Commodity markets are replete with examples of industries roiled by the pandemic: steel sheet is on allocation in the U.S., semiconductor shortages are hampering auto production, drops in South American mine output have sent copper inventories to their lowest level in 10 years.

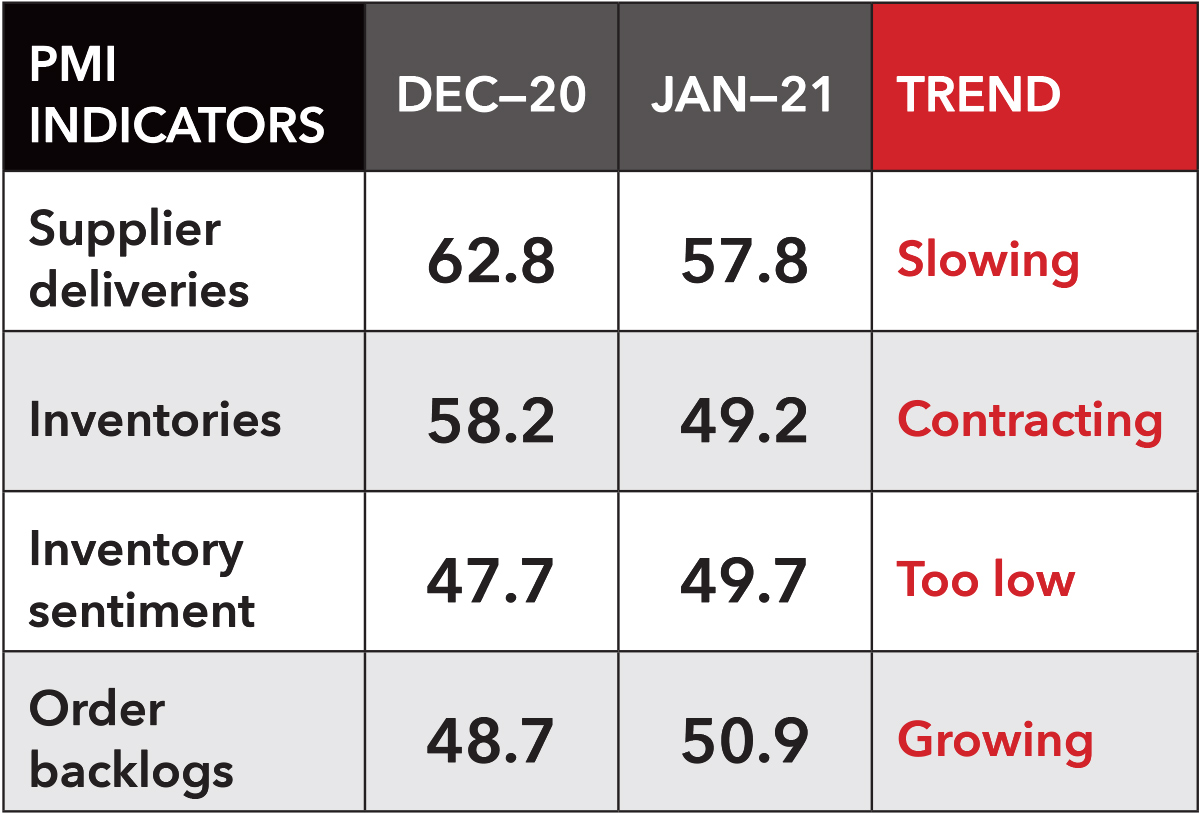

These supply-side problems are highlighted most prominently in the IHS Markit Purchasing Manager Indexes (PMI) for backlogs and delivery times. December data showed delivery times rising alarmingly again after spiking in early 2020. This testifies to continuing problems in meeting orders. Rising backlogs are another manifestation of the same problem, the research indicates.

Together, backlogs and delivery times indicate how stretched—and even fragile—supply chains have become.

Commodity price surges are largely absorbed in company profit margins but there are clear signs that building cost pressures are beginning to push downstream, with a burst of goods price inflation over the next six months now unavoidable.

The price increases have been stronger and lasted longer than was expected six months ago. “This upstream pressure in supply chains is now guaranteed to push into intermediate materials and even final goods prices in early 2021,” says John Mothersole, pricing and purchasing research director at IHS Markit.

In fact, there may even be modest corrections in commodity pricing by spring or summer. “Our Material Price Index, after increasing almost 50 percent between the July 2020 and March 2021, will then retreat by as much as 10 percent by year end,” he predicts.

The IHS Markit Materials Price Index (MPI) measures a weighted average of weekly spot prices for crude oil, chemicals, ferrous and nonferrous metals, paper pulp, lumber, rubber, fibers, tech components and ocean-going freight rates.

Nearly 40 percent of survey respondents forecast an improvement in economic activity in the next three months (up from 34 percent in December), while 54 percent forecast no change and only 7 percent predicted a decline in activity (compared with 17 percent in December).

Half of survey respondents forecast an increase in orders (compared to 41 percent in December), and only 9 percent believed orders would decline (down from 20 percent in December). Forty one percent of the group foresaw steady incoming order rates.

Despite the uptick in expectations, PMA President David Klotz says that great challenges remain, “including the current record-high prices for steel and supply chain problems that are causing low steel inventories as supply tightens.”

Average daily shipping levels improved in January among members, with only 12 percent experiencing a decrease (compared to 24 percent in December).