We’re relentlessly committed to passionate customer service, offering versatile operations and the industries’ most expansive national footprint.

Come ride the VORTEQ wave of momentum for your coil coating needs! Let’s get started at vorteqcoil.com

Features

ow.ly/XwsR30rwFiB

ongress and the administration have a lot to do, including allocating funds for COVID-19 vaccinations and economic relief for people who have lost income as a result of the pandemic. One way to put a great number of people back to work is by passing legislation that finances infrastructure projects, including the surface transportation bill, which expires Sept. 30.

White House Press Secretary Jen Psaki, during a Feb. 16 briefing, confirmed that President Joe Biden met earlier in February with senators about infrastructure. “It’s one of the areas where there’s opportunity to work together. Most people wouldn’t argue that our roads, our bridges, our streets need to be rebuilt,” she told reporters.

Rep. Rick Crawford, R-Arkansas, who serves on the U.S. House Transportation and Infrastructure Committee, agrees that infrastructure typically is able to garner bipartisan support. However, he believes that rules and regulations attached to new spending packages should reflect the local concerns of states, counties and municipalities.

Commodity markets are replete with examples of industries roiled by the pandemic: steel sheet is on allocation in the U.S., semiconductor shortages are hampering auto production, drops in South American mine output have sent copper inventories to their lowest level in 10 years.

These supply-side problems are highlighted most prominently in the IHS Markit Purchasing Manager Indexes (PMI) for backlogs and delivery times. December data showed delivery times rising alarmingly again after spiking in early 2020. This testifies to continuing problems in meeting orders. Rising backlogs are another manifestation of the same problem, the research indicates.

Together, backlogs and delivery times indicate how stretched—and even fragile—supply chains have become.

nfrastructure is the physical framework upon which the U.S. economy operates, and on which the country’s standard of living depends, according to a study released Feb. 1 by the American Society of Civil Engineers. ASCE is the organization that grades America’s infrastructure every four years. The 2017 grade was D+.

As a preview to its 2021 report card, ASCE issued an analysis, titled “The Failure to Act,” which compares current and projected needs for infrastructure investment against the current funding trends in surface transportation (highways, bridges, passenger rail, transit); water and wastewater; electricity; airports; and seaports and inland waterways.

The total documented cumulative investment gap between projected needs and likely investment in these critical major infrastructure systems will reach $2.6 trillion by 2029. If legislators fail to address the investment gap, the U.S. economy is likely to lose more than $10.3 trillion in GDP by 2039. These losses include export and import opportunities, widening the nation’s trade deficit. Job losses will mount annually: By 2039, the U.S. economy is predicted to support 3 million fewer jobs than under baseline conditions.

The Virtual Trade Show, Go to

any highly entrepreneurial industrial companies understand that large capital investments may be tough to take on, and hard to justify, during downturns—such as a global pandemic that tanks the economy, for example. That’s because the return on investment that executives bank on during the planning stages may take much longer to realize.

NSPS Metals, which opened its $18.6 million, 130,000-square-foot service center in Houston in September, announced the mega project in late 2018 and broke ground in March 2019.

With its partners, Nippon Steel Trading Americas Inc. and Pacesetter Steel, Kennesaw, Georgia, “we succeeded,” says NSPS Metals President and CEO Takenori Nakano.

Since September, he says, “we completed installation of the machines and started up the machines—one slitting line and two blanking lines.”

913/396-0697, fax: 913/345-1006

COPPER-BRASS.ORG

517/787-5500, 888/888-2576

fax: 517/787-6390

ALRO.COM

steel@alro.com

847/729-5744; fax: 847/729-5759

christymetals.com

SERVICES: Electroplating, hot-dip tinning, shearing/blanking, slitting, slitting traverse-wound coil, traverse coiling, tinning

847/729-9292; fax: 847/729-0340

CHRISIND.COM

201/438-4600, 800/526-6293

fax: 201/438-6003

juliusblum.com

he latest heir in a lineage of steelworkers is forging a future by relying on an experienced, dedicated team within and the true friendship of an equipment salesman without.

The late William “Bill” J. Thomas Jr. founded Colonial Metal Products, Hermitage, Pennsylvania, in 1990. His son, Will Thomas III, now runs the place, along with a sister company, Colonial Slitting Industries in Weirton, West Virginia, founded in April 2019. The company processes and distributes flat-rolled carbon and stainless steel and aluminum.

“My great-grandfather was at Sharon Steel; my grandfather and father were at Sharon Steel,” says Will Thomas of a steelworks in Farrell, Pennsylvania, that was established in 1887 and closed in 1992. “[Sharon Steel] wanted Dad to run a New York sales office. My dad was not interested, so he started a service center with a partner in the 1970s, sold it in 1987, and then started Colonial in 1990.”

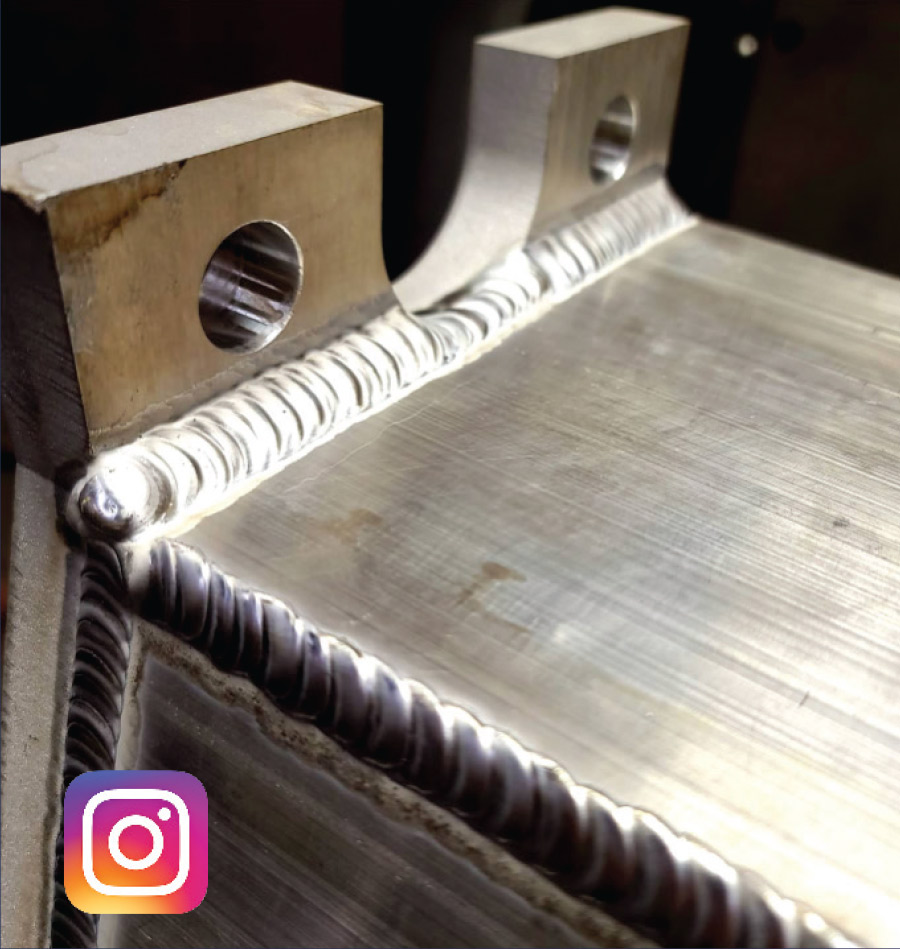

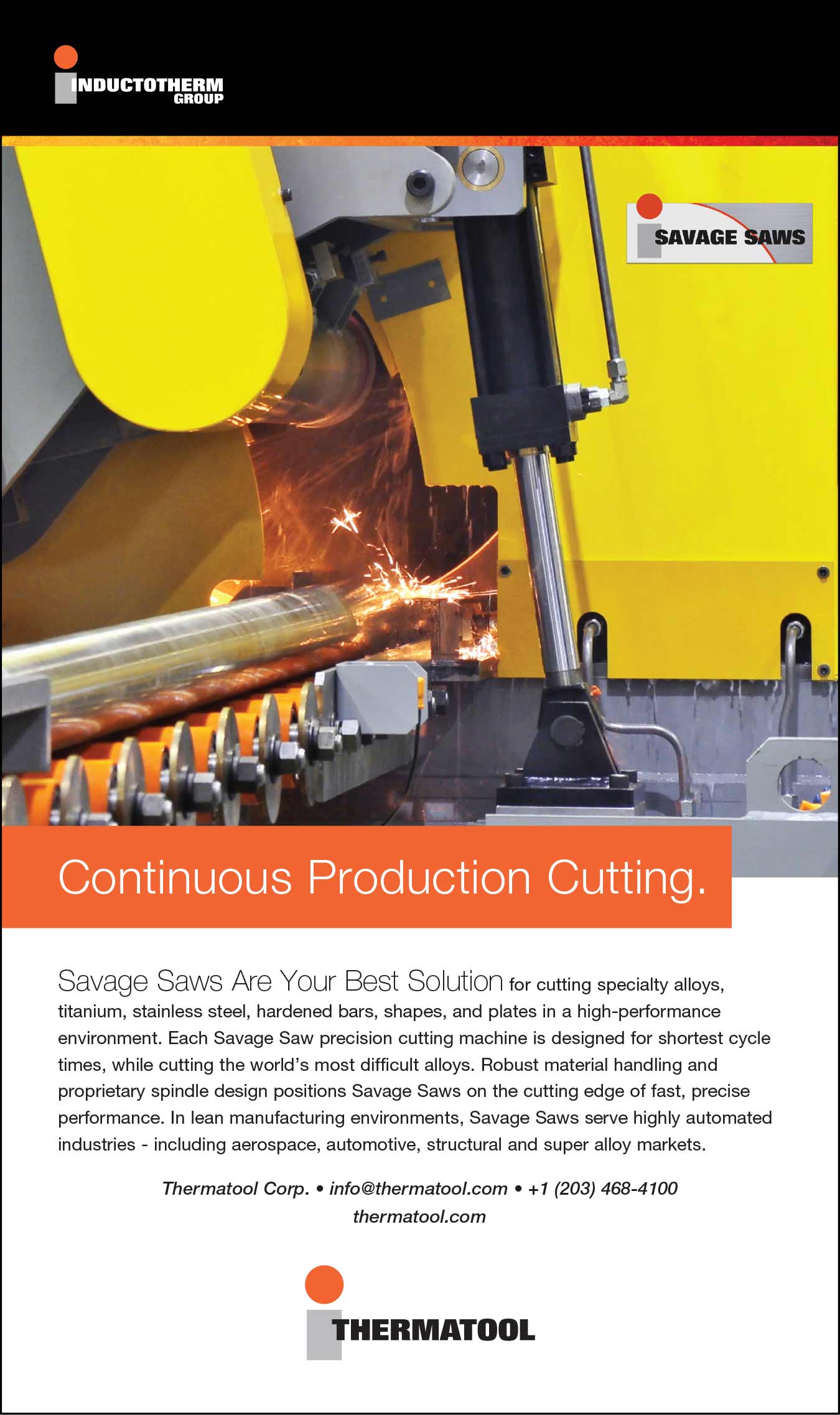

ervice centers and fabricators that are serious about getting the greatest-quality cuts and efficient output from their sawing operations can access a plethora of tactical resources from their vendors, including from the makers and distributors of saw blades.

Jay K. Gordon, North American product manager for sawing and hand tools at The L.S. Starrett Co., explains why everything from YouTube tutorials to tension setting will help sawing operators achieve their goals.

n 1920, Herbert B. Van Pelt and Donald C. Van Pelt, a father-son team, started the Service Steel Co., distributing steel tube, pipe and bar and serving the Detroit automotive industry exclusively. One hundred years later, Service Steel, now with corporate offices in Sterling Heights, Michigan, has a broad base of customers and five branches across the United States.

The branch in East Moline, Illinois, serves industrial customers, including a solid base of agricultural equipment manufacturers, spanning Illinois, Iowa, Missouri, Wisconsin, Minnesota, North and South Dakota, and Kansas.

“The majority of our work is supplying tube, along with some bar, channel and angle,” says Jeffery Smith, district manager. “Roughly 90 percent of the product that is sold has some process done to it before it is sent out.”

View Index

CASTLE

PALACE

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Valerie Treiber, National Sales Manager

203/894-5483

valerie@modernmetals.com

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) MARCH 2021, Vol. 77, No. 3 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.

Modern Metals® (ISSN 0026-8127, USPS 357-640) MARCH 2021, Vol. 77, No. 3 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.