ere for you. That was a key message shared during a Sept. 30 webinar given by the Aluminum Association that focused on the future of vehicle lightweighting.

ere for you. That was a key message shared during a Sept. 30 webinar given by the Aluminum Association that focused on the future of vehicle lightweighting.

“DuckerFrontier interviewed participants throughout the automotive value chain, including automakers. Data tells us that aluminum will remain the fastest-growing material as a way to reduce mass. Whether you are working on an electric vehicle or designing a multi-material vehicle, the aluminum industry is here for you,” Dobbins said.

We expect electric vehicle growth will drive aluminum growth.

We expect electric vehicle growth will drive aluminum growth.

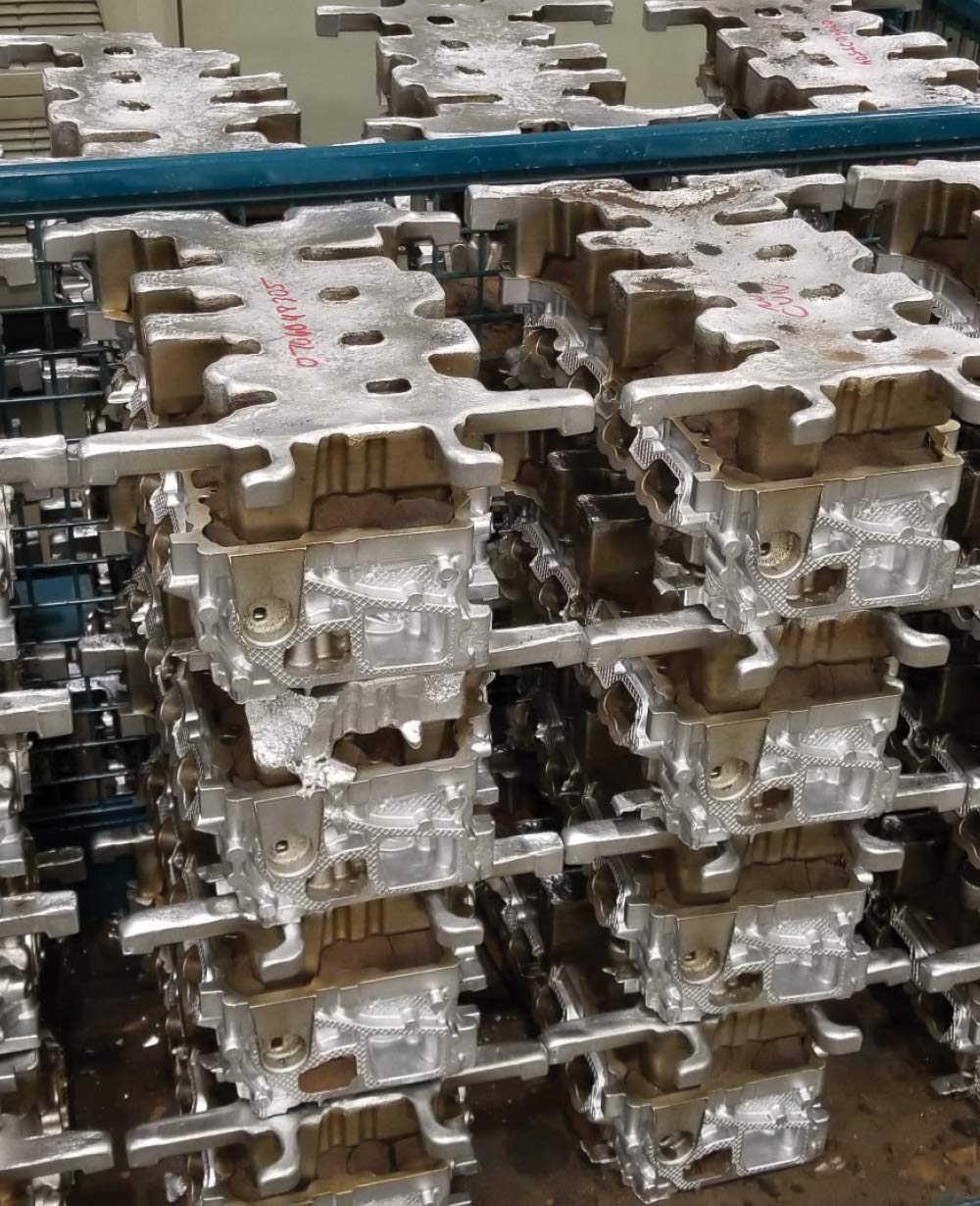

“In 2020, vehicles in North America contained 459 pounds of aluminum. That is projected to grow to 570 pounds in 2030—this includes power train, closures, suspension. The common uses in the early years, 1975 to 2000, were largely castings, heat exchangers, engine blocks, transmission cases and wheels.”

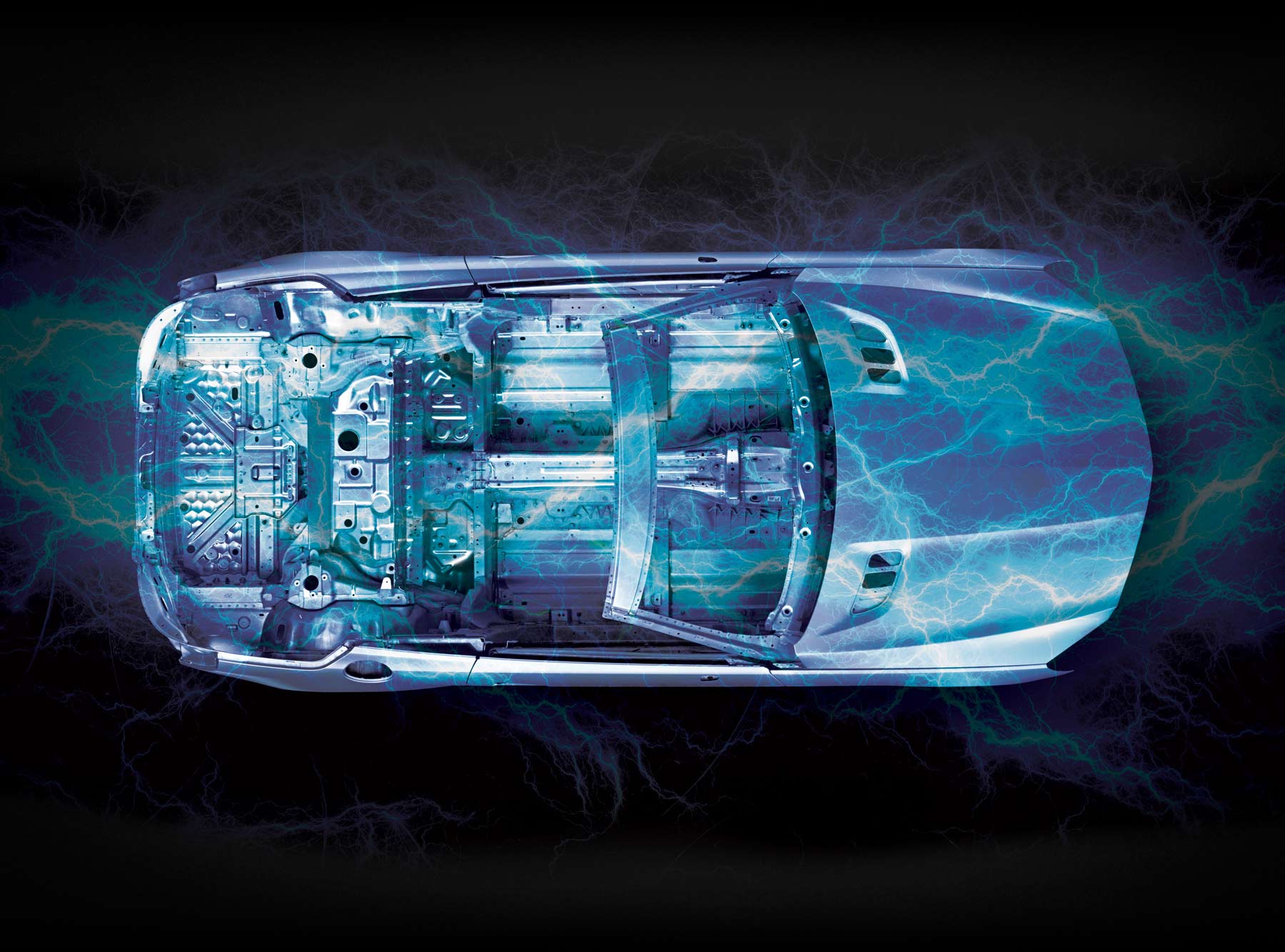

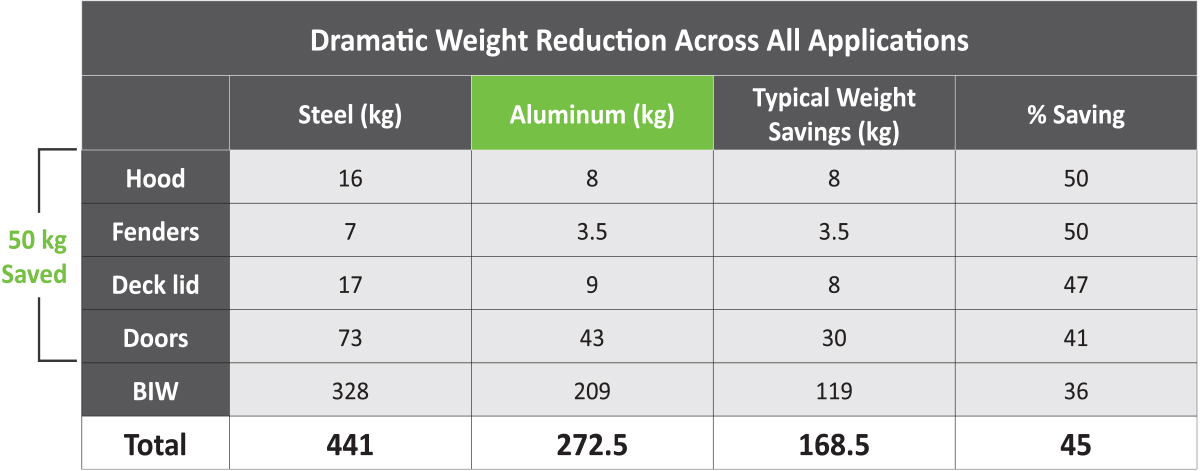

In the early 2000s, cast aluminum suspension components became common. Over the last 15 years, the use of aluminum sheet, extrusions and castings in body in white and closures applications has been the fastest growing segment, Long said. Closures include the hood, fenders, deck lids and doors.

weight reduction can have a significant impact on performance and fuel economy.

weight reduction can have a significant impact on performance and fuel economy.

Fenders are also forecast to grow from 10 percent of the market in 2016 to 35 percent in 2026. Aluminum usage in doors is expected to capture 21 percent of market share in 2020 and rise to about 30 percent in 2026. Aluminum’s share in lift gates and deck lids will grow from 29 percent in 2020 to 46 percent in 2026, the study states.

“Electric vehicles are becoming more common,” said Long. The DuckerFrontier study sorted aluminum use by EVs and nonEVs. The average North American vehicle contains 459 pounds of aluminum. EVs have 643 pounds, and the internal combustion engine (ICE) class vehicles have 454 pounds. “That is a trend we see continuing. EVs will have more aluminum because lighter weight improves driving range. There are additional components, such as battery trays, that contain a fair amount of aluminum. We expect EV growth will drive aluminum growth.”

“If you save 100 kilograms in primary, you can save 25 kilograms in secondary weight reductions,” Long said. “A convenient rule of thumb is a 10 percent reduction in curb weight results in a 6 percent improvement in fuel economy. So the weight reduction can have a significant impact on performance and fuel economy.”

In 2008, Audi released the TT, an early hybrid steel and aluminum body in white. “This vehicle has an aluminum front end and is more steel-intensive in the rear to provide better weight balance. The Audi Q7 is a recent vehicle using a hybrid steel and aluminum BIW and aluminum closures,” Long said. “It’s all aluminum closures, a largely aluminum rear and front end with a steel safety cage. This is a trend: More vehicles mix different materials as the design moves forward.”

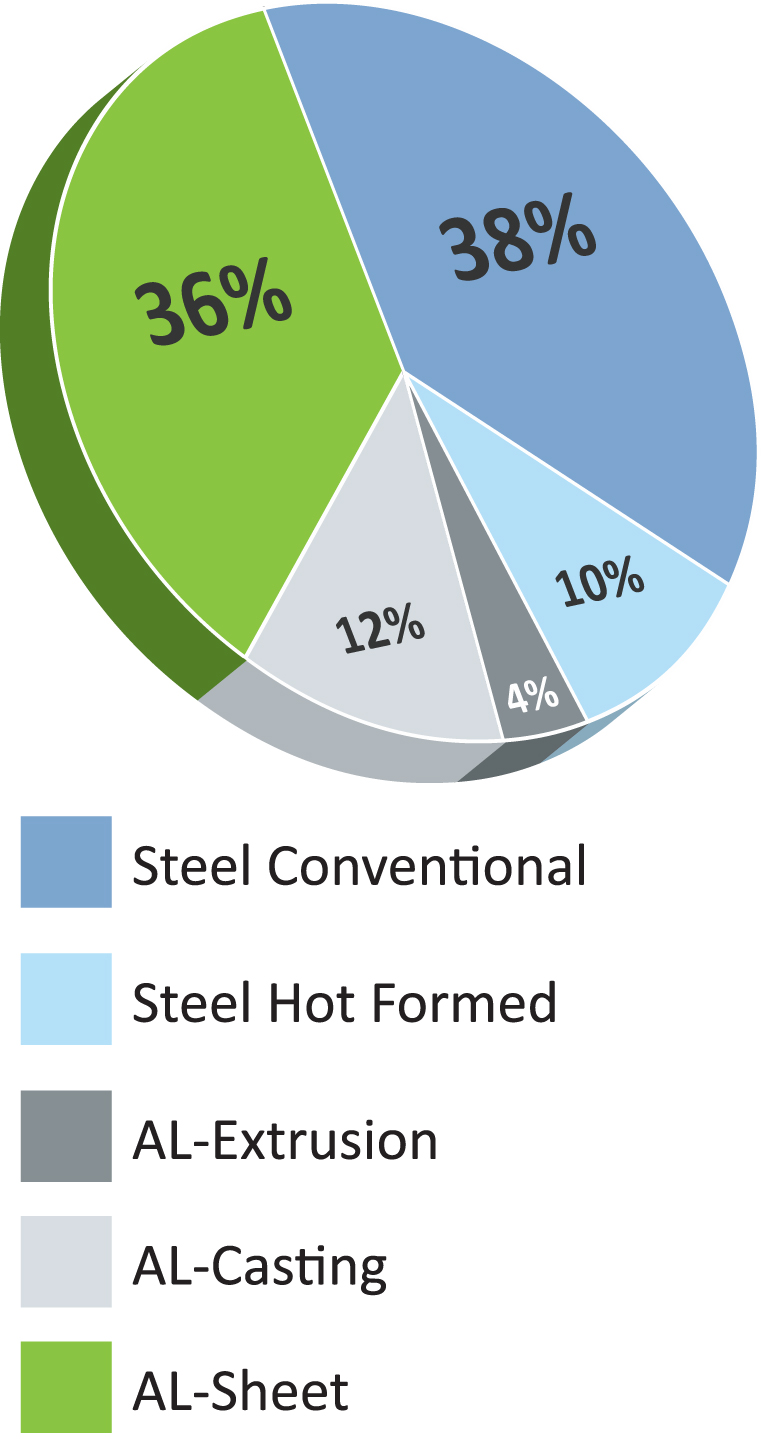

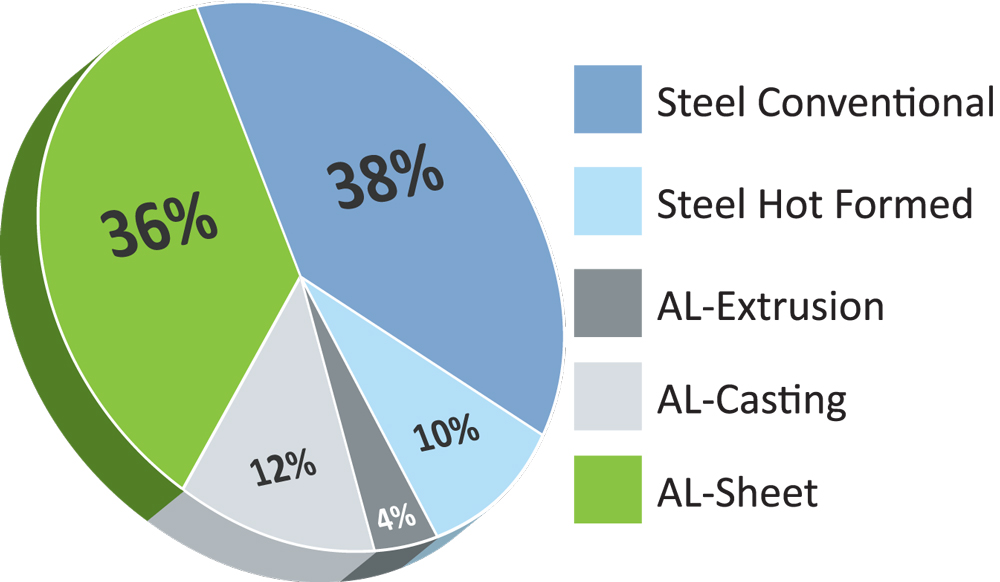

In the case of the Audi Q7, the components are 48 percent steel and 52 percent aluminum by weight.

A majority of Jaguar vehicles have aluminum bodies. The Jaguar XJ has been aluminum since 2003, the Jag SF since 2008, and XE and F types since 2015 and 2013. The Jaguar F-Pace is a hybrid BIW with aluminum closures. The Jaguar I-Pace, an electric vehicle, is all aluminum BIW and closures. It was named EU’s Car of the Year in 2019, Long said. The Range Rover saved 420 kilograms by using aluminum.

“We have been speaking about electric vehicles. The Tesla lineup, Model S and Model X, are all aluminum BIW and closures. The models 3 and Y are hybrid BIW with aluminum closures. If we look to the most recent Mercedes-Benz C Class, it uses all aluminum closures and roof, and some BIW components. By weight, it is 24.8 percent aluminum, Long said.

The principal growth product for aluminum will be flat-rolled sheet for ABS followed by platform high-pressure die castings (HPDC). For example, aluminum hoods will grow from 50 percent penetration in 2016 to over 60 percent in 2020, while platform HPDC shock towers will double penetration from 5 percent in 2016 to 10 percent in 2020.

By 2026, the consultancy forecasts, net aluminum demand will increase to 514 pounds per vehicle, due to penetration increases for all vehicles utilizing aluminum in closures, body in white and chassis to meet long-range CO2 goals as well as the ramp-up of electrified power train and battery electric vehicle platforms that use greater amounts of aluminum sheet, extrusions and castings for mass savings to achieve range targets.

Comparing the steel F-150 to the aluminum F-150, Long noted that both had aluminum hoods. “The fender weight savings was considerable. Tailgate doors also contributed to weight savings. The cab was 40 percent plus [weight savings], as was the cargo box. Overall, it was a 44 percent reduction in [weight across the] closures, cab and cargo box.”

Subsequently, the Ford Super Duty, Expedition and Lincoln Navigator were made with all-aluminum cabs and closures. Jeep adopted aluminum hood and doors for its Wrangler and Gladiator platforms. The 2019 Chevrolet Silverado pickup truck included an aluminum hood, doors and tailgate. The 2019 Toyota Rav 4 used an aluminum hood, fenders and lift gate.

“If you only need to save 50 kilograms, and an aluminum BIW can give you 100 kilograms, you can use selected parts in select areas. Press-hardened steels are dominating the safety cage area. Aluminum parts in the cage can do the job and save 30 percent [by weight], whereas in other areas, aluminum would save 40 percent or 50 percent,” he said, “so it’s logical to use some steel components. The difficulty is you have to change your methods for joining steel and aluminum. OEMs have different approaches to doing that.”