Dark

ecent strong demand has combined with sharply falling inventories, which will add to [economic] growth as companies replenish inventories during the second half of the year,” says Joel Prakken, chief U.S. economist with consultancy IHS Markit. In addition, “the relaxation of state [COVID-19] containment measures has accelerated as the vaccinated share of the population continues to rise.”

IHS Markit raised its forecasts of U.S. GDP growth for this year and next: from 6.7 percent to 7.4 percent for 2021 and from 4.7 percent to 4.8 percent for 2022.

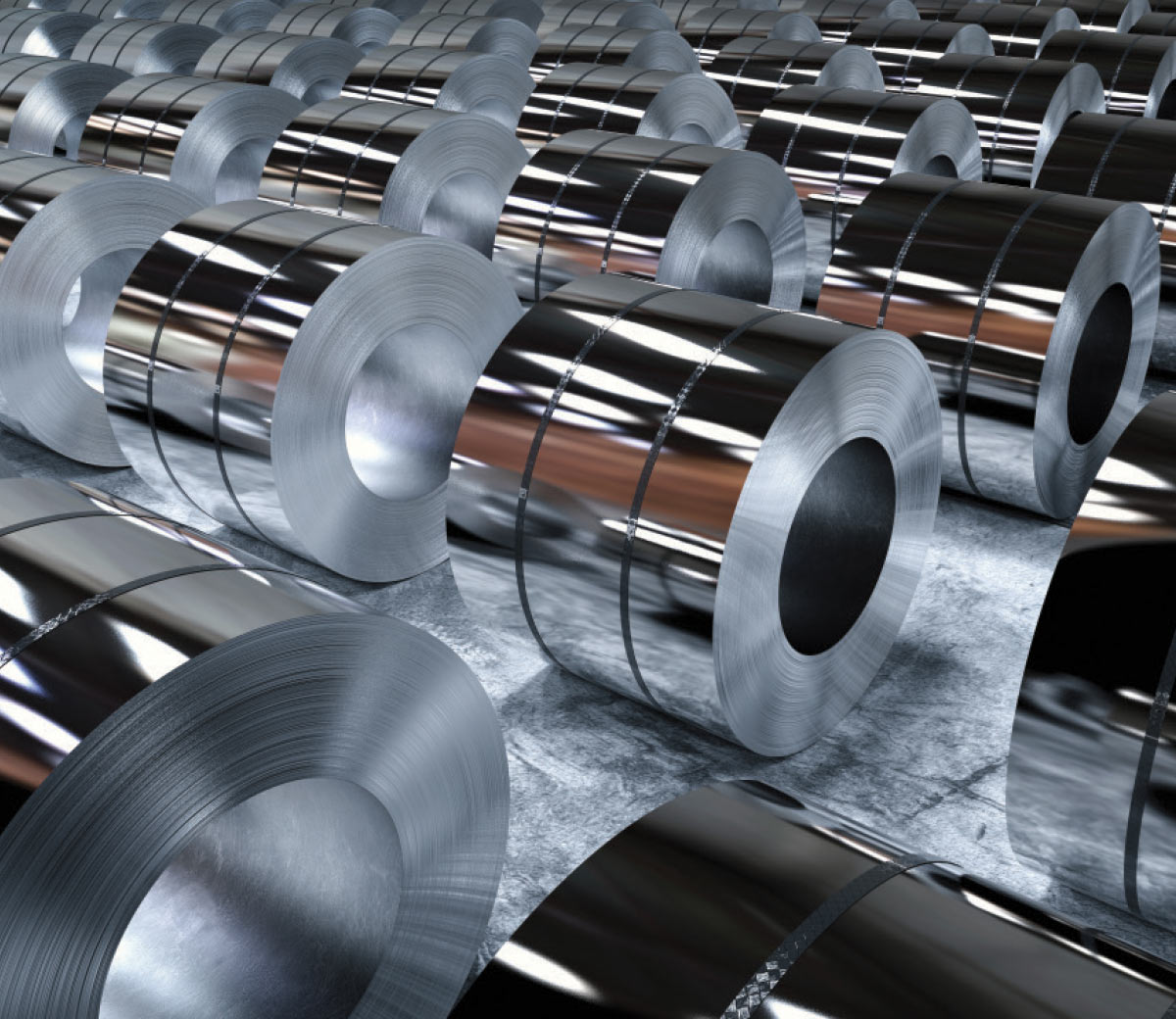

In its short-range outlook, the World Steel Association predicts steel demand will grow by 5.8 percent in 2021 to reach 1.874 billion metric tons, and that demand will climb another 2.7 percent next year.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

flat-roll prices have been supported at historically high levels; customers are placing orders for immediate requirements.

Dark

Dark

ecent strong demand has combined with sharply falling inventories, which will add to [economic] growth as companies replenish inventories during the second half of the year,” says Joel Prakken, chief U.S. economist with consultancy IHS Markit. In addition, “the relaxation of state [COVID-19] containment measures has accelerated as the vaccinated share of the population continues to rise.”

IHS Markit raised its forecasts of U.S. GDP growth for this year and next: from 6.7 percent to 7.4 percent for 2021 and from 4.7 percent to 4.8 percent for 2022.

In its short-range outlook, the World Steel Association predicts steel demand will grow by 5.8 percent in 2021 to reach 1.874 billion metric tons, and that demand will climb another 2.7 percent next year.

Steelmakers with major operations in the Americas are bullish on the second half of 2021 as mill order books are full, order backlogs rise, and spot and contract price increases are accepted by customers desperate for metal.

SDI’s downstream fabrication business saw a 50 percent increase in order backlogs, compared with a previous peak, and the division is training new hires in order to boost its annual output by as much as 30 percent by late summer.

SDI’s raw steel production rate reached 93 percent during the first quarter.

“Demand is strong [for] both flat and long products,” says Millett. “When coupled with historically low customer inventory levels across the supply chain, flat-roll steel prices have been supported at historically high levels and customers are placing orders for immediate demand requirements.”

The demand from automotive remains high while finished vehicle inventory remains low.

Housing construction has also been strong, producing high demand for HVAC and appliance products. “The growing online retail shift is supporting demand strength throughout the supply chain,” including impacts for truck trailer and material handling equipment builders, he says.

SDI finds solar energy to be a growing market, alongside improved oil and gas activity.

“Right now, American consumers are consuming, and they are consuming a lot,” says Cleveland-Cliffs Inc. CEO Lourenco Goncalves. “Stimulus money provided to the majority of the population is being redirected right back into the economy, and that’s great for flat-rolled steel producers.

“This money is being spent on consumer goods like HVAC and appliance and cars,” he continues, predicting the trend will hold and that the experts who predicted “the demise of the domestic steel industry will have been proved completely wrong.”

Christie Breves, U.S. Steel’s senior vice president and CFO, says flat-rolled selling prices rose by over 20 percent since the fourth quarter. “Higher market prices will continue to flow through our selling contracts and are expected to increase average selling prices further in the second quarter,” she predicts.

The company’s Tubular business is benefiting from higher rig counts, a normalization of distributor inventories and rising prices for OCTG.

Cliffs has been running its coating lines at full capacity in response to “outstanding demand,” Goncalves says, and the Columbus galvanizing line began pushing to increase output of galvanized products during the second quarter.

“We are in a moment here in the United States in which the economy is booming. The consumer is consuming. We are selling everything we want,” he says.

Prices, they’re going to go up. There’s no way out. Everything is moved by cost.

Prices, they’re going to go up. There’s no way out. Everything is moved by cost.

Prices in Brazil’s domestic market, which are relatively high—$900 a ton for steel plate, for example—are being matched by international pricing. CSN’s domestic production sold out its melt shop and rolling mill schedule through June.

Luis Martinez, CSN’s executive officer, says he “never observed such strong movements in terms of supply, demand, imports and costs” as he witnessed over the past eight months. Special-bar-quality products are fetching $1,200 a ton in the U.S. and up to $940 per ton in China, he says.

“Prices, they’re going to go up. There’s no way out. Everything is moved by cost,” he says. “I think that the value chain will absorb this price. This is not something that pertains only to CSN, it pertains to the entire market.”

“Demand for our products remains quite strong while inventories remain lean across supply chains. Many of our product groups are running at or near full capacity,” President and CEO Leon Topalian told shareholders. “We are adding shifts in many of our steel facilities to meet robust demand.” He predicts the current favorable demand outlook “will persist through the rest of 2021.”

Even with disruptions in the supply of semiconductors to the automakers, Topalian expects U.S. passenger vehicle production to reach 16 million units in 2021. “Our mills have been running full out to satisfy customer requirements from the auto sector. Light vehicle demand is very strong, and inventories are quite low. We expect that sector will be running hard to get caught up with the demand for at least the rest of the year.”

Demand for steel among sectors such as agricultural equipment, commercial trucks and other heavy equipment “are all showing strength. The oil and gas market is improving, with rig counts climbing gradually from the depressed levels seen last year. The appliance market is benefiting from the economic rebound in direct payments people are receiving as part of the COVID relief passed by Congress,” he says.

Chad Utermark, executive vice president for Nucor’s Fabricated Construction Products, says nonresidential construction activity will remain solid across all sectors through 2021 and into 2022. “Our quoting activity continues to be very robust.” The hottest building projects include warehouses, distribution centers and data centers.

“We continue to see positive momentum as evidenced by a 33 percent sequential increase in our shipments into industrial end markets,” adds Williams. “We are encouraged that the majority of the industrial categories we serve—such as machinery, agricultural equipment, power generation and defense—continue to improve with the overall economy. Distributor inventories are at historic lows, which presents us with restocking opportunities.”

As SDI’s Millett reports, “Demand out there is absolutely phenomenal, across almost every sector and it would appear to be [sustained] for the rest of this year going into next. Supply will absolutely remain tight,” he predicts, “so we’re incredibly bullish. It is going to be a great year.”