Shoots

here seem to be but three ways for a nation to acquire wealth. The first is by war, as the Romans did, in plundering their conquered neighbors. This is robbery. The second by commerce, which is generally cheating. The third by agriculture, the only honest way, wherein man receives a real increase of the seed thrown into the ground, in a kind of continual miracle.”

Farmer sentiment improved slightly in May after falling sharply in both March and April. The Purdue University-CME Group Ag Economy Barometer reading in May was 103, up 7 points from April’s 96. The barometer’s small improvement left the gauge of farmer sentiment nearly 40 percent below its February peak of 168. The barometer is based on a monthly survey of 400 U.S. agricultural producers.

Improved sentiment regarding current conditions means farmers are more inclined, month over month, to think now is a good time to make large investments in their farming operations. The Farm Capital Investment Index rose to a reading of 50 in May compared to 38 in April. However, that leaves the May index 30 percent below its February reading of 72, indicating farmers are still much more reluctant to make new investments in things like farm machinery and buildings than they were prior to the onset of COVID-19.

farmers are taking a wait-and-see approach on any anticipation of an uptick in exports.

farmers are taking a wait-and-see approach on any anticipation of an uptick in exports.

Photo: USDA

Agco’s North America facilities have remained open throughout the crisis, with some plants on reduced hours due to workforce constraints, COO Eric Hansotia told shareholders.

“Our visibility into future disruptions in our supply chain or future COVID-19 related impacts to our workforce is limited and may cause us to close plants again,” Hansotia warned. Agco’s order book at the end of April continued to exhibit a healthy backlog.

ouR visibility into future disruptions in our supply chain is limited.

ouR visibility into future disruptions in our supply chain is limited.

Demand has not wavered for food, he says. However, “we have various bottlenecks all over the world. The whole thing is logistics and how to bring the food to the people who need it, and therefore, manual production varies a little bit and prices vary. In the long run, I’m a little optimistic that [commodity] prices will stabilize.”

“We forecast we will recover any delayed shipments throughout the balance of the year,” Reed says. “For our large [farm equipment] business, the remainder of our 2020 production schedule is largely backed by customer orders through either our early order programs or rolling order books,” Reed told shareholders during a May 22 earnings call. “Order programs for combines and crop cares are completed, while large-tractor order books extend into the fourth quarter, roughly 90 percent full.”

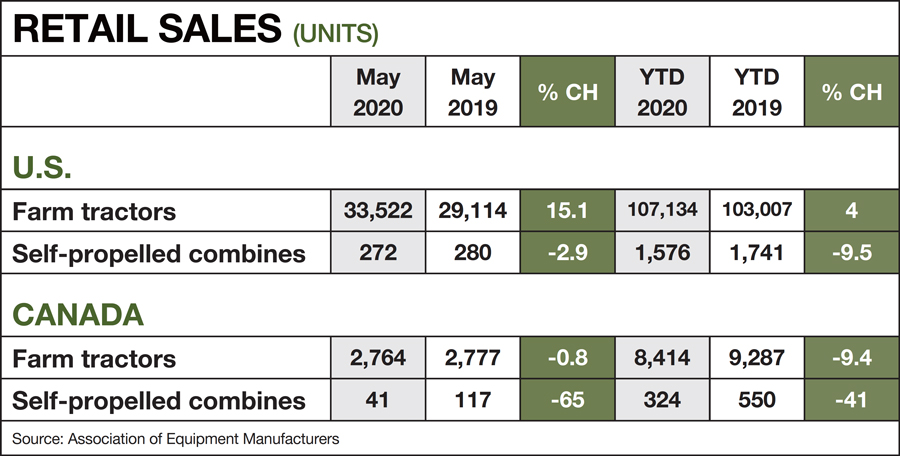

Deere forecast that industrywide sales of farm and turf equipment in the U.S. and Canada this year will fall 20 percent from 2019.

Looking further into the future, Reed says, “demand has yet to be determined going into 2021, because there are a lot of interruptions.” However, government insurance programs have given customers “a level of certainty as to where their incomes will be. As we look to 2021, we’ll look to the general economy and how trade continues.”

At CNH Industrial N.V., North American tractor and combine demand fell 9 percent and 22 percent, respectively, during the first quarter, compared with a year earlier. Suzanne Heywood, chair and acting CEO, told shareholders during a May 6 earnings call that second-quarter farm equipment sales are expected to fall by as much as 20 percent but “we expect the ag industry to begin to recover” during the second half of the year.

In bringing production back online, she says, “We deliberately prioritized agriculture and powertrain manufacturing as they both serve essential industries in which the market demand for our products is greatest.”

“We have a fleet [in service] as old as it’s been in probably a decade or a decade and a half,” Deere’s chairman and CEO, John May, says. This leads to customers considering how the technology available today gives customers an opportunity to lower their cost structure.

“In an environment where overall demand is the question, the thing that customers can do is invest to make sure they have the lowest cost of production of anyone in the market,” he says. “So, we see technology being driven across those acres. If you look at total acres planted, we’ll continue to grow [digital] technologies. We have the ability to change the cost structure on each acre.

“And if you take an aging fleet and you can change the cost structure,” May says, “you have the ability to generate [new] sales.”