it’s been like for a service center. Admiral Steel carries a wide range of products, including carbon and stainless steels and nonferrous products in flat and long forms, plus building products. Services include shearing, deburring, slitting, laser cutting, sawing, cutting, leveling, edging and gauge correction. Admiral caters to customers who buy only 10 pounds of material to those spending millions of dollars per year.

It’s like Christmas shopping on Christmas eve. People will take anything.

It’s like Christmas shopping on Christmas eve. People will take anything.

Admiral Steel

So many customers need material right now, he says, that they’ve had to temporarily shut down a production line until the completed order arrives at their loading docks.

In terms of mill lead times, he says, “it continues to get longer and longer—12 to 18 weeks on certain items. More common items might be shorter. We are having problems getting light gauge because it’s easier for mills to make bigger, heavier coils.”

Pricing has continued to rise. However, “Everybody has work and needs material so pricing is secondary. They are happy to pay—if they can get it. It’s a unique time, for sure,” says Averill. “I have never seen the market in this situation. Particularly after last year, everyone was down manpower and trying to get by. We have gone from one extreme to the other.”

“Even material that had issues—maybe there was a scratch or surface defect—that stuff is all gone. It’s like Christmas shopping on Christmas Eve. People will take anything,” he says.

What this means for service centers and non-automotive customers is “the shortage of raw material is going to get worse when the automakers ramp up. The automakers are asking for just-in-time material,” Averill says.

Meanwhile, “Inflation is running rampant in the industry. The lumber we use [for pallets], everything. I just had a couple customers saying, ‘here is a quote we got four years ago,’ and they see our price, and they are saying ‘what?!’ Our prices are based on what we pay. Every order we buy is more expensive than the last. That’s long products, tubing, carbon plate, stainless, everything. The pricing has to be passed on,” says Averill.

“We are seeing organized chaos,” says Averill. “We have the experience and we proceed using our best practices but every call and every email has red asterisks,” which indicates urgency.

“It’s not like each is the only one who needs a quote. It’s all red asterisks. They think that helps to send a purchase order, rather than an inquiry, to expedite a response. But you cannot jump to the front of the line. We want to help out everyone. You feel like people are mad at you.”

Last year, Admiral Steel typically moved most processed orders out the door within five days. “Now we are at 20 days. People are shocked when we tell them that. You would think we could catch up, but the situation has not lightened up,” Averill says. At the beginning of the year, he surmised that some of the accelerated order rates represented panic buying “but after six months, that’s not it,” he says.

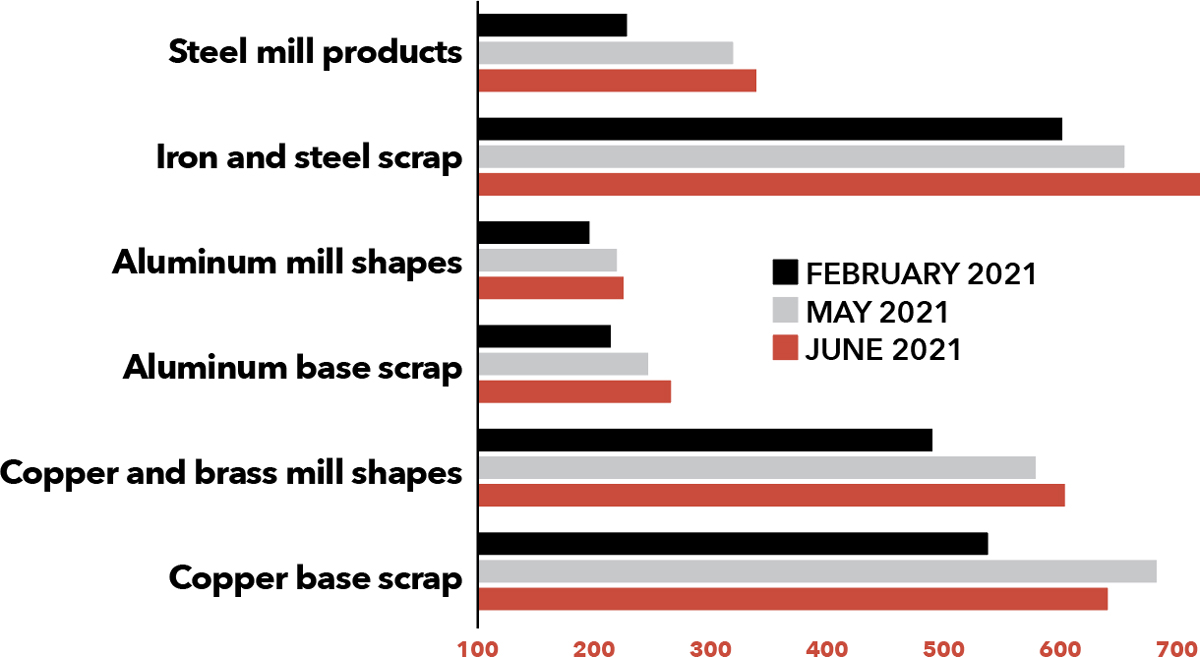

The value of new orders for producers of primary metals during the first five months of 2021 was $113.6 billion, or 24.6 percent above the nearly $91.2 billion in new orders during the same 2020 period, according to the U.S. Census Bureau. The spike is due to a combination of higher pricing and higher order rates.