Features

/steel

/servicecenters

/coatedcoil

he Metals Service Center Institute (MSCI) welcomed the signing in mid-December of the United States-Mexico-Canada Agreement (USMCA), negotiated by the U.S. and Mexican governments and agreed to by House Speaker Nancy Pelosi.

“MSCI represents more than 285 companies with approximately 2,300 locations across North America,” MSCI President and CEO M. Robert Weidner III said in a statement. “This trade pact is critical to these firms’ ability to compete on this continent, and globally.” The USMCA “will preserve well-established relationships and partnerships that have expanded exports, enhanced growth, and provided well-paying jobs to millions of North American metals workers.”

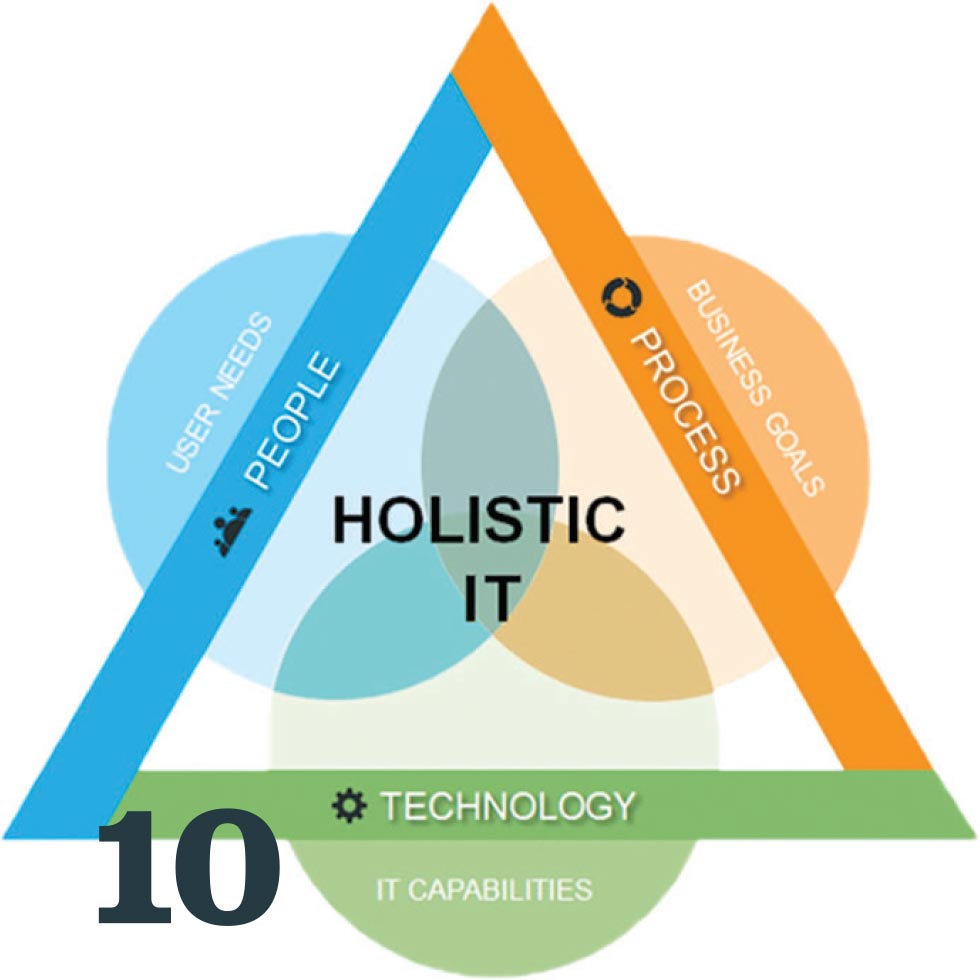

hen I ask someone if they like their company’s enterprise resource planning system, I rarely hear a positive answer. Most say something along the lines of, “It’s the devil that we know.”

Why do they feel this way? Possible reasons include that their organization selected the wrong product, implemented it incorrectly or the software is obsolete.

For many companies, an ERP system is the most expensive and complex software that they will purchase. Implementing an ERP system is a growing company’s rite of passage with many promises: increased efficiency, the opportunity to scale up and a means to transform a company to higher levels of business maturity.

Following the appointment of CEO Klaus Keysberg to the executive board of thyssenkrupp AG, Duisburg, Germany, the board of the thyssenkrupp Materials Services business area is being partly restructured. Martin Stillger will succeed Keysberg as chairman of the executive board of Materials Services. Keysberg oversees the businesses of Steel Europe and Materials Services. COO Ilse Henne is taking on a new position of chief transformation officer. The role of COO will no longer be filled.

Miller Fabrication Solutions, Brookville, Pennsylvania, named Paul Sorek as director of business processes. He succeeds Rich Steel, who was named director of lean manufacturing. Sorek oversees automation, engineering, process development and quality control. He spent the previous 15 years at a lumber company, including the last eight as its president.

Omar Chavez is now manufacturer’s representative for Heyco Metals, Reading, Pennsylvania, in Mexico. Chavez has experience marketing products such as clad metal, nickel products and cold-rolled steel.

Kevin Ramirez has joined SigmaTEK Systems, Cincinnati, as vice president of sales for North America. Ramirez has more than 20 years of production, cutting machinery and software experience, working in diverse roles such as CNC operator, support and service engineer and technical sales and account manager.

BLM Group, Novi, Michigan, 248/560-0080, www.blmgroup.com.

hroughout North America and worldwide, economic and demand trends in 2020 may prove unpredictable (as usual), but there remains sufficient confidence among the producers of steel and aluminum to engage in mergers and put money into long-term growth projects. Modern Metals has tapped into discussions by CEOs from mining to finished flat-rolled and long products.

Let’s first look at announced mergers.

1. Cleveland-Cliffs Inc. and AK Steel Holding Corp. have agreed to a transaction under which Cliffs will acquire all shares of AK Steel common stock. The deal will combine Cliffs, North America’s largest producer of iron ore pellets, with AK Steel, which produces flat-rolled carbon, stainless and electrical steel products, to create a vertically integrated producer of iron and steel products.

apham-Hickey Steel Corp. began creating its brand over 93 years ago in Chicago, and its reputation has grown alongside its 10 branches—four of which became part of the company less than two years ago.

Will Hickey, chief commercial officer for the fourth-generation, family owned service center chain, says continuing to offer excellent service to customers plays a paramount role in Lapham-Hickey’s strategic decisions. He cites a series of capital expenditures over the past three years.

utomatic for the People,” released by REM in 1992, was one of the most worn-out CDs I ever owned. There is not a bad song on that record. Calstrip Industries, likewise, is humming along with its extensively automated new coil processing plant in Blytheville, Arkansas.

Calstrip was founded in 1939 near Los Angeles as a strip producer with narrow rolling mills and annealing furnaces. In 1999, the company entered a new era by building a new slitting and sheeting facility in Santa Teresa, New Mexico, which is near both El Paso, Texas, and Juarez, Mexico, says Calstrip Chief Operating Officer Ed Camden.

coilcoating

upersize, modernize and optimize—these seem to be the connected goals for Vorteq Coil Finishers LLC. The coil coater recently closed on a major acquisition, the second inside of two years; has rebuilt a major operation in Tennessee; and is automating functions where it makes the most sense.

The acquisition of Western Metal Decorating, Rancho Cucamonga, California, closed in October 2019. This followed the May 2018 acquisition of Wheeling Service & Supply Inc. and the October 2016 purchase of Prior Coated Metals Inc. With seven facilities and nine coating lines, Vorteq now has the broadest geographical reach of any independent coil coater in North America.

lexible factory setups allow manufacturers to use automation to create a fully connected, smart production line. According to research from Deloitte Insights, “Smart factories go beyond simple automation. The smart factory is a flexible system that can self-optimize performance across a broader network; self-adapt to, and learn from, new conditions in real or near-real time; and autonomously run entire production processes.”

“Automation and autonomous processes have been a major growth point in the industry for several years,” says Ryan Welcome, who works for machinery manufacturer Trumpf Inc. as a TruConnect specialist for the TruLaser Center 7030. Companies are taking a “deeper look into total throughput of processing sheet metal parts,” he notes. “To really evaluate the process chain, we need to look at more than just linear cutting times.”

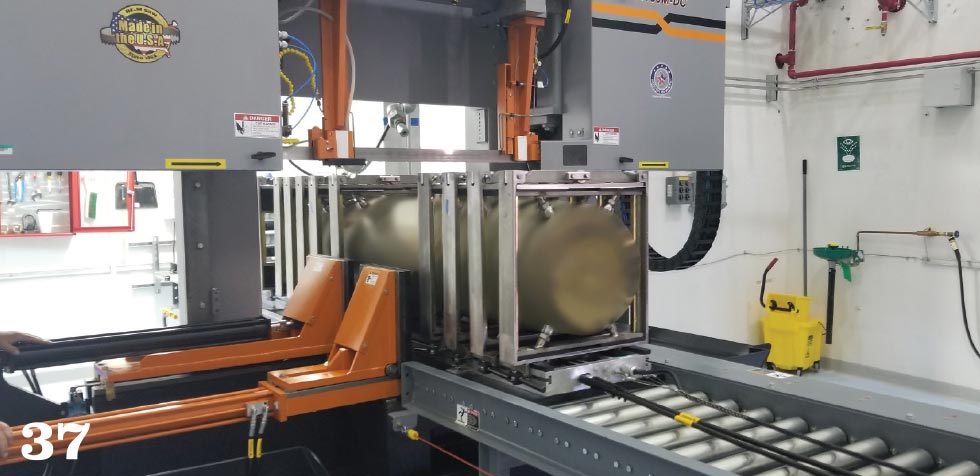

HE&M Products Manager

ver the 55 years that HE&M has manufactured band saws, its team frequently becomes involved in sawing applications where a standard model just won’t do for the task. So the company has built numerous custom saws. This proved challenging but not insurmountable for the design and engineering staff because each of these builds had unique requirements, which made the results all the more rewarding.

In the early 1990s, a facility that had produced plutonium for nuclear ordnance since the 1950s was decommissioned in Colorado. During deconstruction, over 800 structures were demolished and 21 tons of weapons-grade material was removed. The demolition resulted in 1.3 million cubic meters of waste. Much of that waste was compressed into 3-foot cubes and buried.

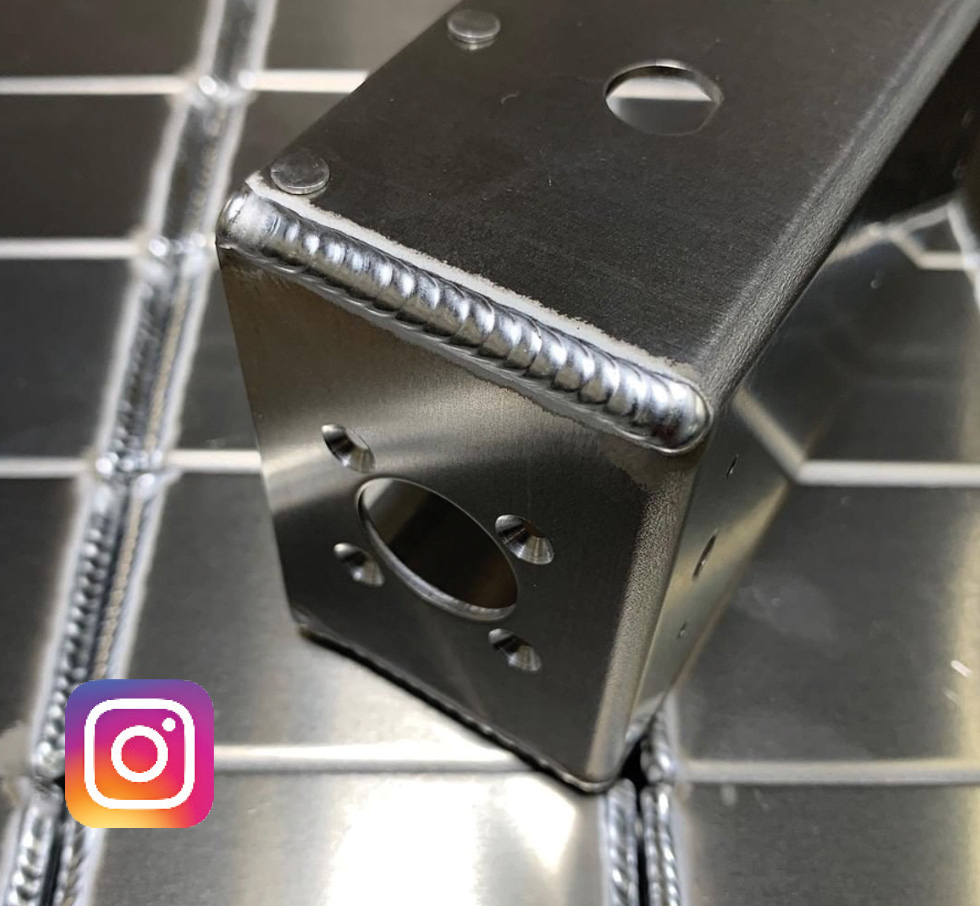

partingshot

partingshot

Advertiser Index

View Index

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) January 2020, Vol. 76, No. 1 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2018 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.