a nationwide network.

Our team is here, there and everywhere ready to help when you need it. Let us bring your business the ultimate flexibility and competitive edge so you can deliver the most consistent product to your customers!

serving metal service centers, fabricators and OEM/end users since 1945

serving metal service centers, fabricators and OEM/end users since 1945

serving metal service centers, fabricators and OEM/end users since 1945

Features

usiness media outlets often focus on the big players and how they perform during economic cycles. Big Tech, Big Pharma, Big Box retailers, etc. But the bread-and-butter portion of the manufacturing sector is often small to midsize companies with fewer than 50 employees. These include distributors, forging companies, processors, traders, fabricators and niche suppliers.

Umpqua Bank, based in Portland, Oregon, surveyed its mid-market business customers to produce a report about how those companies have fared through a global pandemic and how they are adapting.

“Umpqua’s latest national survey captures how [small and middle-market] companies have transformed … in the face of unprecedented challenges. It finds they are emerging more prepared. They’ve embraced the reality of disruption as the new normal and the need for continuous evolution as vital to success,” the bank’s report, based on its survey, states. Companies are “more efficient and more nimble, which will make them better prepared to adapt to the next disruption.”

Founded in 2002, Service Center Metals began operating in Virginia in 2003. It produces aluminum billets, rods, bars, extruded shapes and tubing, all of which are shipped to service centers across the United States. The company is vertically integrated with two plants on its 30-acre campus.

Exceeds Supply

Exceeds Supply

Exceeds Supply

t is rarely the case but manufacturers are talking about an “upside-down world” where multiple price increases are accepted because the material they need is far more valuable to them than ever before. Shortages in labor, port berths, trucks, semiconductors, resins, steel and other resources have not allowed manufacturers to take their production rates to the next level or to keep much inventory for a rainy day. It’s been “raining” for months.

The purchasing managers index (PMI) for manufacturing registered 59.9 percent in August, up slightly from July’s reading, indicating a small expansion in the overall economy for the 15th month in a row, after shrinking in April 2020.

Existing home sales during July rose 2 percent from June (seasonally adjusted) and 1.5 percent from a year earlier, according to the National Association of Realtors.

At aluminum producer Arconic Corp., CEO Timothy D. Myers told shareholders that “while it remains the biggest question mark in our portfolio,” he believes that decisions about increasing build rates “boils down to timing. We fully expect the industry to return to pre-pandemic levels and are encouraged by indicators in the market.

“Inventory constraints are expected to limit any upside potential to U.S. auto demand levels through the rest of 2021, with little recovery expected even in the first half of 2022,” Hopson predicts.

“U.S. light vehicle sales are constrained by inventory more than any time in recent memory, and the situation is likely to continue to be difficult,” says Stephanie Brinley, principal automotive analyst at the firm.

ALTHOUGH SOARING PRICES and material shortages have caused strain for builders, makers of construction equipment are hoping for greater stability in the mid- to long-term, especially if and when the pandemic eases and state and local infrastructure projects get started in earnest, with the help of federal intervention.

The Association for Equipment Manufacturers (AEM) released a recent report on the prospects for growth in demand for construction machinery. Considering that fiscal stimulus already played a pivotal role in helping the U.S. economy recover, the group notes that additional proposals carry “a lot of potential” for the construction sector.

“We’ve included the American Jobs Plan (AJP) in our economic forecast,” says Mark Killion, director of U.S. industry at Oxford Economics. “There is a big infrastructure component to the [plan] that could offer a lot of fuel for growth.”

The number of rotary petroleum rigs operating in the United States as of Sept. 10 totaled 503, up 6 units from the week before and jumping by 249 units from the same week in September 2020, according to Baker Hughes. The number of operating rigs in Canada fell by 9 units from Sept. 3 to 10, but the rig count is still up by 91 units compared with the same week of 2020.

U.S. gasoline consumption averaged 8.6 million barrels per day (b/d) during the first half of 2021, up from 8.3 million b/d in the same six months of last year, but below the 9.3 million b/d in the second half of 2019, according to the U.S. Energy Information Administration (EIA).

Delays have been commonplace in recent weeks and months, owing to stronger import demand into North America amid drawdowns in warehouse stocks for many retailers, according to S&P Research. The delays have been exacerbated by logistical challenges such as port closures in China and escalating intermodal tie-ups in the U.S.

Recently, U.S. rail providers have metered or halted intermodal rail traffic in order to correct terminal congestion, particularly in the Midwest, resulting in drawn-out container dwell times.

lliance Steel LLC relocated its main plant and expanded during the 2020 portion of the ongoing global health crisis and continues to win new business, despite working within a market that is no longer predictable.

“It has been 18 months of craziness” in terms of how the steel market has reacted through the pandemic, says Alliance Steel’s Drew Gross, vice president-commercial.

Although Gross and his team continuously assess the steel environment, after this experience, they “gave up on definitive statements. Everyone has been wrong, from 30-year steel veterans to purchasing executives to analysts. This thing outlasted expectations. The way the market moved was just insane.

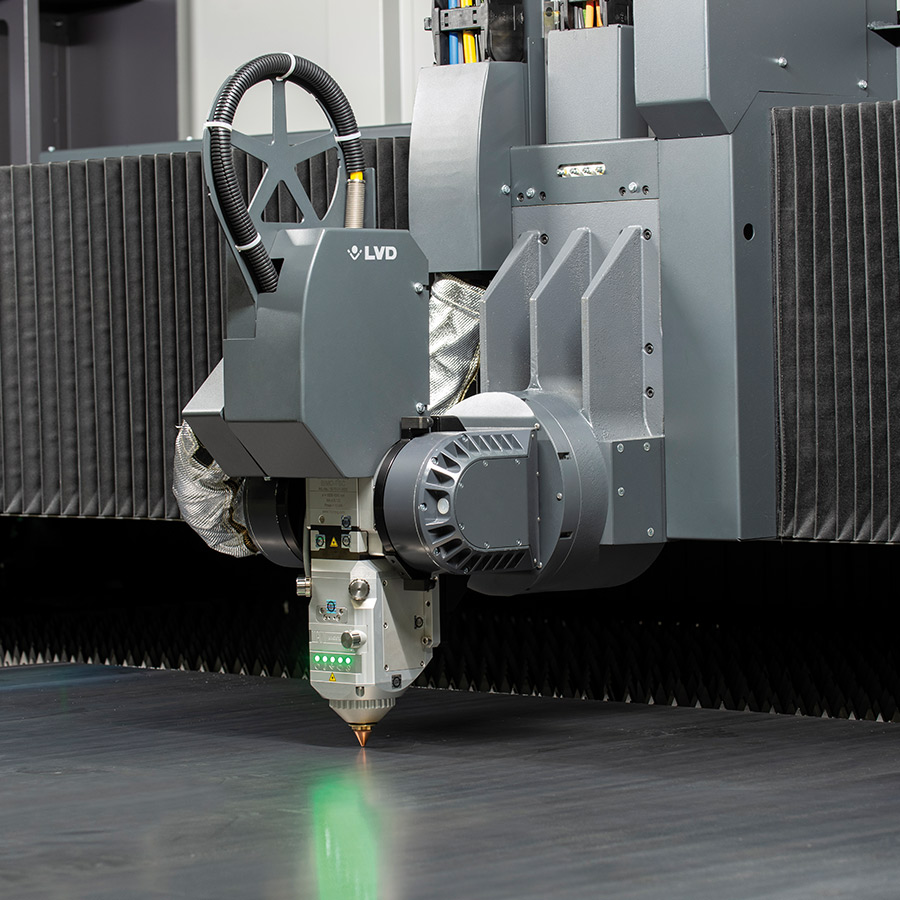

LVD’s Taurus is a large-format gantry-style fiber laser machine engineered for extra-large cutting capacity.

XXL

Large-format fiber laser has big cutting capacity that helps fabricator prioritize parts

cala, Florida-based contract manufacturer OFAB Inc., has been humming along since 1984 and has served the fire and emergency vehicle industries since 1988, providing services from laser cutting to finishing. OFAB also fabricates and machines parts for the mining, engine distribution, military and agriculture sectors.

“When we first started with laser cutting, they were rare machines,” says Mike Klinkroth, manufacturing manager. “Most cutting work was being done with plasma. We [owned] the first laser in our area, and selling laser work on a 5-foot by 10-foot cutting bed was pretty easy. Now, as lasers have become a mainstream piece of equipment, customers expect their parts will be cut with lasers.”

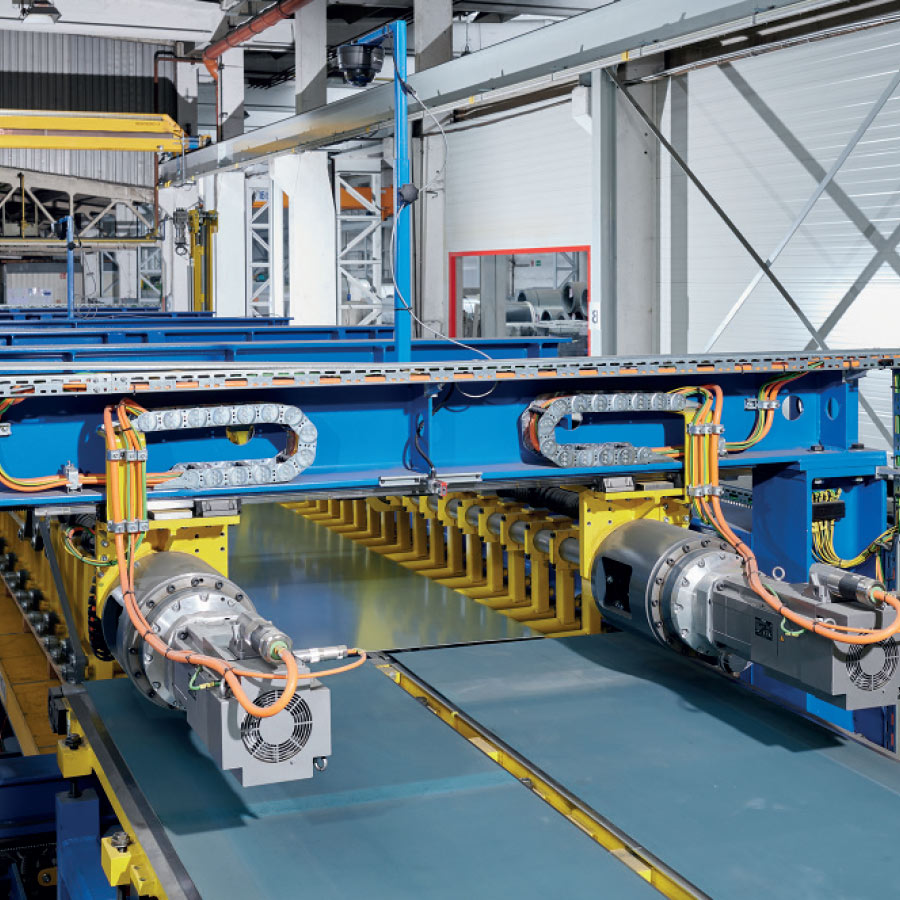

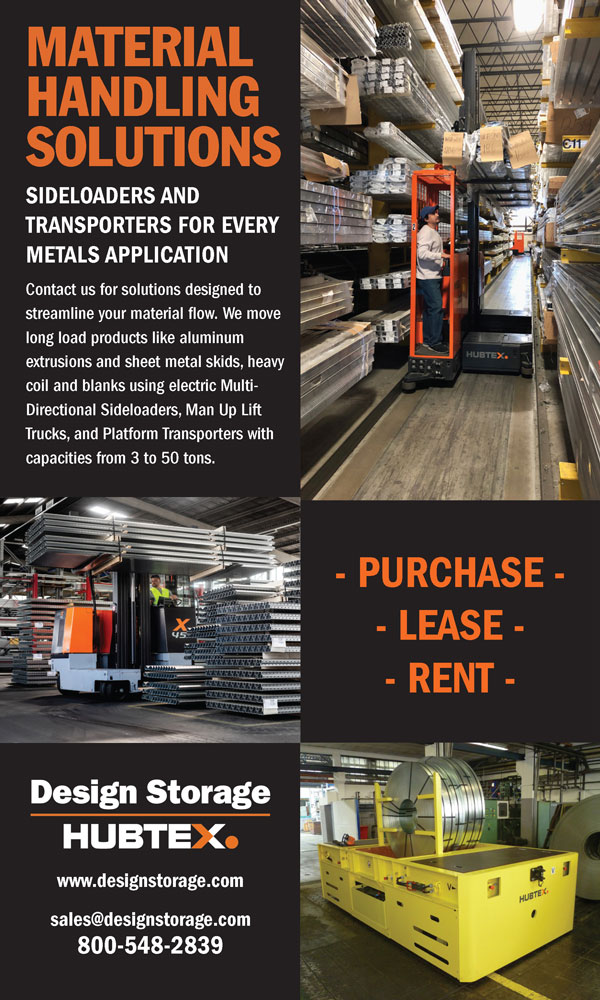

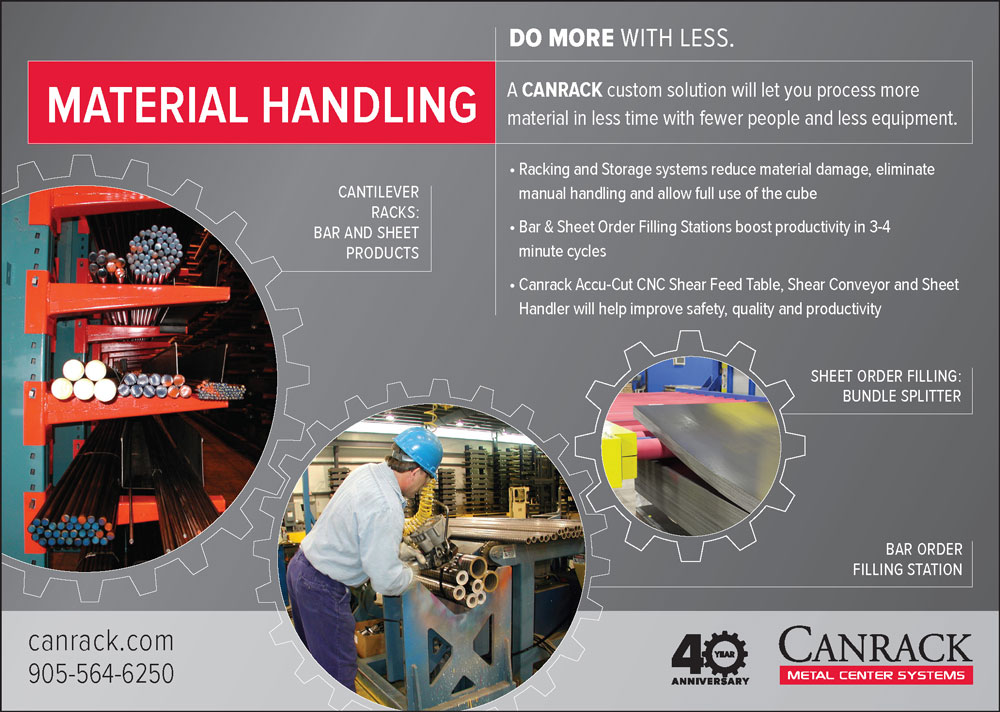

Material Handling

Engineering a turnkey picking and restocking system creates a host of advantages for a busy warehouse

By Corinna Petry

acific Steel & Recycling, based in Great Falls, Montana, has 46 locations from the Northern Plains and Alberta, Canada, to the Rocky Mountains, Nevada and Pacific Northwest. Employee owned and operated, it has been on a path of steady growth for the past 25 years.

Stan Sears, general manager for the company’s Nampa, Idaho, branch, says, “The Boise market has been expanding over the last 10 years, and we hadn’t done any upgrades until the past year. We’ve gained over 30 percent more tons annually during that period and are really trying to meet the demand to move more tons every day.”

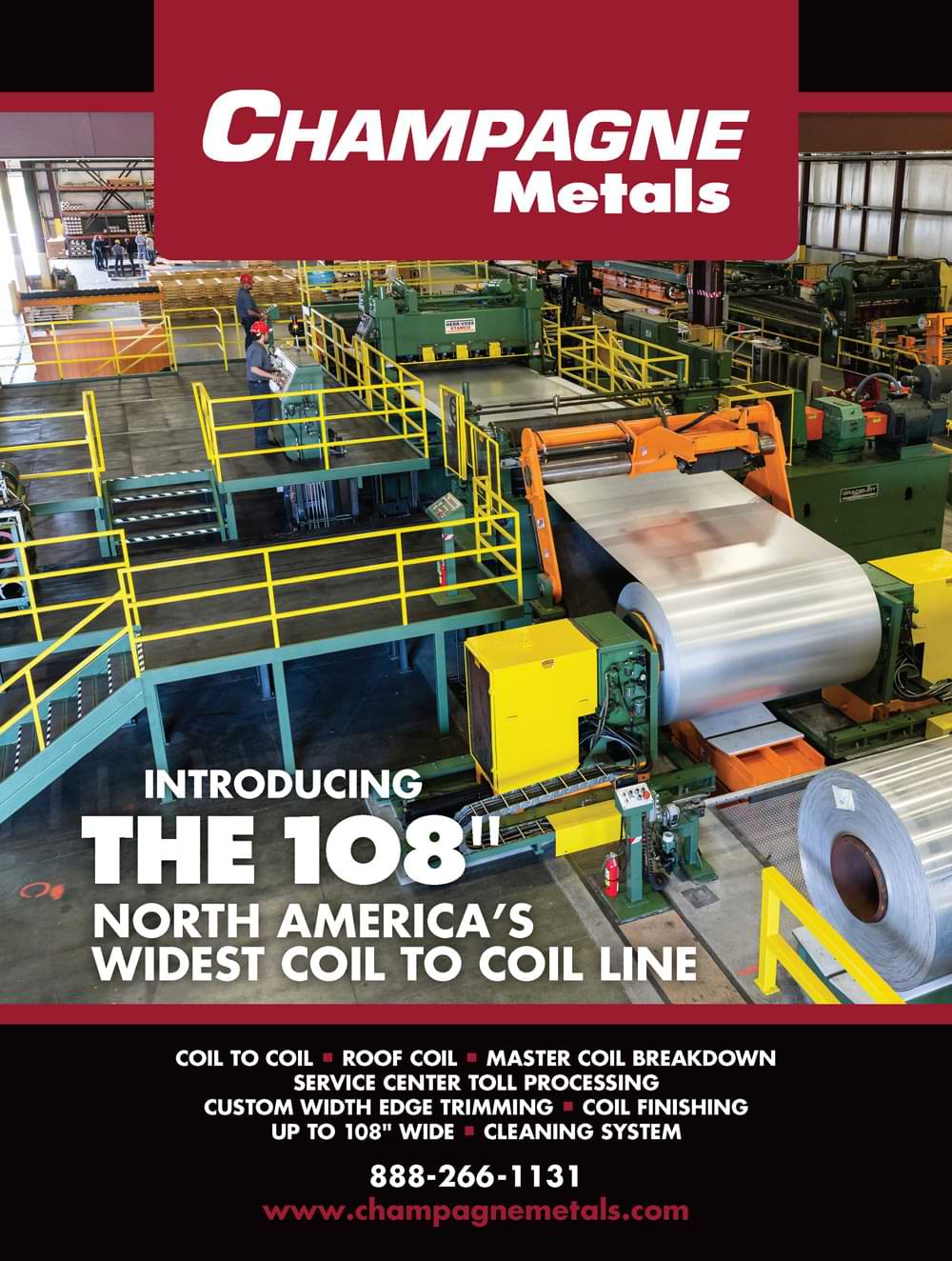

COIL PROCESSING

Gentle treatment

ystems for the packaging of master coils, small coils, slit strips and sheets must meet differing requirements depending on the material. The finishing format as well as the number of pieces, size, thickness and possible coating also play a role. They may require, for example, particularly gentle handling of very sensitive surfaces, compliance with short set-up times or handling partial coils.

very company approaches transition in a different way: Wait and see or get involved early and become a trendsetter.

Once metals fabricators or manufacturers decide to invest in the future, they will soon find that sawing has a holistic influence on the production chain and that using the correct sawing tool ensures quality and process stability.

Additive processes represent an important technology in the production process for high-performance industries now and in the future. 3D printing is becoming increasingly efficient and is moving away from its original niche status. It is now worthwhile to test the technology and its applications and learn what it can do.

Esco Tool, Holliston, Massachusetts, 800/343-6926, escotool.com.

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) October 2021, Vol. 77, No. 9 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) October 2021, Vol. 77, No. 9 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.