luminum extruder and specialist machine shop Richardson Metals Inc., Colorado Springs, is one of thousands of manufacturers that have faced difficulties this year finding and recruiting qualified people to operate processing machinery and perform all sorts of necessary functions.

Primary metal producers in September employed 353,200 people, down 0.5 percent from August and declining 1.2 percent from July, the U.S. Bureau of Labor Statistics reports. Fabricators employed nearly 1.42 million people during September, up 0.2 percent from August, but down 0.1 percent from July. Fabricators’ employment levels grew 3.2 percent from a year ago while metal producers’ employment levels rose 2.6 percent year over year.

More broadly, job openings in the U.S. durable goods manufacturing sector during July (the latest month for which data was available) totaled 480,000, down 2.8 percent from June but up 115.2 percent from July 2020, the bureau reports. Hires in the sector totaled 317,000 people in June and 255,000 in July. However, that compares with 164,000 people who quit their jobs in durable goods during June and 160,000 workers quitting during July.

we bring someone in and they work a couple days and they disappear. we cannot find them.

we bring someone in and they work a couple days and they disappear. we cannot find them.

richardson metals inc.

Richardson Metals Vice President John Tassone recalls that, in February 2020, “we were two days away from having nothing to run on our equipment. Then, we had a customer that makes medical devices call us. We make three parts for this piece of equipment and the customer won a government contract.”

After adjusting to the new normal, “we had a pretty good second half of 2020 and we’ve had a decent 2021. Our biggest issue is hiring and keeping employees,” he says. “We bring someone in and they work a couple days and they disappear. They don’t call, and we cannot find them. Some stay a couple weeks, a couple months. We are continuing to run short a couple people, sometimes more. We don’t know how to fix that. Is it something we can fix?”

As a result of the labor shortage, Tassone says, “We pushed out our lead times to our own customers. We are still meeting our commitments to them. It is just frustrating not to find people to stay. We offer a good benefits package. We offer four 10-hour days and a three-day weekend. We are still flexible when we need to require overtime.”

He says most of Richardson’s customers have issues “around labor as well,” so they have been understanding about the situation.

“That makes sense, during COVID, with people going out and doing things they hadn’t done before,” Tassone says. For example, “I took my daughter fishing [in September], and we had to book the trip back in February. That lends credence to the increase in sporting goods.”

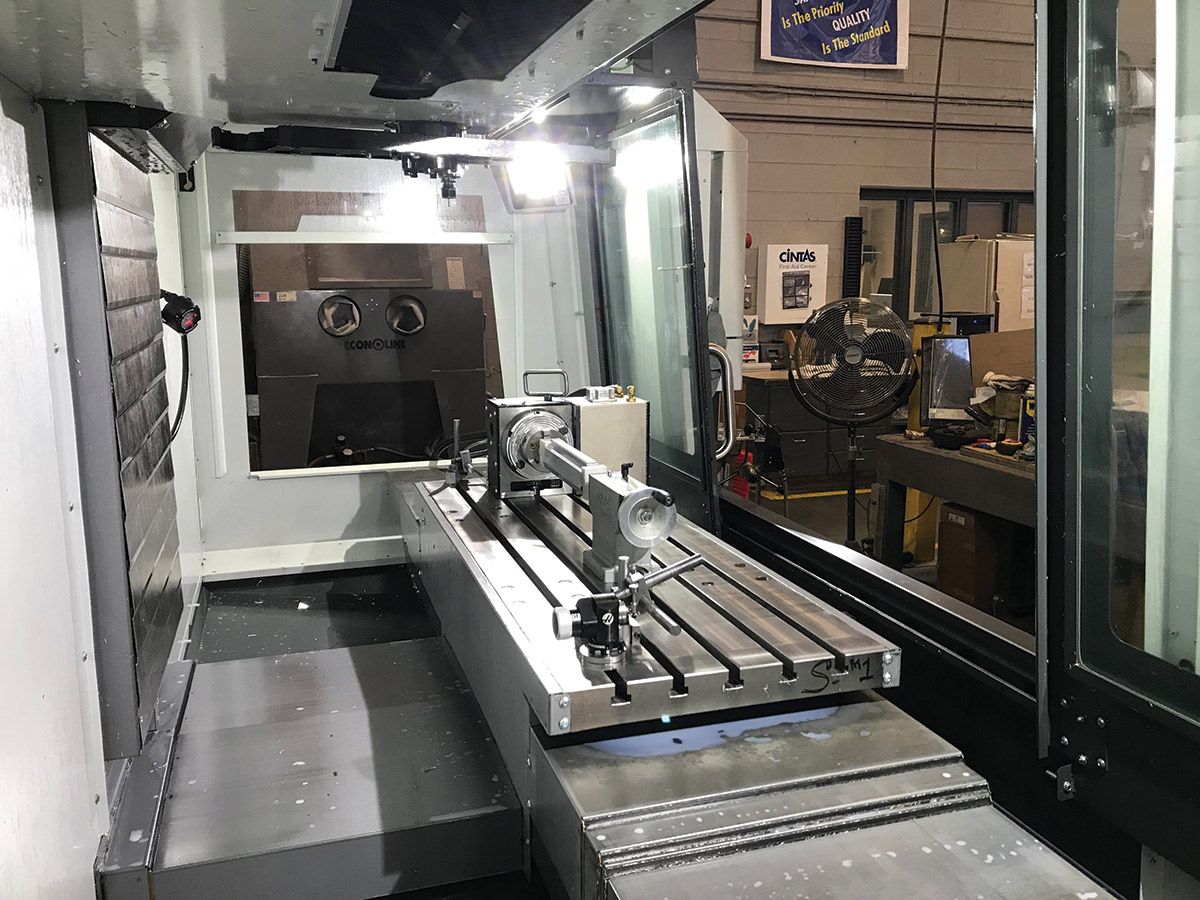

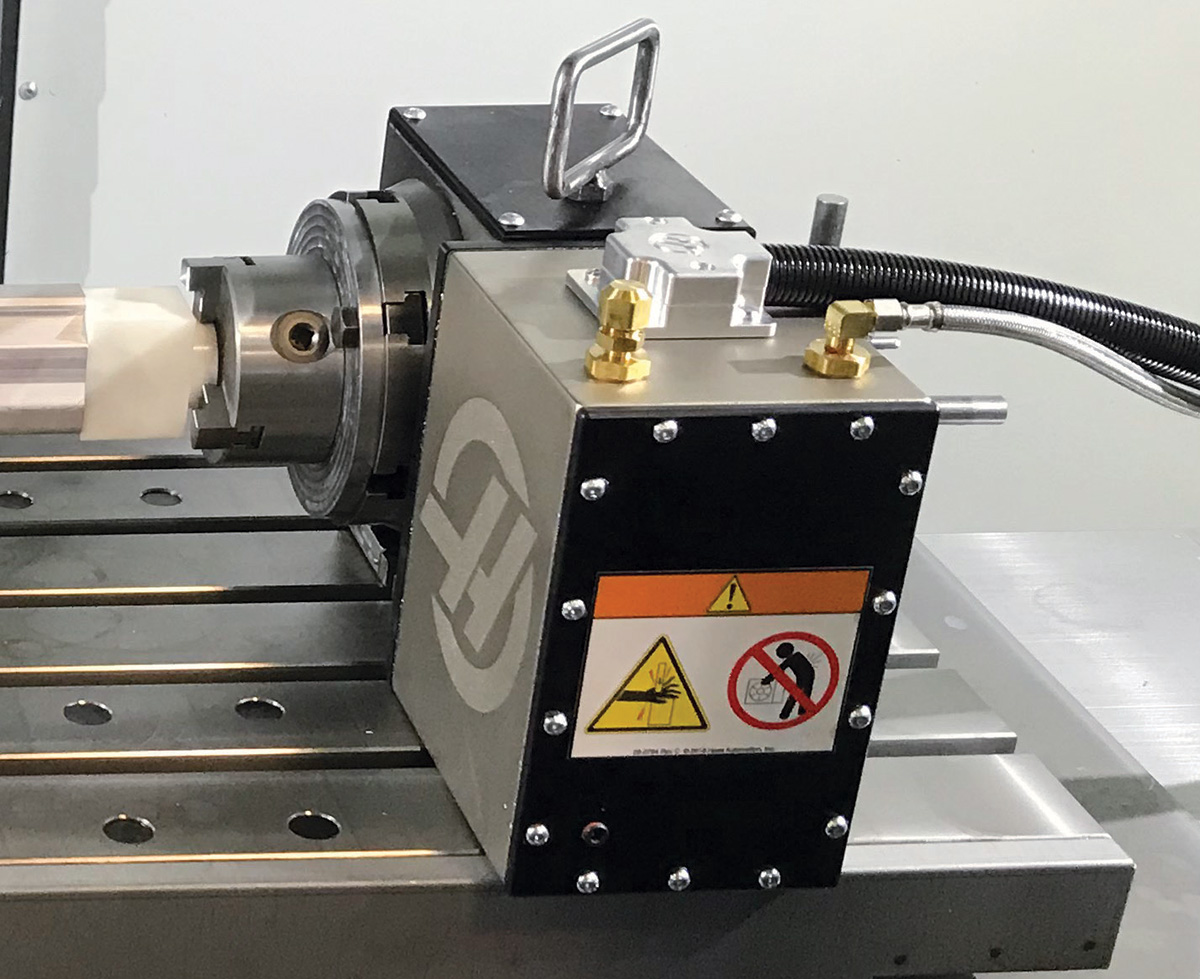

During the bulk of 2021, he says, customers overall are busy. “And we have seen an influx of new customers over the past few months. One of the things we did to attract customers is we just purchased a 4-axis machining center for our extrusions.

“Many customers typically outsourced work to a machine shop but, now, we can do that without incurring more freight and a long lead time,” Tassone explains. “That’s a value-add, and customers like one-stop shopping.”

Providing such in-house skills makes Richardson Metals “more attractive to the customer base. Another attraction is we can hold tight tolerances on the as-extruded part. We have a fair amount of new customers, and they all want new dies.” So those are new parts that Richardson will produce.

“We hope that with the second machine, we will grow that aspect of our business, he says. “If we can continue to add value, that will be our focus for 2022.”