a nationwide network.

Our team is here, there and everywhere ready to help when you need it. Let us bring your business the ultimate flexibility and competitive edge so you can deliver the most consistent product to your customers!

serving metal service centers, fabricators and OEM/end users since 1945

serving metal service centers, fabricators and OEM/end users since 1945

Features

uring a candid roundtable discussion at the Copper and Brass Servicenter Association’s fall summit in Tampa, Florida, participants addressed a host of issues around the pull and push of demand versus supply.

“Demand for every single one of our strip products is through the roof,” said one member. “As a mill, we aren’t having constraints on raw materials we buy but there are [shortages with] labor and equipment. Most of our markets operated in survive, not thrive mode for 20 years, and we weren’t investing in our capacity. Now the market is calling for more capacity but it doesn’t happen overnight.” He believes there will be more capital investment in domestic copper and brass production very soon.

Service Centers POV

Rick Stewart and his team at Stainless Steel Services pioneered many of its practices, and his son Patrick will help move the company into the future.

Rick Stewart and his team at Stainless Steel Services pioneered many of its practices, and his son Patrick will help move the company into the future.

ick Stewart, president and owner of Stainless Steel Services, often brings a little bowl of plastic horses to trade shows as swag, toys that “people can take home to their kids. They ask me, ‘What’s this about?’ And I say, ‘We’re a one-trick pony.’ We take flat stainless steel and make it shiny.”

Being a one-trick pony isn’t a negative trait where Stainless Steel Services is concerned. The company’s committed focus on polishing has elevated it to excellence in its niche.

What are the biggest trends you’re seeing in metals technology this year?

Barnes: We’ve been surveying metals executives for the past 10 years as part of our annual technology in metals survey. This year, we saw a shift in companies’ investment focus toward their customers and employees. Historically, tech investments were primarily internally focused with the goal of controlling costs and improving operational efficiencies. Those factors remain important, but they no longer seem to be the driver for new tech investments. Instead, executives are focusing on meeting customer expectations and improving employee experience.

The Allegheny County Airport Authority expects the terminal will require more than 12,000 tons of steel. Structural steel for the new terminal will be fabricated locally, officials said.

Flight operations are scheduled to begin in early 2025.

is now

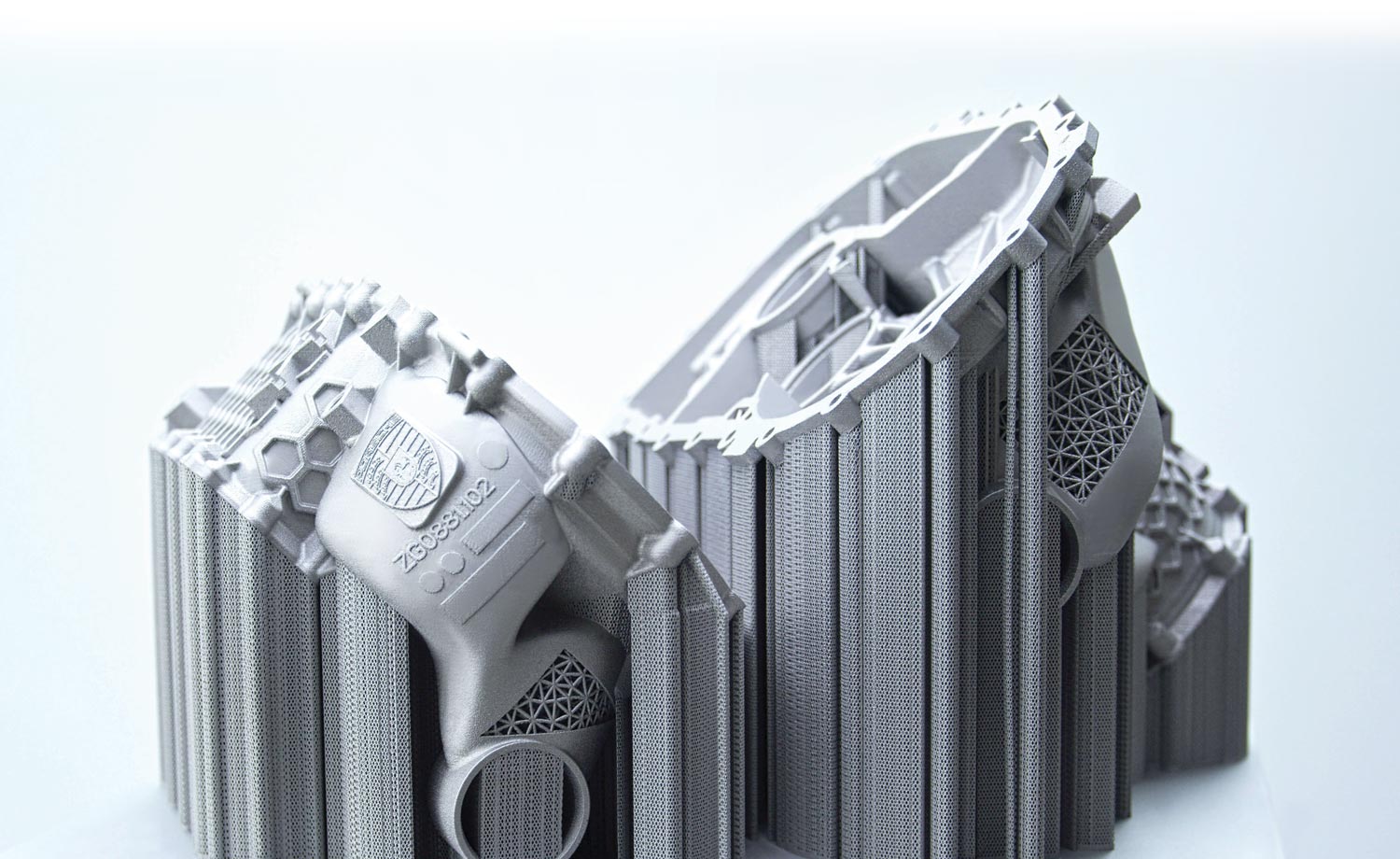

printing is now a 40-year-old manufacturing process that has advanced by leaps and bounds over the past decade, especially in the metals sector, with new materials continually being qualified and printing methods being perfected—allowing creative genius to be realized. We have come across some exciting examples, some of which hold the promise of achieving scale.

For example, MASK Architects, Sardinia, Italy, designed a steel 3D-printed structure of modular prefabricated houses for Nivola Museum, also in Sardinia. The architects foresee living as art and want housing to be beautiful.

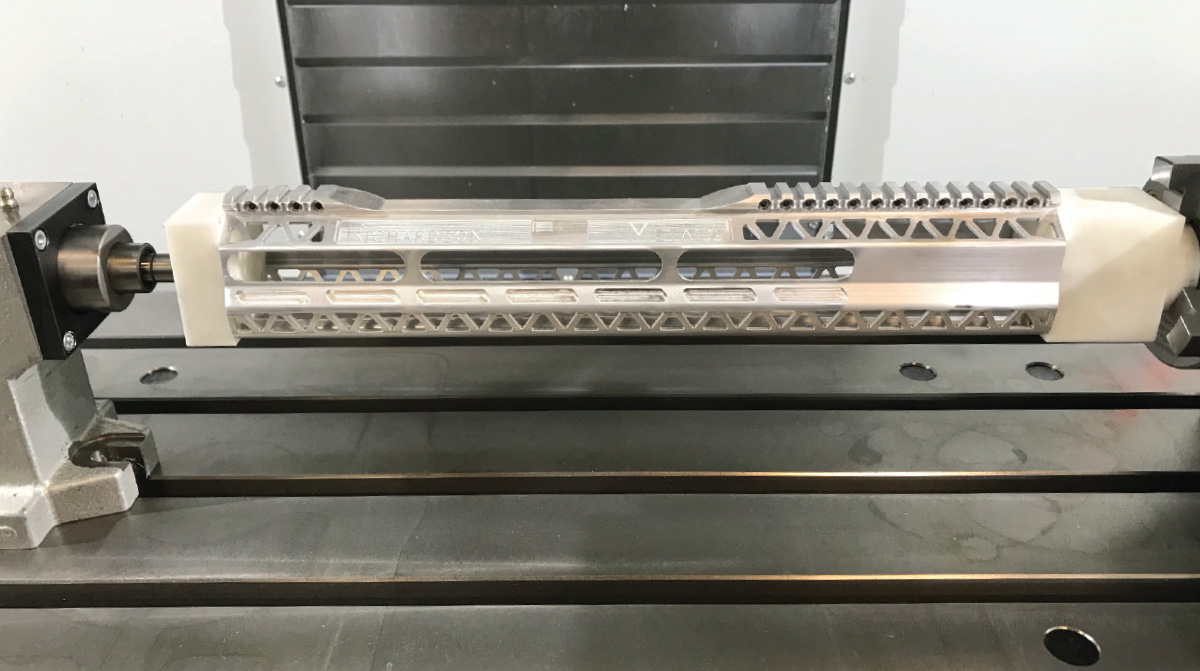

luminum extruder and specialist machine shop Richardson Metals Inc., Colorado Springs, is one of thousands of manufacturers that have faced difficulties this year finding and recruiting qualified people to operate processing machinery and perform all sorts of necessary functions.

Primary metal producers in September employed 353,200 people, down 0.5 percent from August and declining 1.2 percent from July, the U.S. Bureau of Labor Statistics reports. Fabricators employed nearly 1.42 million people during September, up 0.2 percent from August, but down 0.1 percent from July. Fabricators’ employment levels grew 3.2 percent from a year ago while metal producers’ employment levels rose 2.6 percent year over year.

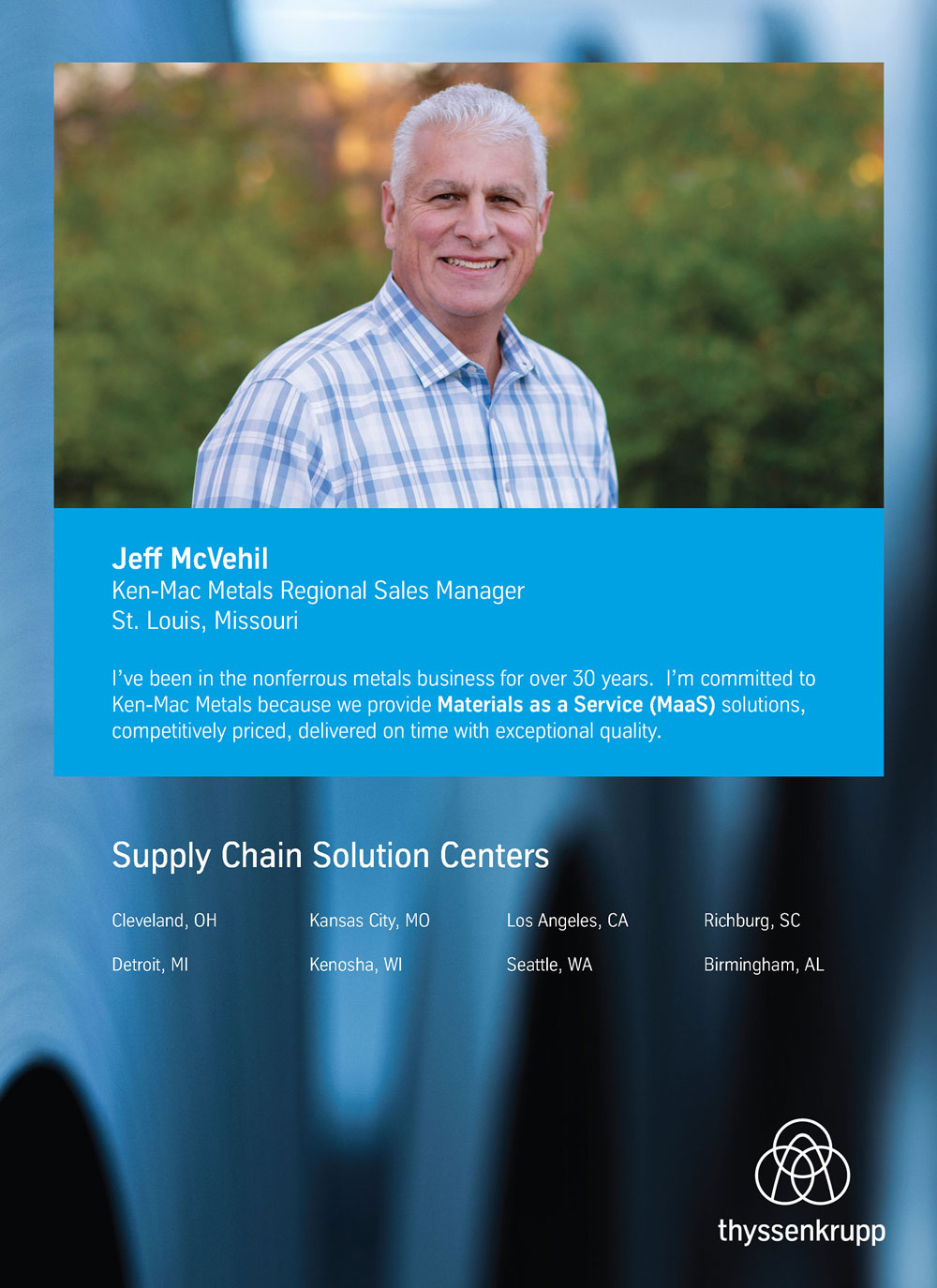

inton, Texas—located 167 miles northeast of Matamoros, Mexico, and 190 miles southwest of the Port of Houston—is at a crossroads of commerce. thyssenkrupp’s Coil Processing Group (CPG), comprised of Ken-Mac Metals and thyssenkrupp Steel Services, is breaking ground on its newest facility to help one of its key suppliers make processed steel more accessible in a market that was underserved until now.

Not long after Steel Dynamics Inc. (SDI) announced it would build a 3-million-ton melt shop and rolling mill in Sinton, it reached out to major steel processing partners to gauge their interest in co-locating assets there.

merinox Processing Inc. was established 25 years ago in Camden, N.J., and has kept very busy ever since, gradually expanding to 325,000 square feet. Today, the company processes stainless steel and aluminum, plus certain coated carbon steels and other materials. The New Jersey shop houses four cut-to-length lines; a coil polishing line; a plate polishing line; a third polishing line that handles sheet and light-gauge plate; and a fourth polishing line that imparts a Super No 8. mirror finish.

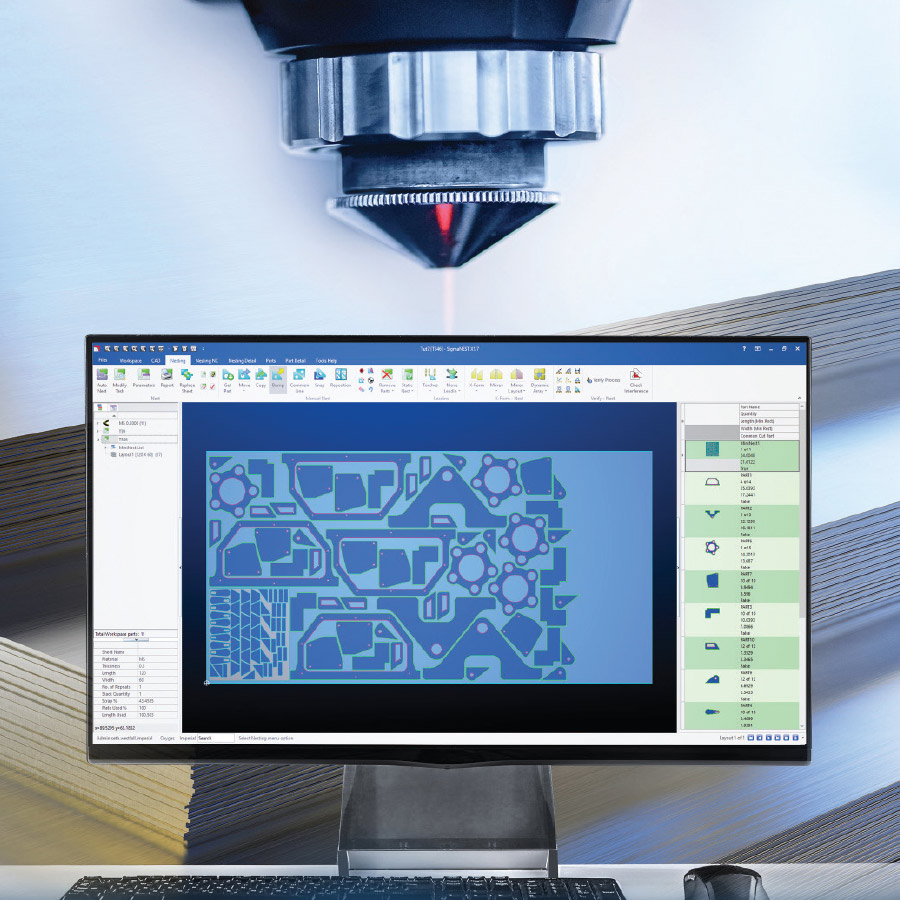

here is a lot of potential for digital solutions in the metals industry, according to a recent survey by McKinsey and Co., which collected perspectives from 30 leading metals companies around the world. The results showed that there are five main success factors to scaling digital and analytics: setting bold targets and strategies, investing, setting up a flexible data and technical architecture, building skill sets, and implementing the right governance behind data and analytics programs. “Companies that successfully harness the potential of digital will be the first to capture breakthrough increases in top-line revenues, capture the next 10 to 15 percent of cost improvement and leapfrog ahead of the rest of the industry,” the consultancy’s analysts said.

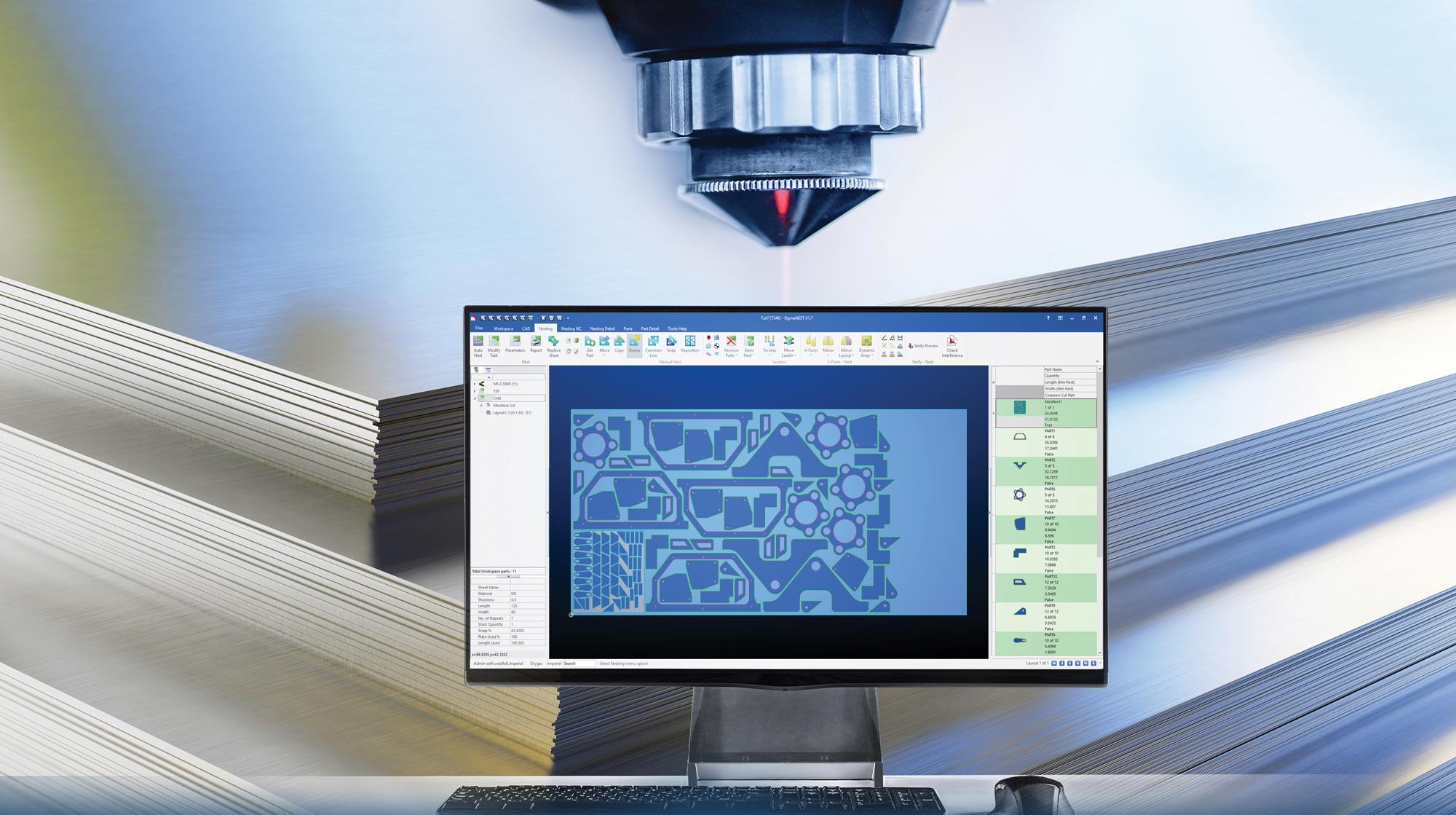

Cutting multiple sheets made easy

WARDJet Tailored Waterjet Solutions, Tallmadge, Ohio, 330/677-9100, wardjet.com.

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) NOVEMBER 2021, Vol. 77, No. 11 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) NOVEMBER 2021, Vol. 77, No. 11 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.