specialist in software for the metals service center industry has been acquired by a private equity firm and, as a result, is flush with the capital needed to scale up its expertise and its core products.

Founded in 1983, Enmark Systems Inc. agreed to be acquired in 2021 by Accel-KKR, a private equity firm holding $10 billion in assets.

Grant Stanis, a product of one the Big Four accounting/consulting firms, was appointed CEO. “I was brought in as part of the acquisition,” he says. Stanis is working with Enmark’s owner Michael Rybicki, who “realized how great the market was and wanted to invest further in the software.

Lots of companies were interested in Enmark,” he notes. Menlo Park, California-based Accel-KKR, he says, is “a unique investor with Silicon Valley chops” that fielded questions from Enmark about how it can provide greater value and improved technologies. “I worked with a lot of private equity firms; this one is not just about driving profit at all costs,” says Stanis, who has experience consulting in the manufacturing and distribution sectors.

we want to provide customers with more than software. we want to be thought leaders.

we want to provide customers with more than software. we want to be thought leaders.

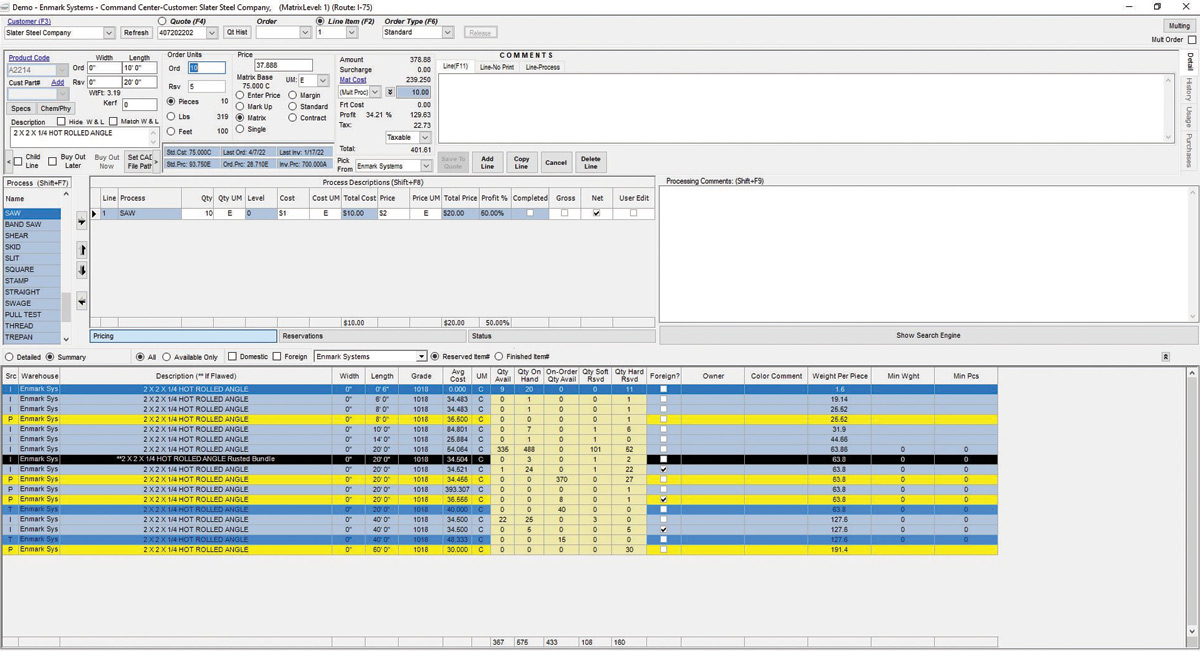

Enmark is consulting with customers and other industry voices to find other opportunities, such as enabling safety reporting through existing ERP software. “We want to bring all these ideas together to become the platform to achieve” what clients want most.

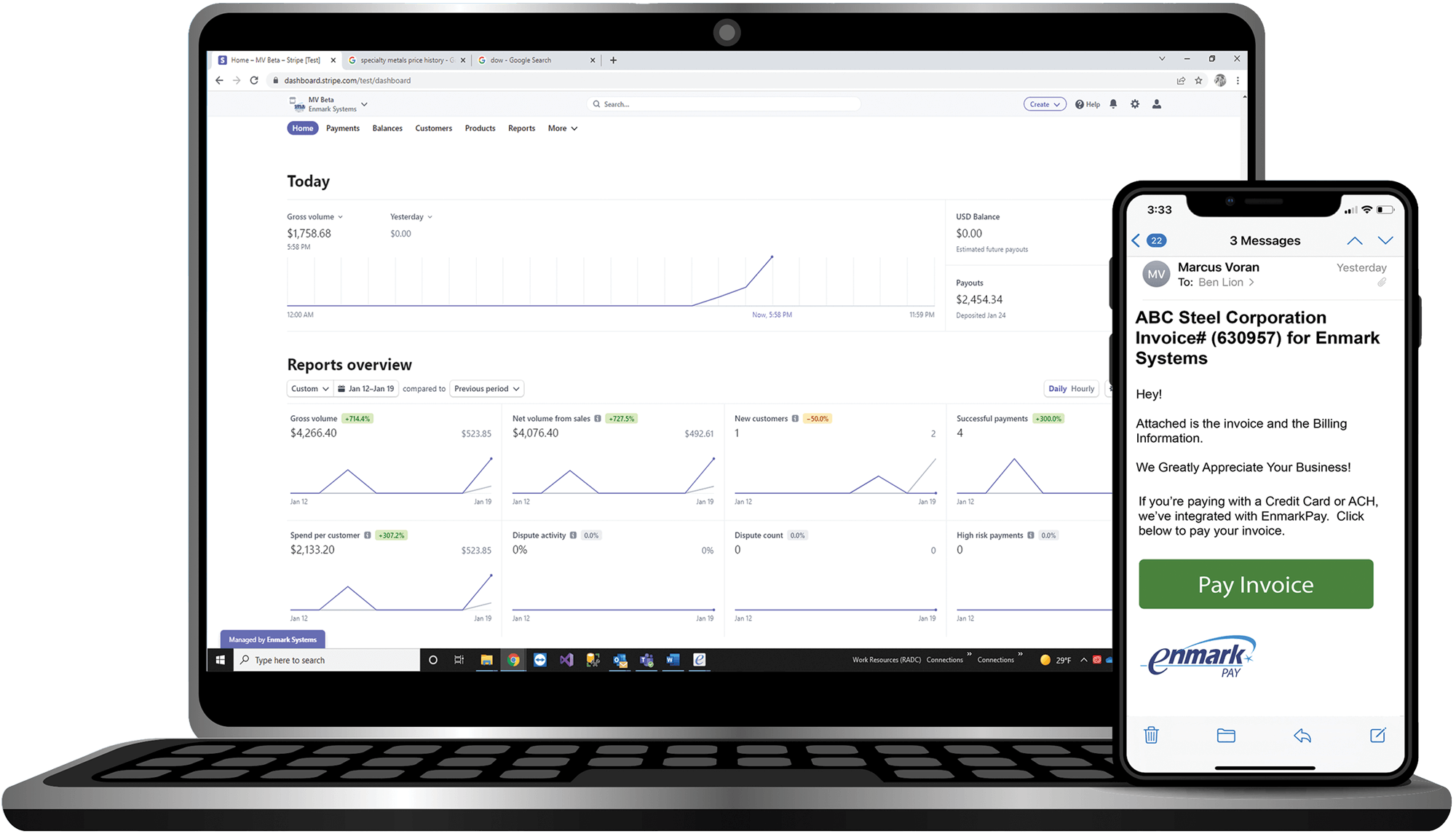

customers can receive an invoice electronically, click a link and pay immediately.

customers can receive an invoice electronically, click a link and pay immediately.

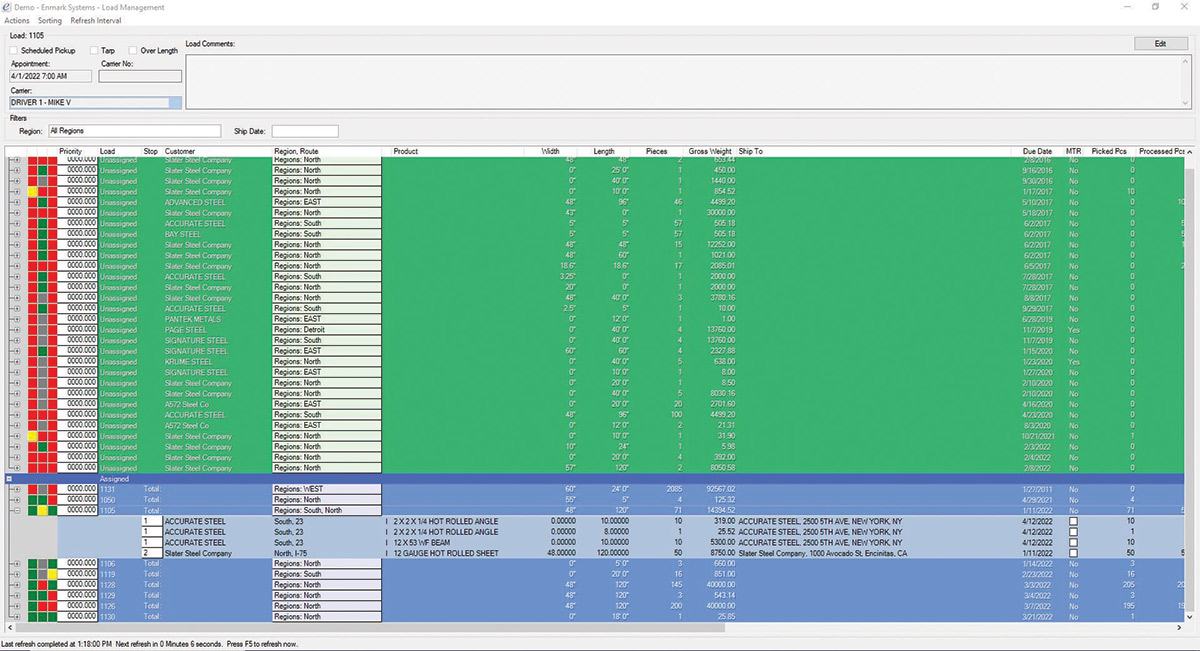

“It’s a modern digital perspective—connect everywhere. With the investment, we want to modernize the software so it is mobile everywhere,” he says. “You can know where your trucks are at all times, when your deliveries are made, when the invoices are sent out. Why wait until your truck returns to your loading dock” before sending that invoice? The connection is inside the warehouse, office and loading dock, “but also to wherever you are.” Employees are looking at daily shipments, looking up customer credit reports.

“We have something called Enmark Pay. Collecting from customers is important,” says Stanis. The pace of the U.S. Postal Service is very slow in a world where payments can be made instantly. Now, “customers can pay electronically. They can receive an invoice electronically and they can click a link and pay immediately. You pay the service center the same day. That’s the type of modernization we want to offer.”

With the private equity resources being brought to bear, “We are excited. It’s a fantastic market in a very American industry with a great set of customers,” Stanis says.