We’re relentlessly committed to passionate customer service, offering versatile operations and the industries’ most expansive national footprint.

Come ride the VORTEQ wave of momentum for your coil coating needs! Let’s get started at vorteqcoil.com

Features

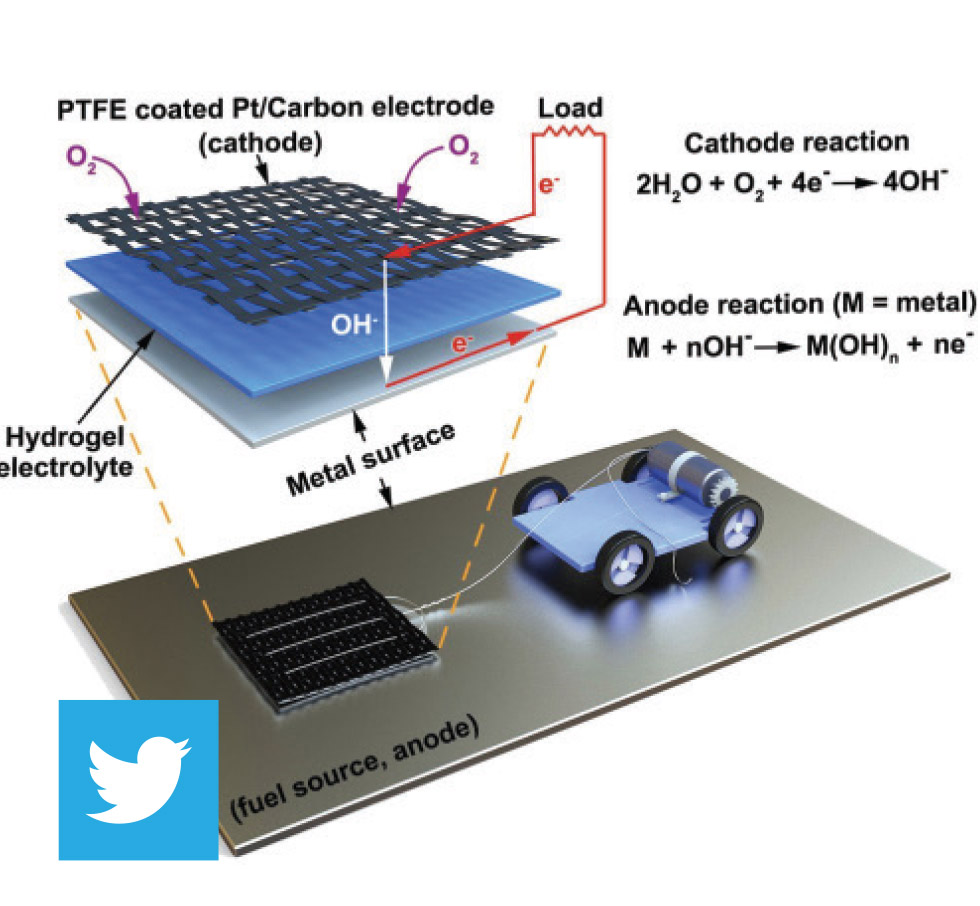

ow.ly/39yC30qy2yi

@nwtls

e will know soon enough how deep the recession of 2020 will plunge, but judging sheerly by jobless claims in the first few weeks of lockdown, it will be historic. There is a silver lining, and that is the sense of community—coming to the aid of our neighbors.

Steelmaker SSAB Americas has prioritized production of steel designated for use in local, state or federal-level COVID-19 disaster relief programs or projects. The company implemented a new order designation, Relief Effort Priority (REP), for customer orders of steel destined for disaster relief. REP-designated orders are inserted immediately into the production cycle with expedited finishing, shipping and logistics.

Ladd R. Hall will retire June 20 from his role as executive vice president at Nucor Corp., Charlotte, North Carolina, having served 39 years with the steelmaker. Hall joined the inside sales team at Nucor Steel-Utah in 1981 and held numerous sales and management roles before becoming EVP in 2007. Allen C. Behr will take over as executive vice president in May. Behr joined Nucor Building Systems-Indiana in 1996 as design engineer. After numerous promotions around the country, Behr has served as general manager of Nucor Steel-Texas since 2017.

Coil processing equipment builder Delta Steel Technologies, Irving, Texas, has hired two new regional sales managers. Luke Brunsmann will handle the Upper Midwest territory, while Braxton Buckley will oversee the Southeast territory.

Krissy von Philp was hired as vice president at Specialty Strip & Oscillating Inc., Masury, Ohio, overseeing internal operations. Von Philp was previously chief operating officer at KDA Inc., a freight shipping brokerage firm.

Eriez, Erie, Pennsylvania, appointed Lukas Guenthardt as president and CEO, succeeding Timothy Shuttleworth, who has retired after serving in that role since 2004. Guenthardt joined the Eriez board of directors in 2011 and was named executive vice president of global strategy and development in 2014.

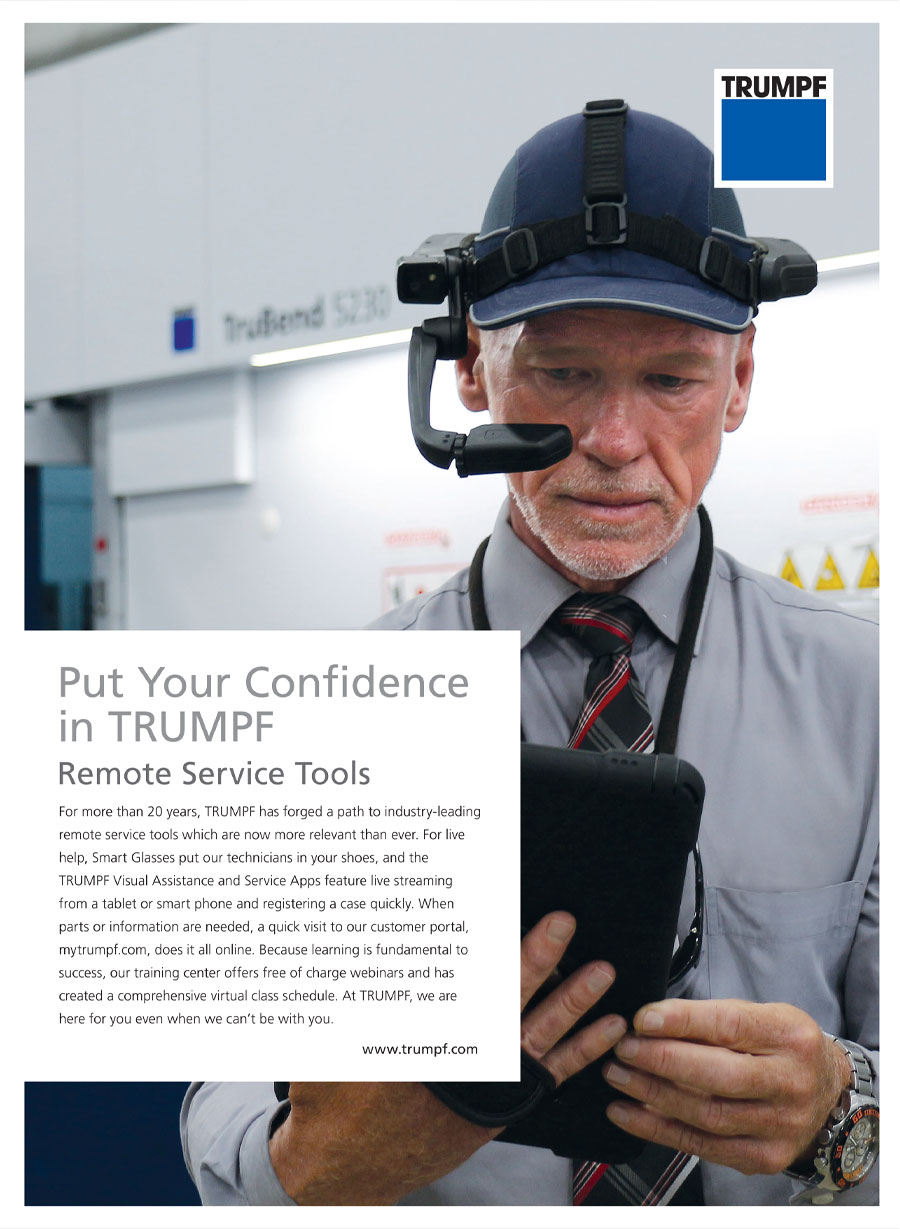

Salay Quaranta has been named 2-D TruLaser product manager for Trumpf Inc., Farmington, Connecticut. She provide technical expertise to customers, and oversees the in-house sales engineer and applications teams.

Emuge Corp., West Boylston, Massachusetts, 800/323-3013, emuge.com.

so many other industries don’t have as much room to grow and be successful.

so many other industries don’t have as much room to grow and be successful.

inning is not a sometime thing; it’s an all-time thing. You don’t win once in a while, you don’t do things right once in a while, you do them right all the time. Winning is habit,” said Vince Lombardi, Super Bowl winning coach of the Green Bay Packers.

inning is not a sometime thing; it’s an all-time thing. You don’t win once in a while, you don’t do things right once in a while, you do them right all the time. Winning is habit,” said Vince Lombardi, Super Bowl winning coach of the Green Bay Packers. so many other industries don’t have as much room to grow and be successful.

so many other industries don’t have as much room to grow and be successful.

inning is not a sometime thing; it’s an all-time thing. You don’t win once in a while, you don’t do things right once in a while, you do them right all the time. Winning is habit,” said Vince Lombardi, Super Bowl winning coach of the Green Bay Packers.

inning is not a sometime thing; it’s an all-time thing. You don’t win once in a while, you don’t do things right once in a while, you do them right all the time. Winning is habit,” said Vince Lombardi, Super Bowl winning coach of the Green Bay Packers.

LIGHT

new laser cutting machine is a huge investment. When making the leap, it’s easy to be attracted to the highest wattage laser, thinking its cutting capabilities assuredly increase productivity and reduce operating costs. But when laser-cut parts are piling up because the bending or welding department isn’t set up to match cutting volume, how efficiently is that faster-cutting laser fitting into the overall process?

Dustin Diehl, laser division product manager at Amada America Inc., says that it’s human nature to want the most powerful machine—the bigger-is-better mindset. But, “the whole picture is the overall investment. Can you get by with less wattage? There is a lot more to your actual cost per part.”

“First, evaluate what your goals are,” adds Jason Hillenbrand, Amada’s general manager for blanking and automation. “Often, customers think they want the most power, but it’s really about throughput—how many parts you can get through the entire process within a given period of time.”

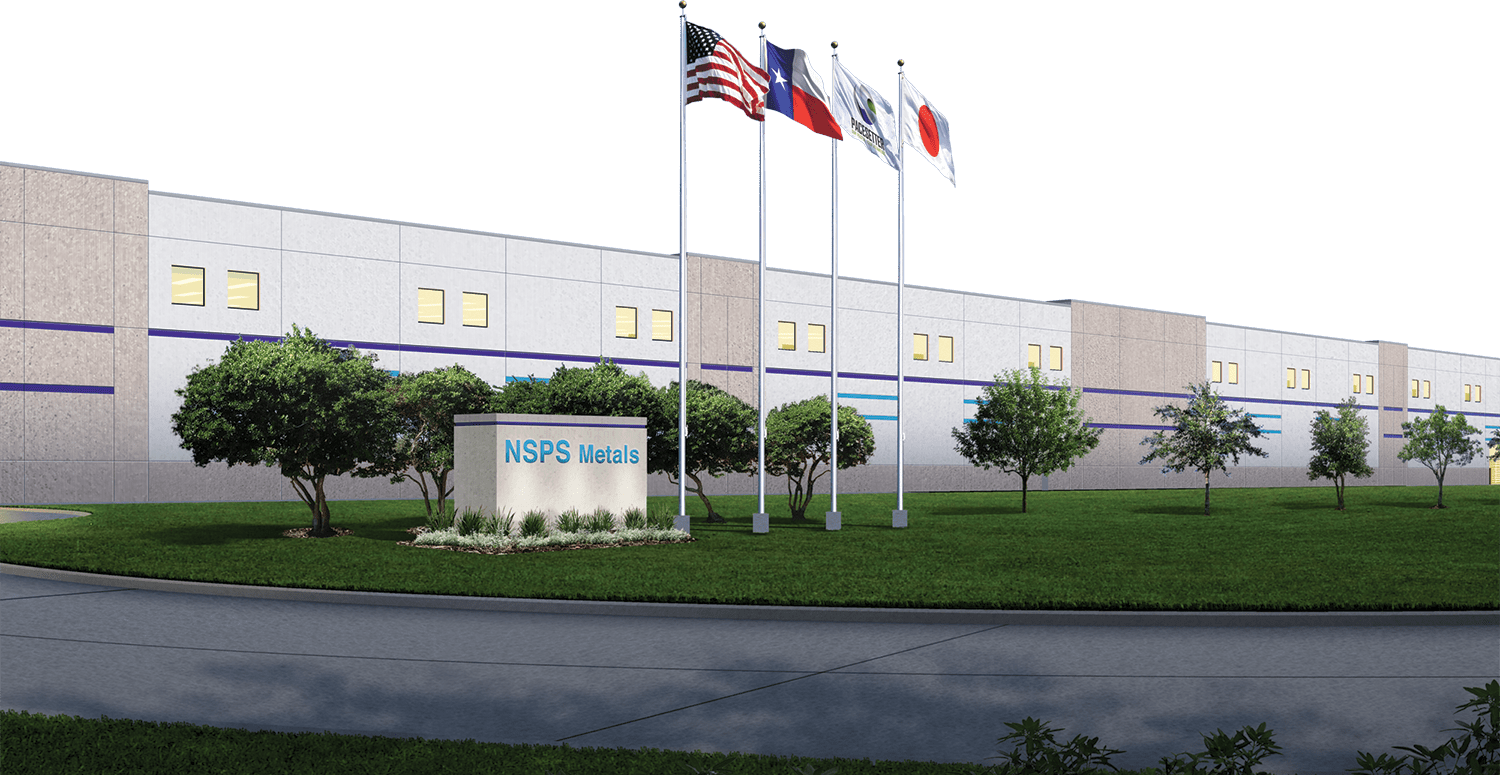

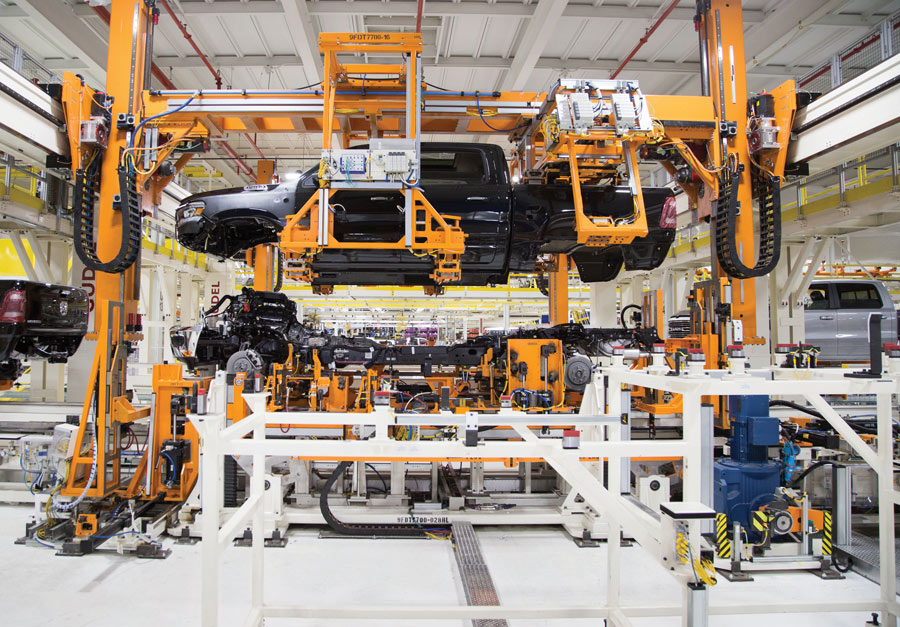

he impact of COVID-19 on industrial activity “has been immense,” Paul Williams, head of aluminum at CRU Analysis said in a March 27 report. And that could not be more true than within the automotive supply chain, which wraps around the world and includes metals production, stocking and distribution, forming, and stamping.

Because the pandemic was still escalating as of that date, CRU forecast a global economic recession in 2020. “Uncertainty about the end game has fueled financial market volatility and prompted unprecedented government support,” Williams writes.

“Aluminum demand has collapsed across many markets and countries. For example, the automotive industry is a sector that will see a severe contraction in 2020 output that will significantly impact aluminum demand.”

In Europe, many assembly operations are idled, and production is expected to fall by around 15 percent in 2020, although any such projection “has a high degree of uncertainty given the current crisis.” CRU expects North American vehicle output to drop 10 percent. Aluminum producers announced curtailments downstream in response to the weakening demand.

he operating rig count in the United States and Canada, as of April 9, was 637 units, down 41.5 percent from that of April 12, 2019. Publicly traded energy majors and their suppliers were pulling their previously issued first-quarter financial guidance during the second week of April.

West Texas Intermediate crude oil futures rose during that same week, compared to a week earlier, then plunged into negative territory. Boom and bust cycles in the oil patch are nothing new. Steel suppliers can recall the 1973 oil embargo, growth in the 1980s followed by a recession, a boom in the ’90s followed by the tragedy of 9/11, the growth of fracking and horizontal drilling opening up American reserves, then the Great Recession. Now there is a price war between OPEC and Russia.

Such cycles are not for the faint of heart, but the smart money traditionally invests even during periods of falling demand. Many hope that the current downturn in economic activity as a result of the global pandemic will be short lived and V-shaped.

ver the past 50 years, the U.S. industrial sector has seen a lot of heartache, with permanent factory closures and layoffs and machinery moved offshore or just scrapped. It’s heartwarming when you find a manufacturer that was most certainly bound for the dustbin of history but clawed its way back to relevance.

Skana Aluminum Co., an aluminum mill on the western shore of Lake Michigan, began life as the Aluminum Goods Manufacturing Co., which established the Mirro cookware product line in 1917. It was sold in 1983 to Newell/Rubbermaid and was shuttered in 2000.

When in 2009, the rolling mill assets became available, Thomas Testwuide Sr. and four friends came to Manitowoc, Wisconsin, to see what could be done to purchase, revitalize and operate the mill. The doors reopened in April 2010, and by early July, Skana Aluminum cast its first aluminum slab. Two years later, Skana acquired the assets of Scott Aluminum in Clarksburg, West Virginia, which included a cold mill and slitting capacity. Today, Skana Aluminum employs approximately 225 people across its two plants.

partingshot

partingshot

Advertiser Index

View Index

123 W. Madison St., Suite 950, Chicago, IL 60602

312/654-2300, Fax: 312/654-2323

www.modernmetals.com

312/654-2309, Fax: 312/654-2323

mdalexander@modernmetals.com

Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Montana, New Mexico, North Dakota, Wyoming

Jim D’Alexander, Vice President

770/862-0815, Fax: 312/654-2323

jdalexander@modernmetals.com

Alabama, Colorado, Florida, Georgia, Louisiana, Minnesota, Mississippi, W. New York, North Carolina, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas

Bill D’Alexander, Principal/Sales Manager

203/438-4174, Fax: 203/438-4948

bdalexander@modernmetals.com

Connecticut, Delaware, Kentucky, Maine, Maryland, Massachusetts, Missouri, Nevada, New Hampshire, New Jersey, E. New York, Ohio, Oregon, Rhode Island, Utah, Vermont, Virginia, Washington, West Virginia; International

Bob D’Alexander, Principal/Sales Manager

616/916-4348, Fax: 616/942-0798

rdalexander@modernmetals.com

Illinois, Indiana, Iowa, Kansas, Michigan, Nebraska, Wisconsin

Traci Fonville, Classifieds, Logos and Reprints

312/654-2325, Fax: 312/654-2323

tfon@modernmetals.com

Modern Metals® (ISSN 0026-8127, USPS 357-640) May 2020, Vol. 76, No. 5 is a registered trademark of Trend Publishing Inc. Modern Metals® is published 11 times a year by Trend Publishing Inc., with its publishing office located at 123 W. Madison St., Suite 950, Chicago, Illinois 60602, 312/654-2300; fax 312/654-2323. Michael J. D’Alexander, President, Trend Publishing Inc. Copyright 2020 by Trend Publishing Inc. All rights reserved under the United States, International, and Pan-American Copyright Conventions. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means—mechanical, photocopying, electronic recording or otherwise—without the prior written permission of Trend Publishing Inc. This publication is sent free of charge to qualified subscribers. Single copies $14. Paid subscriptions in the U.S. $125/year. Canada, $145/year. Foreign subscriptions, $180/year surface mail and $260/year air mail. If interested in a free subscription go to www.modernmetals.com to see if you qualify. Periodicals postage paid at Chicago and additional mailing offices. POSTMASTER: Send address changes to Modern Metals® c/o Creative Data Services, Inc., 440 Quadrangle Drive Suite E, Bolingbrook, IL 60440. Printed in the USA.