hroughout North America and worldwide, economic and demand trends in 2020 may prove unpredictable (as usual), but there remains sufficient confidence among the producers of steel and aluminum to engage in mergers and put money into long-term growth projects. Modern Metals has tapped into discussions by CEOs from mining to finished flat-rolled and long products.

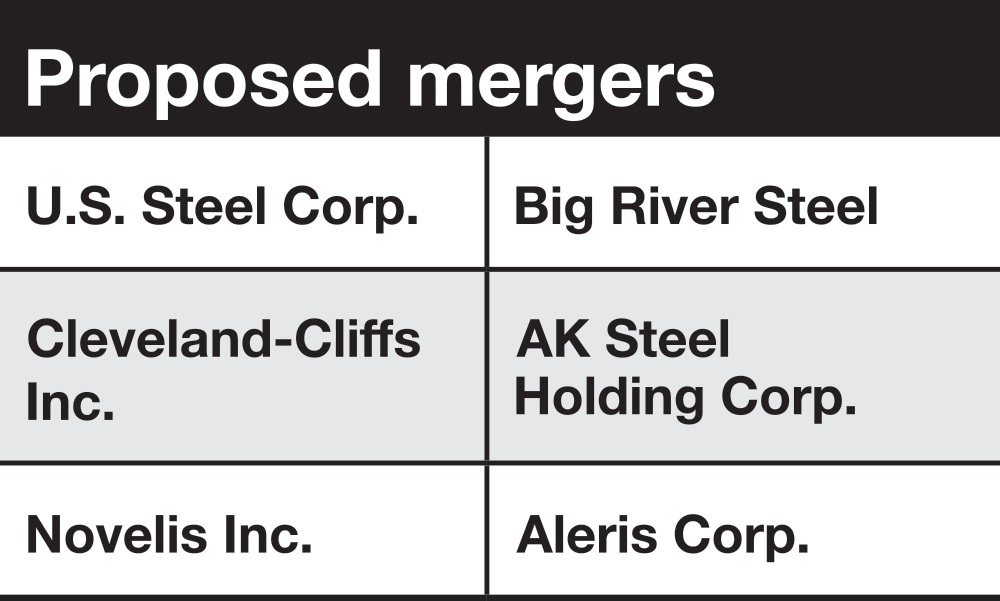

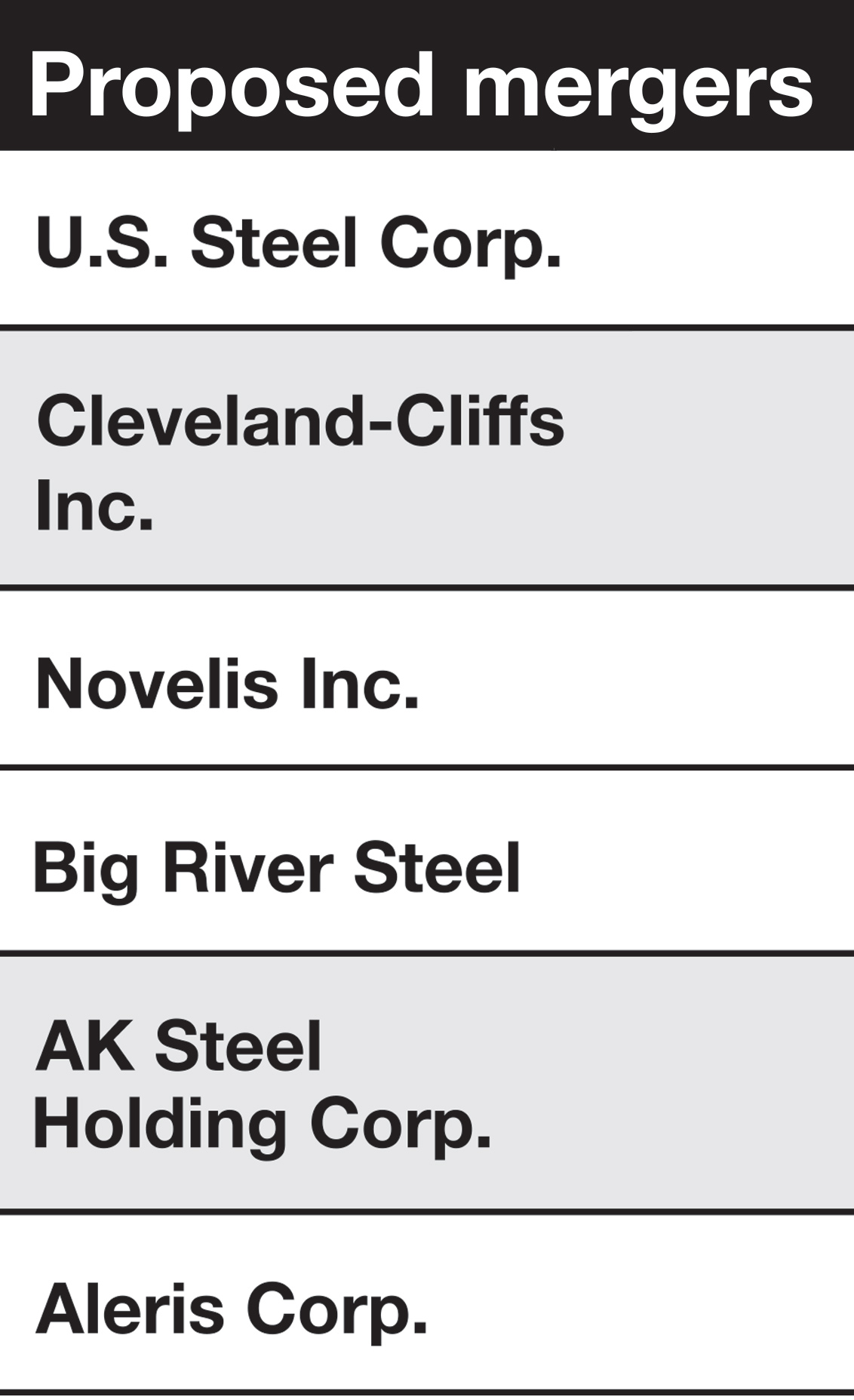

Let’s first look at announced mergers.

1. Cleveland-Cliffs Inc. and AK Steel Holding Corp. have agreed to a transaction under which Cliffs will acquire all shares of AK Steel common stock. The deal will combine Cliffs, North America’s largest producer of iron ore pellets, with AK Steel, which produces flat-rolled carbon, stainless and electrical steel products, to create a vertically integrated producer of iron and steel products.

Lourenço Gonçalves, chairman, president and CEO of Cliffs, said the combined company will be well-positioned to serve both the blast furnace and electric arc furnace segments, with a balance sheet and self-sufficiency in pellets providing flexibility to pursue further growth opportunities. One such potentiality would be to employ the blast furnace in Ashland, Kentucky, to produce merchant pig iron.

U.S. Steel has “a lot to offer Big River in terms of commercial capability, qualifying and running trials faster, and valuable R&D and intellectual property,” he added.

3. Novelis Inc., a division of India’s Hindalco Industries Ltd., is working to acquire Aleris Corp., which has 13 aluminum rolling operations across North America, Asia and Europe, for $2.6 billion.

For Novelis, Aleris and their customers, the combination will establish a more diverse product portfolio, including aerospace, beverage can, automotive, building and construction, commercial transportation and specialty products.

The transaction will integrate complementary assets in Asia to include recycling, casting, rolling and finishing capabilities and allow Novelis to more efficiently serve the growing Asia market. It will broaden Novelis’ automotive business to meet growing demand and diversify its global footprint and customer base.

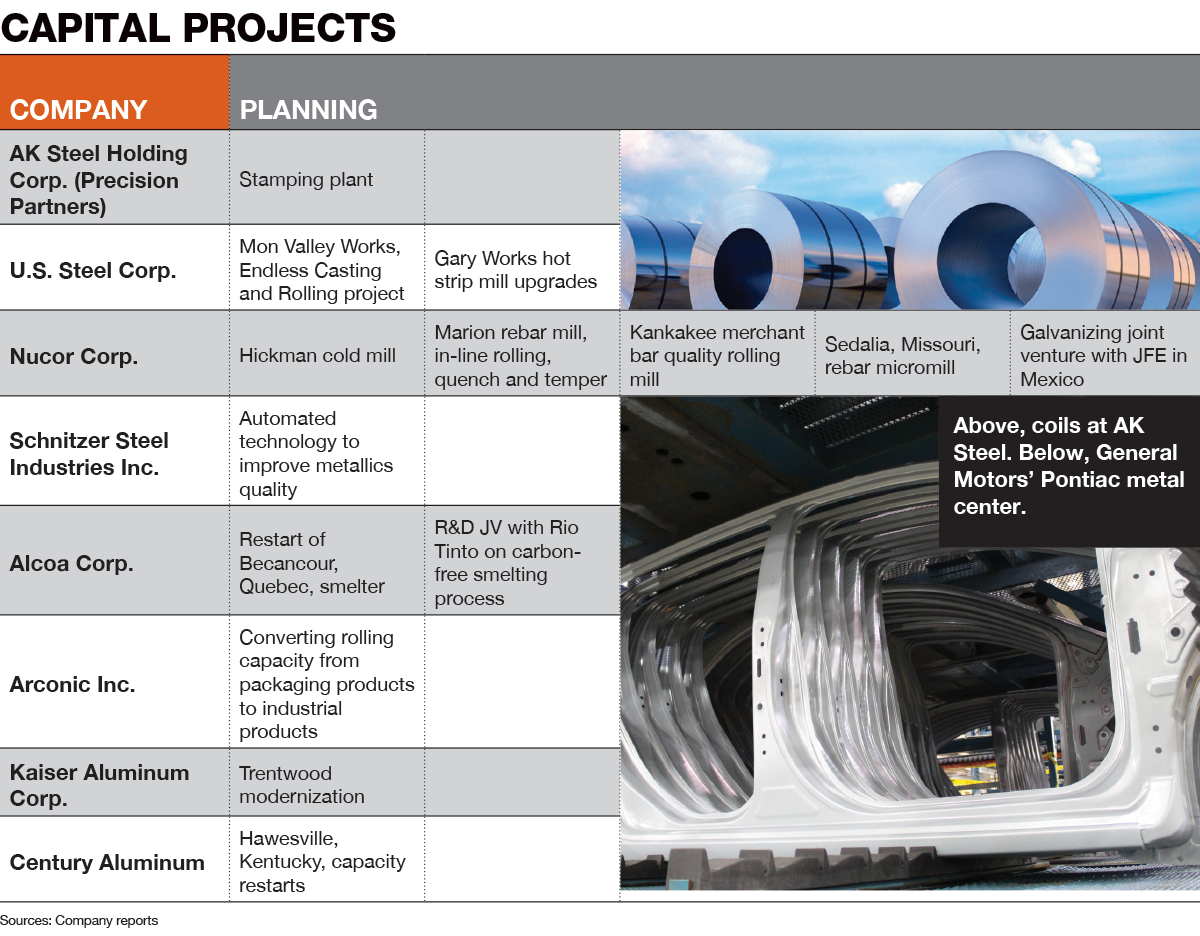

He also cited a series of projects at the Gary Works hot-strip mill meant to expand the line’s competitive advantages, particularly in heavy-gauge products. “This project is part of our Asset Revitalization Program and is about 30 percent through the expected $500 million investment.”

U.S. Steel forecast its 2020 capital spending at $950 million. “Big River is our No. 1 priority, and we will finish the tubular EAF in the second half of 2020.”

…the ability to produce single-piece hot-stamped door rings and large subassemblies.

…the ability to produce single-piece hot-stamped door rings and large subassemblies.

President and CEO Roger Newport, during a November earnings call, commented that people are asking why the company is so confident about 2020. “It’s because we’re already awarded the business,” particularly with automakers’ newest platforms. “In some cases, there are good-selling platforms that started in 2019 and continue to ramp up in 2020.”

Nucor Corp.’s Hickman, Arkansas, team continues to increase production and improve yield performance on its new specialty cold mill, President and COO Leon Topalian told shareholders in late October. “With its dual configuration, [the] new cold mill can change from a high reduction mill for the advanced-strength steels of the future to a very efficient four-high mill in just six minutes. There is no other carbon mill like this in North America,” he claimed.

President and CEO Roger Newport, during a November earnings call, commented that people are asking why the company is so confident about 2020. “It’s because we’re already awarded the business,” particularly with automakers’ newest platforms. “In some cases, there are good-selling platforms that started in 2019 and continue to ramp up in 2020.”

Nucor Corp.’s Hickman, Arkansas, team continues to increase production and improve yield performance on its new specialty cold mill, President and COO Leon Topalian told shareholders in late October. “With its dual configuration, [the] new cold mill can change from a high reduction mill for the advanced-strength steels of the future to a very efficient four-high mill in just six minutes. There is no other carbon mill like this in North America,” he claimed.

Topalian said.

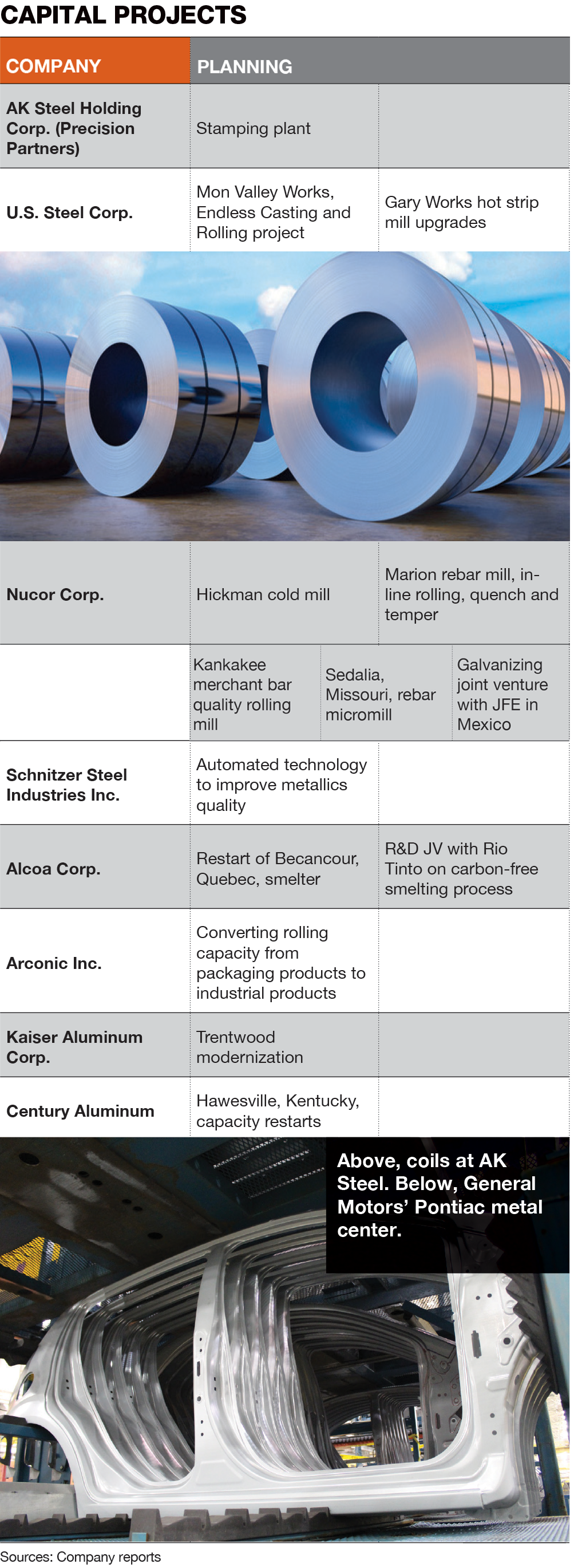

Nucor commissioned a new in-line rebar rolling mill in Marion, Ohio, and expects to install quench and temper equipment to reduce alloy costs early in 2020. For other Nucor projects, see table (above).

“These projects target defined market opportunities where we are confident that we will compete and win highly profitable market share,” Topalian told shareholders.

Schnitzer Steel Industries Inc., Portland, Oregon, is rolling out an automated system that should eliminate its production of lower-value mixed nonferrous products such as Zorba (a mix of copper and aluminum that comes from shredded cars). The new equipment will be installed in at least five major recycling plants.

According to Schnitzer CFO Richard Peach, “The technology will allow us to convert Zorba to higher value, furnace-ready products such as twitch, copper, brass, zinc, stainless steel and other metals. By early 2021, we expect to be in a position to eliminate Zorba from our product set by converting to more valuable products.”

The company will also roll out advanced metal recovery equipment in four of its major export facilities. “These installations will replace and upgrade our downstream process during fiscal 2020 and 2021,” Peach said.

Arconic Inc. should complete its conversion of packaging products capacity to industrial rolled products by the fourth quarter of this year, Chairman and CEO John Plant said in early November. “The plan has been to transition from North American packaging and marginal business to industrial products, which is supported by the China common alloy trade case. We expect [the duties on Chinese imports] to last at least five years.”

At both Kaiser Aluminum Corp. and Century Aluminum Co., a StarTrek scenario comes to mind: “Scotty, we need more power!”

This means serial modernizations of Trentwood may continue during 2020 and beyond. “The oversubscribed capacity has increased interest among investors regarding our plans for expansion,” Hockema says. “Our team developed a future state vision that can be implemented in phases to accommodate customer needs decades into the future.”

Century also continues to work on capacity restarts at Hawesville, Kentucky. The facility has five potlines; each produces 50,000 tons when at capacity. In 2015, Century curtailed three potlines. The remaining two continued to run well past their five-year service life. This month, Hawesville hopes to bring back two rebuilt potlines and reach 80 percent of capacity.

a range of products will require an increased focus on materials that are sustainably produced.

a range of products will require an increased focus on materials that are sustainably produced.

“While it’s difficult to predict steel markets far into the future, we have great confidence in Nucor’s business fundamentals and our long-term strategy.”

Alcoa’s Harvey comments, “The long-term outlook for aluminum demand remains strong. A range of products will require more aluminum but with an increased focus on materials that are sustainably and responsibly produced.” The market for low-carbon metals will “take time to develop, yet more and more customers are interested in [them].”