hile long-term, trusting relationships will always be crucial to buyers and sellers, there are often some missed opportunities to know all you can about the data-filled world that surrounds each transaction. Two men—one with a decade of experience in the service center business, the other who started up technology companies on both coasts—have formed Felux Co.

Felux is a B2B marketplace and supply chain platform for the metals industry that is helping companies digitize their organizations and give their customers a digital way to buy and sell steel.

Dallas Hogensen, co-founder and CEO, says that Felux helps suppliers to “list all their inventory digitally and access thousands of buyers on our platform. We help steel leaders to transact with thousands of buyers and sellers, negotiate in real time, obtain financing, conduct data analysis and secure freight, which is tracked seamlessly to your back door. All in one place. It’s a consumer-like purchasing experience, much like Amazon.”

Hogensen spent the past 10 years building technology companies in New York and San Francisco. After he sold his previous company, he became passionate about the possibilities technology could bring to the steel supply chain. “I have family who have been in the steel industry for over 30 years. Here was a clear opportunity to bring world-class procurement software and provide digital distribution services to an industry that could help broaden their customer base and manage their relationships.”

Hogensen was connected to Chris Day, co-founder and COO, through an executive recruiter. Day joined Felux in 2019.

[at] one location, match your needs with available inventory and gain insights into your buying patterns.

[at] one location, match your needs with available inventory and gain insights into your buying patterns.

Day was the leader of analytics and innovation for Majestic Steel, where he helped build out the company’s digital platform. “There is a great opportunity to build that for the whole industry,” he says. Teaming up with Hogensen, Felux rolled out a prototype product.

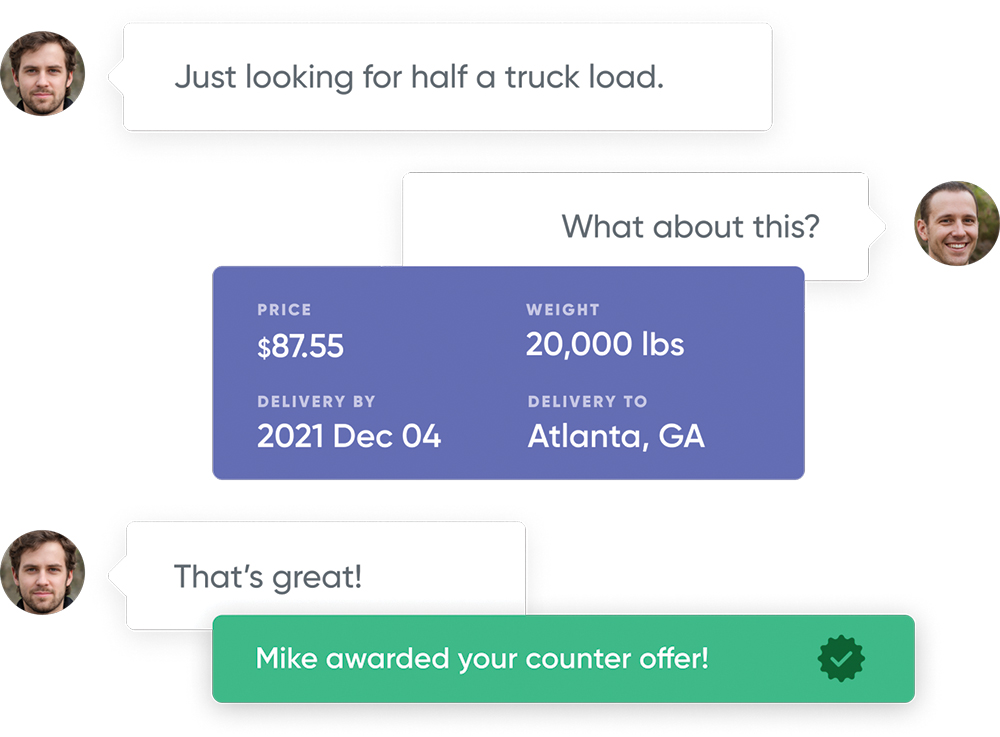

A user of the platform can “have a digital experience with old or new customers. You can purchase or sell a coil, instantly obtain credit approval and track the material digitally. You’re no longer saying, ‘the coil is in the Chicago area’” because the available information is much more precise, Day says.

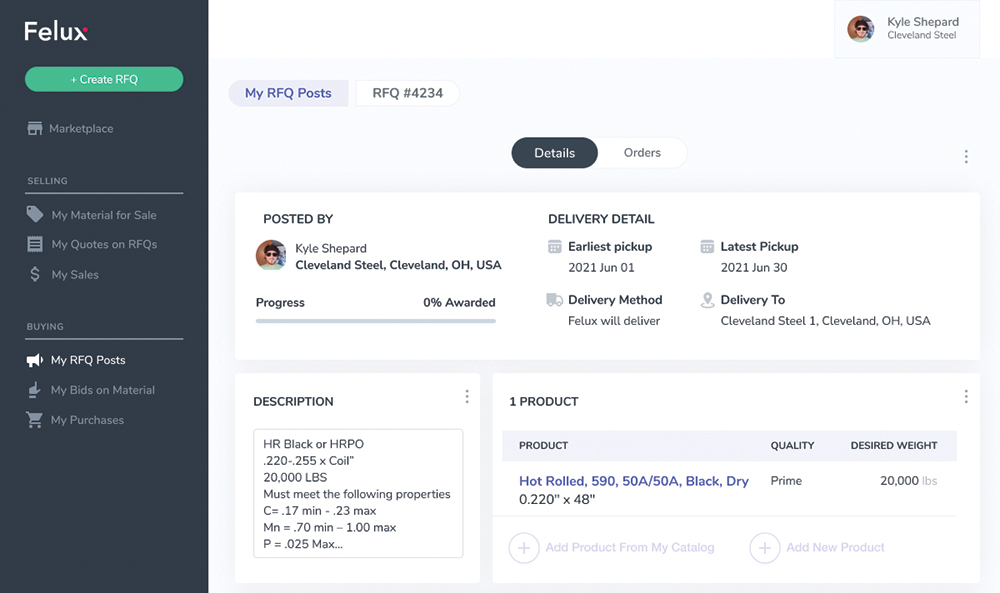

Using Felux, Hogensen adds, “you can come to one location and match your needs with available inventory and gain insights into your buying patterns.”

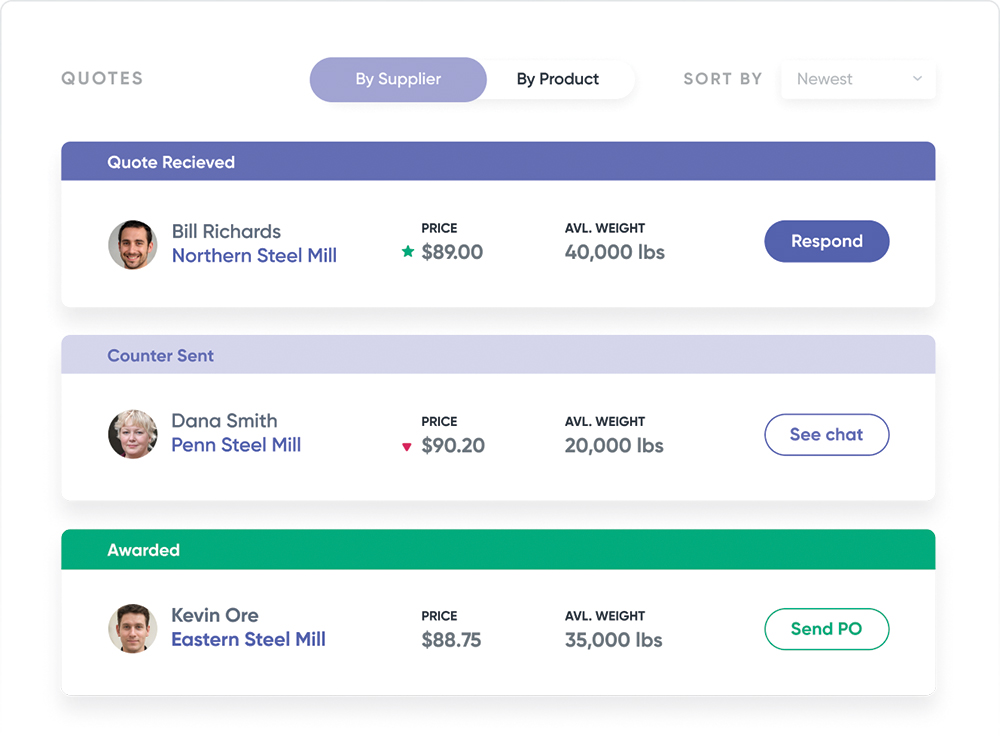

A service center that both buys and sells material can list prime or excess stock for sale and invite existing buyers to make offers through the platform and then aggregate that information, says Day. That is far more useful for devising sales strategies than emailing a spreadsheet or a PDF and waiting for individual responses.

“If a service center is in the spot market, it can search available inventory or put out an RFQ to the marketplace. The search engine is very easy, almost just like Google,” says Day. “We have probably the largest set of product inventory data, and you can search with a few letters. Seeking a certain grade of aluminum? You can find it. Or, you can type in a location or a buyer’s name.”

Today, says Hogensen, “we have thousands of products listed on the marketplace and are slowly introducing the tools for your entire organization, from sales, management, logistics and accounting, to manage and communicate in one location on every sale that happens between your customers.”

The platform has already attracted buyers and sellers that operate 1,400 locations and has processed over $500 million in transactions. “Right now, all transactions are free, but there is a small subscription fee for suppliers,” he says. Felux does charge for its logistics and financial services.

“Because we can gather information so quickly, we can perform credit checks in seconds rather than days,” Hogensen says. As a subscriber, “you’re introduced to new buyers all the time, so we have to know the creditworthiness and the history of the buyers’ businesses. We don’t hide the supplier and buyer information,” which is where the transparency comes in. “And by offering that visibility, we can help people establish new relationships and complement their existing relationships through a new digital channel.”

How to stand out

Participants want to know how to stand out from their competition. Felux shows them how “they can drive digital channels, get more visibility into their business and not remain stuck with outdated ERP systems.”

People are looking at tools to provide a better customer experience and better channels for growth, he continues. “We talk about making steel sexy. Our customers are beginning to have fun and our technology can be impactful to their businesses.”

Day says that Felux works with a network of underwriters that provide quick payments. If a seller wants payment within 24 to 48 hours and normally collects from the buyer, “they can instead receive payment from us, and we collect from the buyer.”

Some suppliers have teams in place that are used to establishing credit, but there may be cash flow considerations, where they want a quick payment and don’t want to wait through standard payment terms, he explains. “We started rolling out this solution in 2021. We also started exploring extended-term solutions for buyers.”

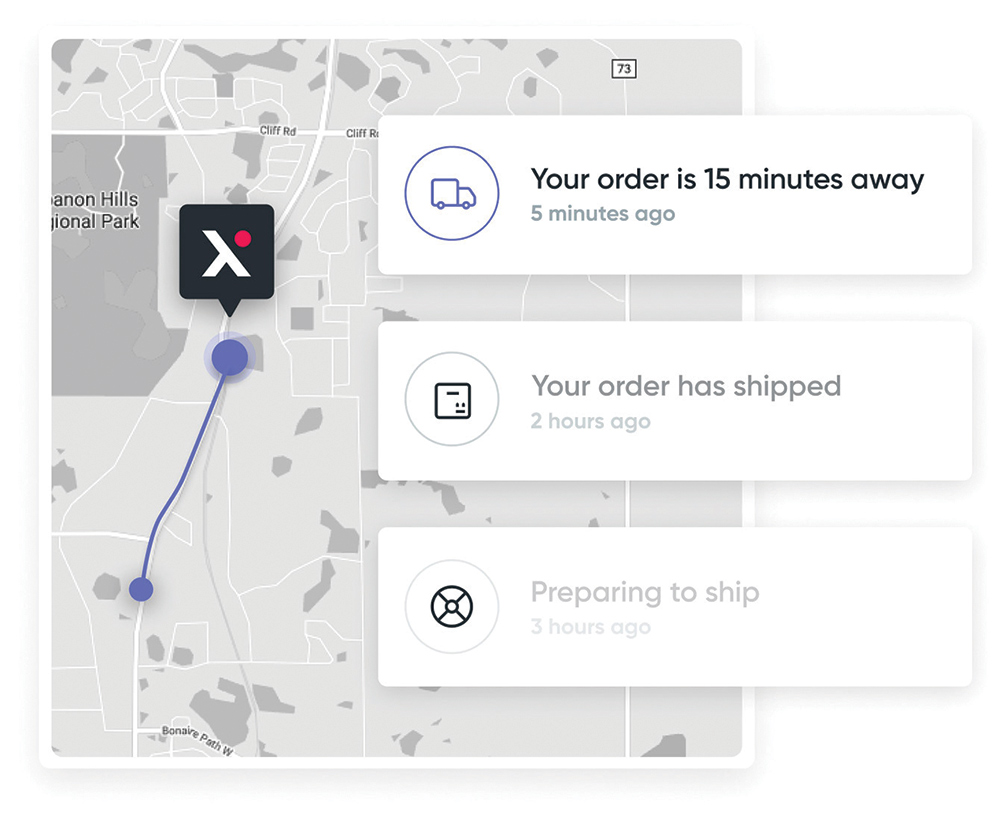

On the logistics front, Felux has “been able to build out a network, supplying capacity for flatbed trucking, compete with aggressive rates and real-time tracking of the truck. It’s nice to get real-time pricing, an instant delivery quote, secure a truck and have your load delivered,” says Day. “The supplier doesn’t worry about coordinating the delivery and the buyer can plan better because of that transparency.”

In an effort to provide the greatest granular detail, Felux is working to “map out every loading dock, what equipment they have and who they’re working with, and make all that information digital,” Hogensen says. “This is the first time this is happening in the steel industry. We are excited to pioneer this set of tools.”

Felux’s co-founders have a clear vision about becoming sustainable end to end, Day says. That means understanding origination and destination and providing tools to help members run their business more effectively and to “build on relationships and find the right partner for the right material at the right time.”

Day says he’s seen “a massive shift in interest, and the timing could not be better for sales leaders to expand their relationships in an economy that is restricting travel and discouraging traditional face-to face sales calls. There is also a need to collect and analyze data and have the tools to do that in a meaningful way.”

The platform might also make a difference in light of the difficulty of finding new talent. “The expectations among young people are much greater to use digital tools, not old technology,” Day says. “We have to provide those tools.”